Volatility carried over from 2022 into 2023, as equity and bond markets reacted to Fed activity. But in the end, investors were rewarded with strong returns on risk assets. Does 2024 promise to be more of the same? Read on for our thoughts on how to position for the year ahead.

To sum up the major takeaways from 2023, one big-picture theme stands out: both the real economy and markets held up remarkably well despite the countervailing pressure of elevated interest rates, a hawkish Federal Reserve, and a flurry of steadily weakening economic indicators.

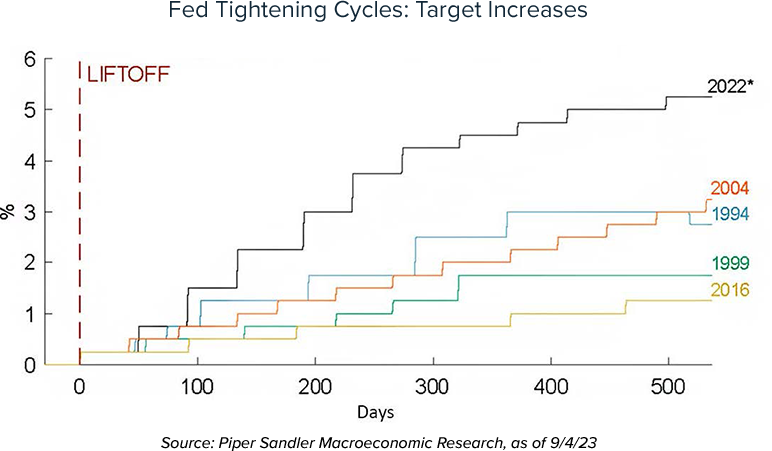

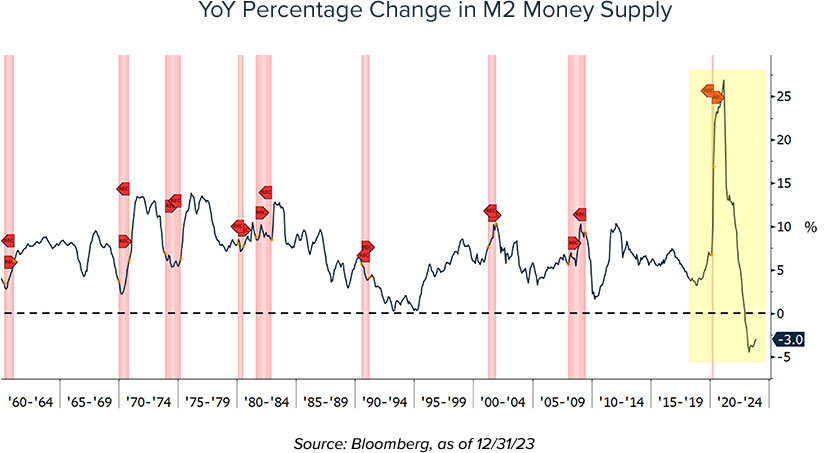

After more than a decade of ultra-easy monetary policy that helped spark a generational surge in inflation, in 2022 the Fed kicked off the most aggressive rate hike cycle in a generation, along with a steady stream of Quantitative Tightening (QT) to boot.

