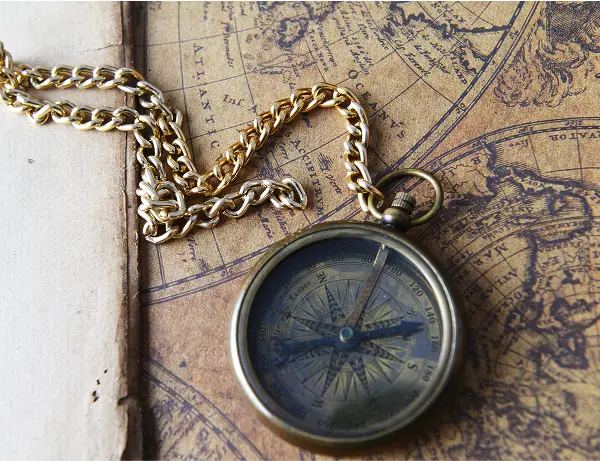

Navigating the Unknown: Your Investment Strategies for Uncertain Times

In uncertain economic times, effective investment strategies prioritize diversification, agility, and alignment with personal financial goals. Whether reallocating into safer assets or capitalizing on new opportunities, staying adaptable is key.