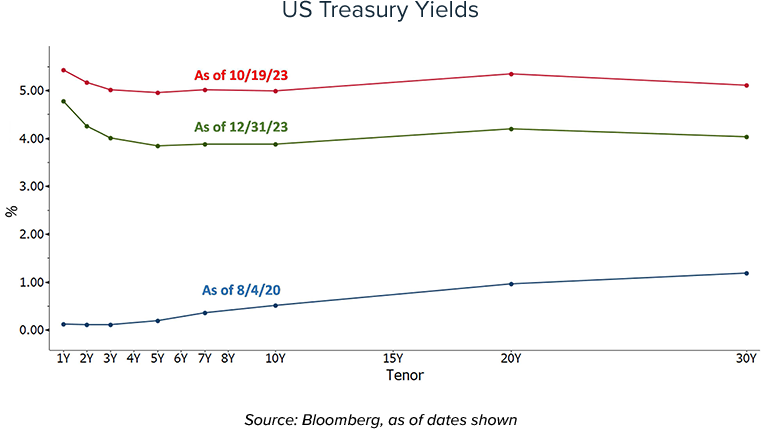

As a result, interest rates across the curve rocketed higher by 450-500 basis points (4.50-5.00%) from their summer 2020 all-time lows to an October 2023 peak. Although a major year-end bond market rally has since driven long-term yields lower by 100+ bps, it's still a massive increase from where rates sat just a couple of years ago.

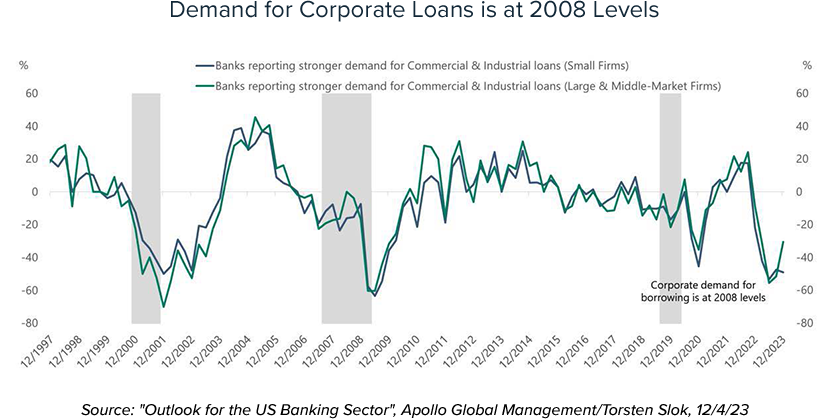

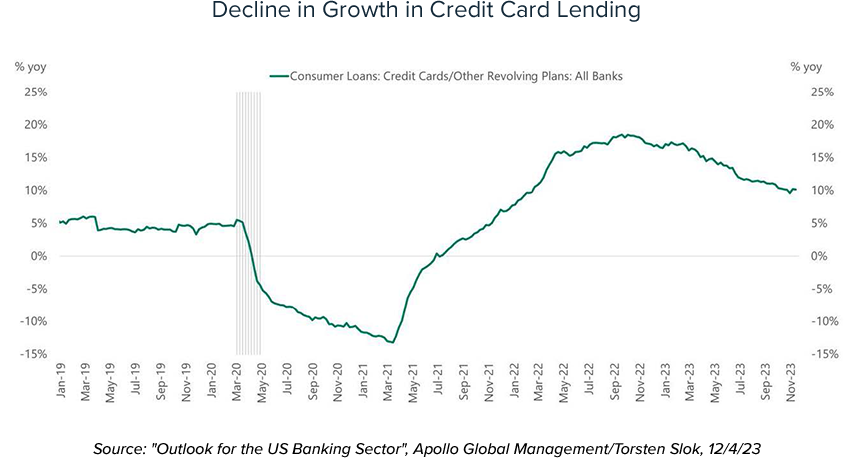

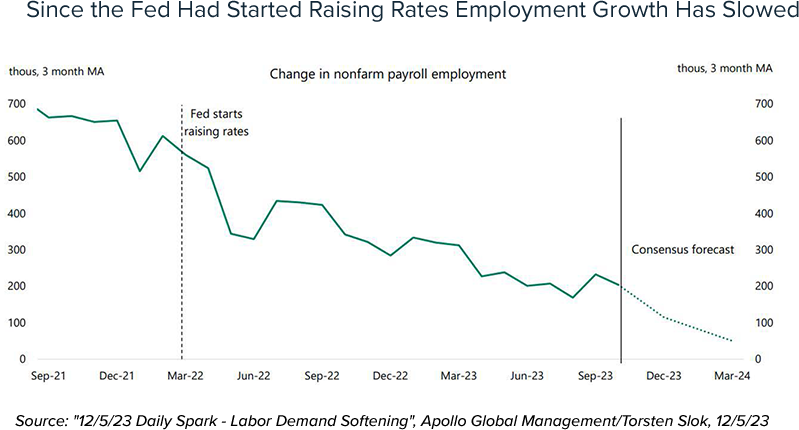

Higher benchmark rates typically act as a drag on economic growth: increasing loan costs lead to less borrowing by both companies (fewer capex investments) and consumers (lower spending). We're already seeing mounting evidence of both dynamics in effect.

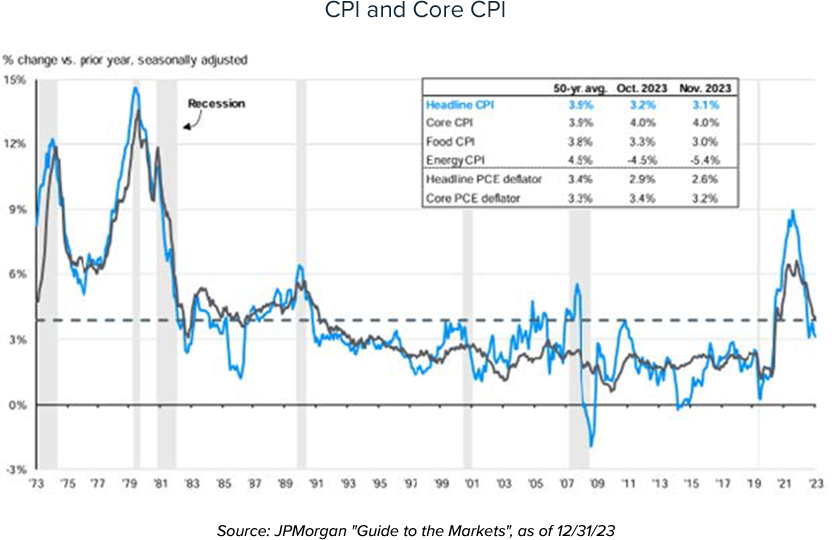

Of course, this is an intended outcome, as the Fed seeks to suppress inflation. But there's real risk that if they misjudge the situation and overtighten, the economy will instead swing past mere 'slowing' and instead help tip the economy into outright recession. As of now the more benign 'Goldilocks' scenario is still in play: inflation has cooled considerably while the economy has proven surprisingly resilient.

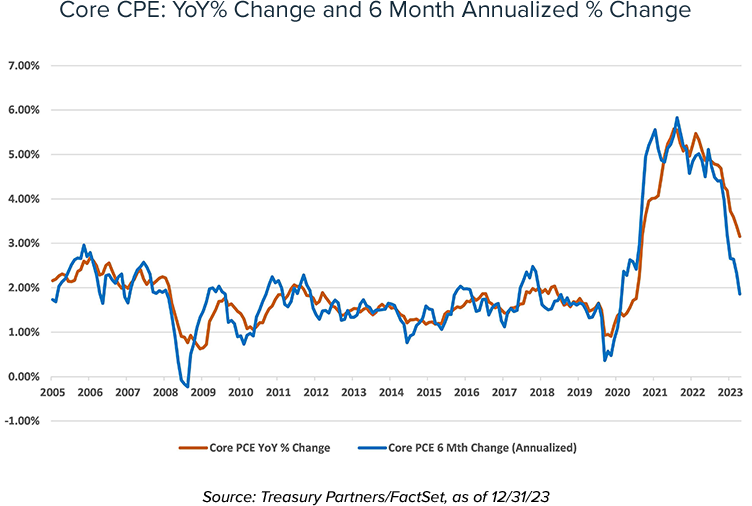

We continue to expect further improvement in the inflation data. Using the 6-month annualized rate of change shows underlying inflation is already trending within hailing distance of the Fed's 2% target.

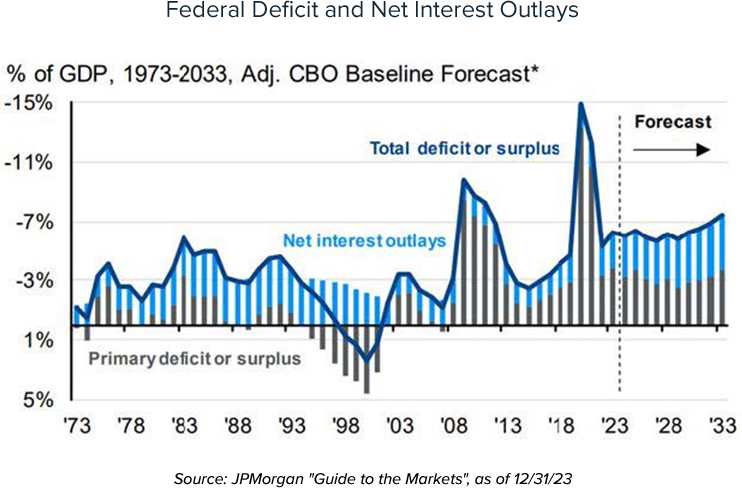

One big reason why the economy has kept chugging along is that tight monetary policy has been roughly counterbalanced by easy fiscal policy; copious federal spending and fiscal transfers have been financed by deficits larger than anything we've seen outside of wartime and periods of financial crises.

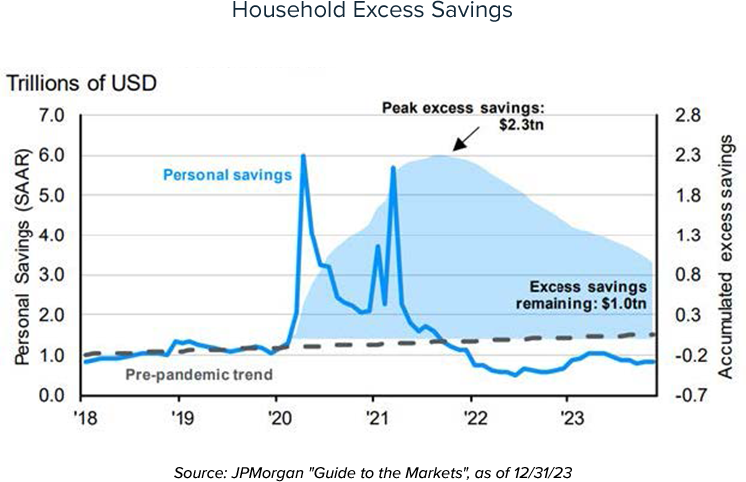

Additionally, despite the inflationary surge it appears households still aren't quite finished spending down their accumulated excess savings from the COVID era. It means the American consumer, the engine powering our economy, still has more levers left to pull.

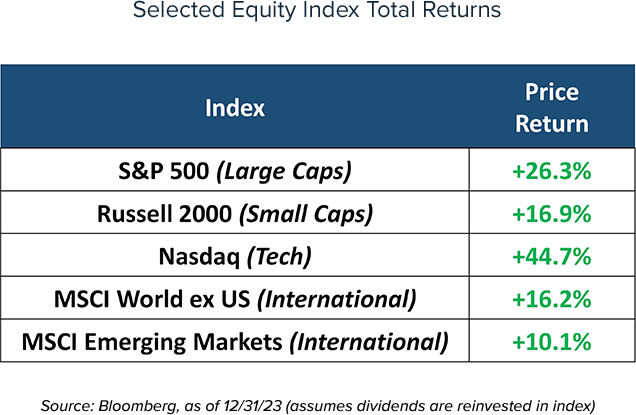

The unexpectedly benign backdrop has greatly supported equities, with the major domestic indices posting strong headline returns in both absolute terms and relative to their global counterparts.

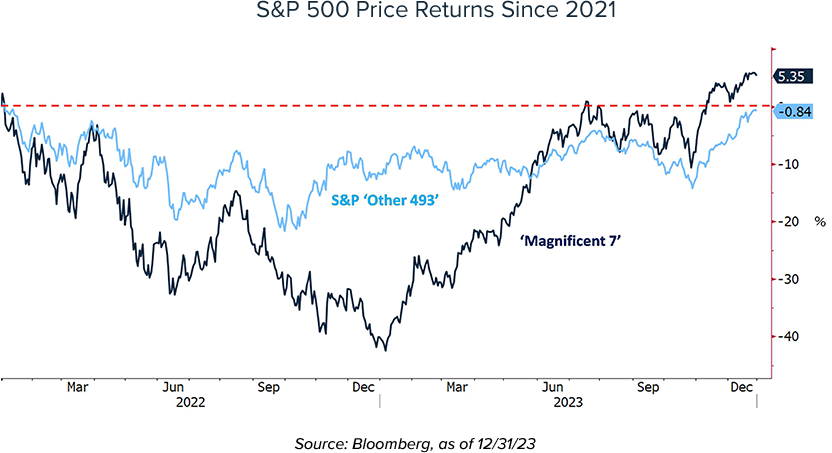

But there's an even more nuanced story underneath the hood - notice the wide divergence within the S&P 500 between the 7 largest stocks (aka: the 'Magnificent Seven' comprising Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and Nvidia) and the 'other' 493 stocks.

The 'Mag 7' was clearly responsible for the vast majority of the market's growth in 2023. In this winner-take-all market, it wasn't even a close contest: the relative performance of the equal-weight S&P 500 vs. the headline cap-weighted S&P 500 was the worst since 1998.

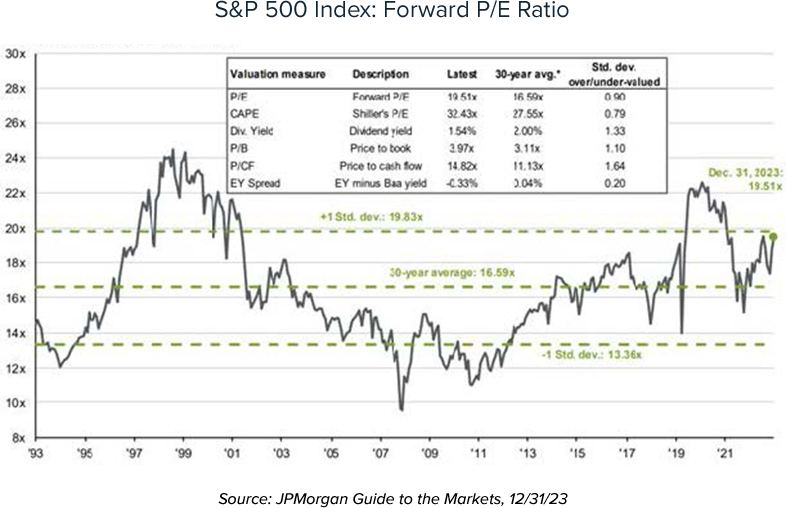

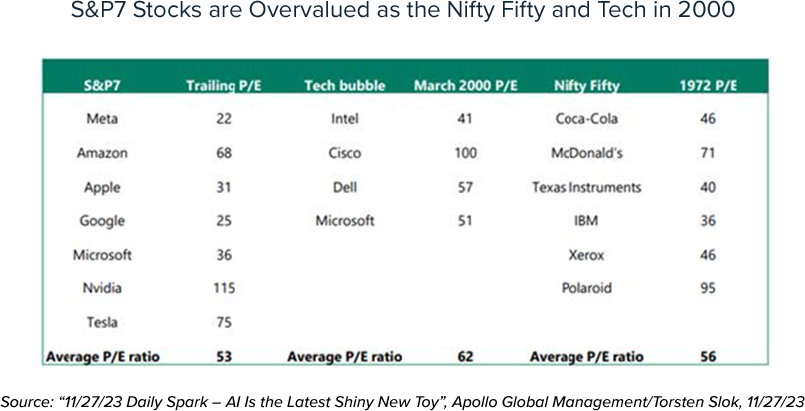

Ultimately, this means that equities are closing out 2023 with P/E multiples that are noticeably elevated vs. historical norms. If Fed tightening continues to dull economic activity, that means there's little cushion left in multiples to absorb the accompanying pressure on corporate profits.

Real Economy

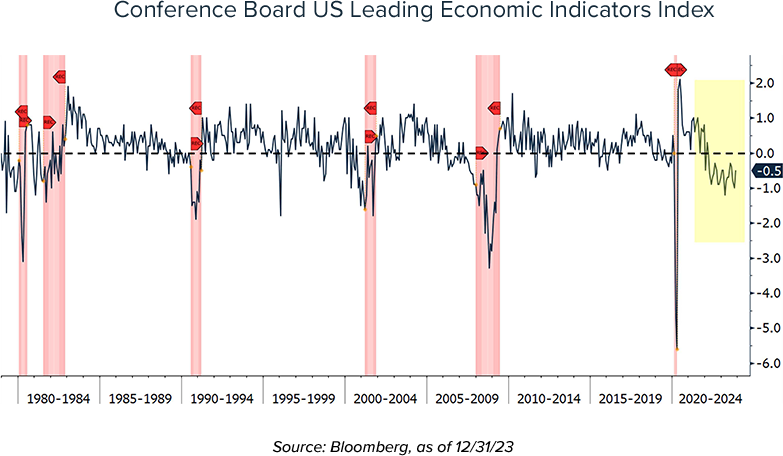

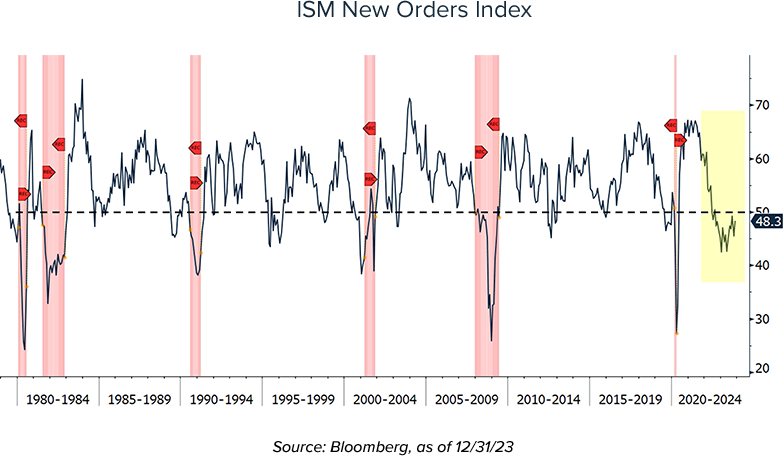

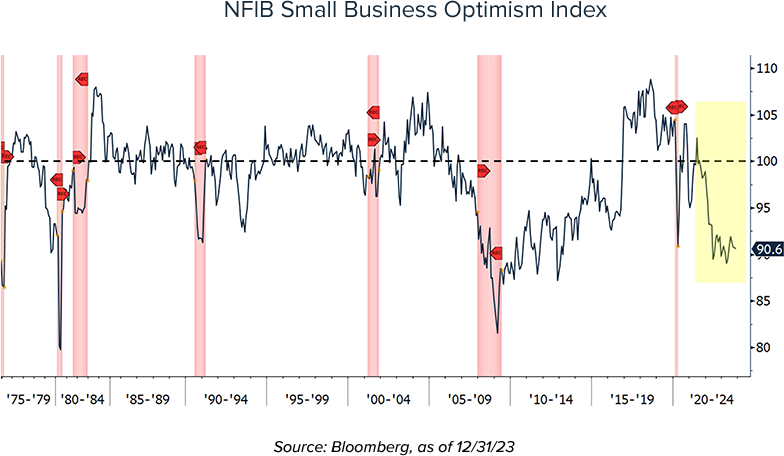

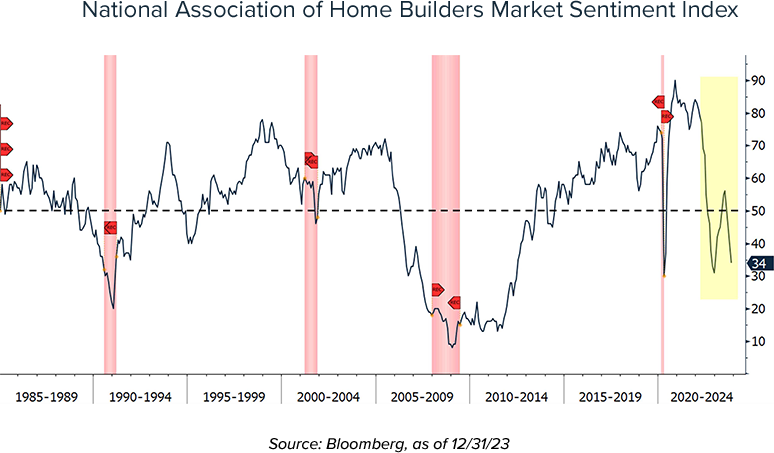

For some time now, we've pointed out that underlying real economic conditions

are weakening.

For example:

Remember that fundamentals aren't necessarily near-term drivers of markets - after all, 2023 proved excellent for risk-assets despite these economic conditions persisting all year. But over the long run, they're far more likely to have impact. We suspect that, at least for now, the long lags between the Fed's tightening campaign and its associated economic impact are being stretched out over a longer period than usual because of the lingering support from continued drawdowns of 2020-2021's unprecedented liquidity injections. But sooner or later, that will come to an end.

Equities

Here's a surprising fact: if you exclude the Magnificent 7, collectively the

other 493 stocks in the S&P 500 have been in a 2-year bear market. The two-year

cumulative return has been just about unchanged. To state that market breadth

has been 'lacking' is a real understatement.

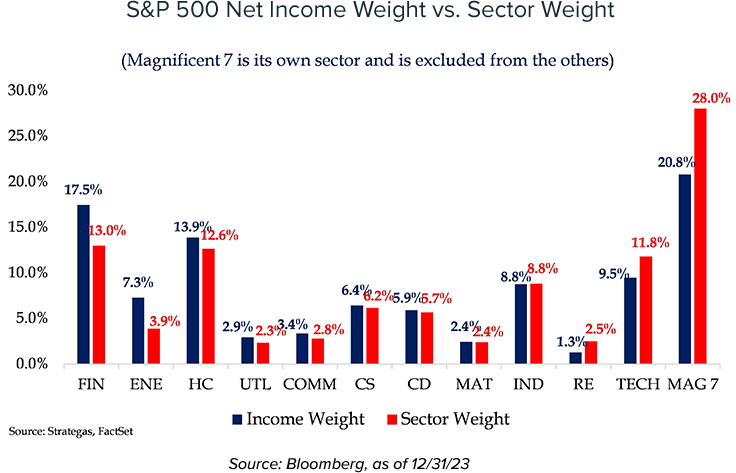

Although the Mag 7's performance carried the index for most of 2023, in Q4 the performance metrics started to broaden out. This is a positive sign for valuation, but nonetheless a lot of optimism has already been baked into the current market pricing. When considered as a standalone sector, the Mag 7's index weight is approximately 29% while from an earnings perspective these 7 stocks only generate 17% of the S&P 500's aggregate earnings.

The prospect of a future bonanza from Artificial Intelligence-related technological advances has driven investor interest in these stocks to lofty levels. The P/Es on these index-driving names are at levels reminiscent of some of the most vicious equity bubbles of modern times. But as long-time readers know, we like the long-term prospects of large cap technology as many of these companies enjoy strong levels of (growing) recurring cash flow, wide moats around their businesses, and innovative technologies that in many cases are unmatched by competitors. As an example, Alphabet's (GOOG) FY 2019 operating cash flow was $54 billion. By 2023, this amount had nearly doubled to $106b. While multiples will ebb and flow, their core business continues to grow, benefiting investors over the long term.

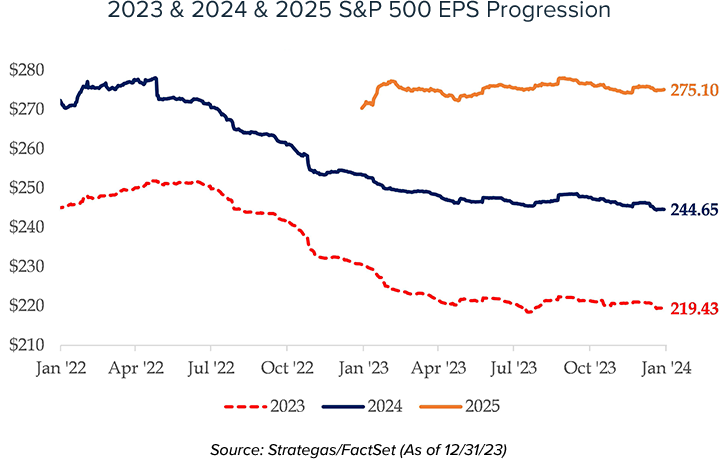

Speaking of earnings: while 2023 EPS figures declined as the year progressed (as stocks simultaneously rocketed higher), today's consensus estimates for 2024 and 2025 nonetheless assume robust annual increases of +11% and +12%, respectively. That's an optimistic forecast given the current level of high interest rates.

Even taking these estimates as a given, at the S&P 500's current 4,750 level that pencils out to implied >19x forward P/E multiple, a very generous value. However, historical multiple comparisons must be adjusted to reflect the fact that today, the Mag 7 carry much higher multiples and market share.

Fixed Income

After a decade-long drought in yields, the last few months of 2022 gave us a

fleeting taste of an investable bond market. Happily, 2023 proved to finally be

the year when the opportunity to lock-in genuinely meaningful yields on fixed

income portfolios became achievable once again. As we wrote barely 2 months ago:

As clients know, we spent most of the year aggressively adding long-maturity municipal (and where appropriate, corporate) bonds to client portfolios, typically capturing tax-free yields upwards of 4% when market conditions permitted. Our market call was and remains clear: Fed tightening will eventually lead to lower rates. As you've undoubtedly heard us say time and again, our experience in past cycles is that rates typically 'take the stairway up but the elevator down;' That's exactly what's happened since early November when in the final 2 months of the year, ten-year yields plunged by nearly 120 basis points (1.20%).

There are times when it makes sense to extend maturities, and times when it’s not so appealing. With rates having retreated from their highs, we're dialing down the degree to which we're repositioning portfolios. But, as always, we stand ready to act (aggressively) if and when the window for higher rates opens once more.

The return of an investable bond market meant we spent much of 2023 taking advantage of the opportunity to adjust client asset allocations to add long-term bonds. This strategic shift enabled us to reduce exposures to other potentially riskier (and often less liquid) asset classes such as alternative investments.

Simply put, we're thrilled to have done so. It represents a return to a more 'normal' asset allocation strategy for our clients and their families, where the overarching priority is to conservatively grow generational wealth.

Looking ahead, there are more competing crosscurrents than usual to be considered, any of which could drive near-term risk-asset returns in either direction:

That doesn't mean we've totally retreated from allocating to stocks – quite the opposite. As we've written before, we remain committed long-term equity investors: