After 15 years of mostly meager yields available on bonds, rates have surged to levels where they can provide ballast, protection against stock market declines, and meaningful income returns for client portfolios. Read on to learn more about how we're positioning client portfolios.

Prior to Q4 2022, we regularly pointed out that the fixed-income market was practically uninvestable. Thanks to global central bankers maintaining ultra-easy monetary policies investors spent over a decade trying to balance meager yields with increasingly large bond price (duration) risks. Remember that as yields rise, bond prices fall, with the longest maturities typically taking the largest hits to their market values.

As a result of the near-zero interest rate environment, investors faced the reality that bonds no longer provided the full set of portfolio benefits they had in years past, namely: income, safety of capital, and a potential hedge against a slowing economy.

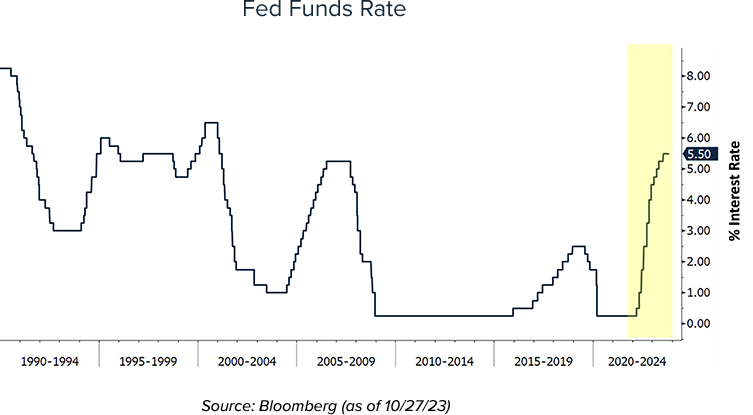

But things are starkly different now. In the last 18 months, in an attempt to arrest surging inflation, the Fed has rapidly raised short-term rates by 525 basis points.

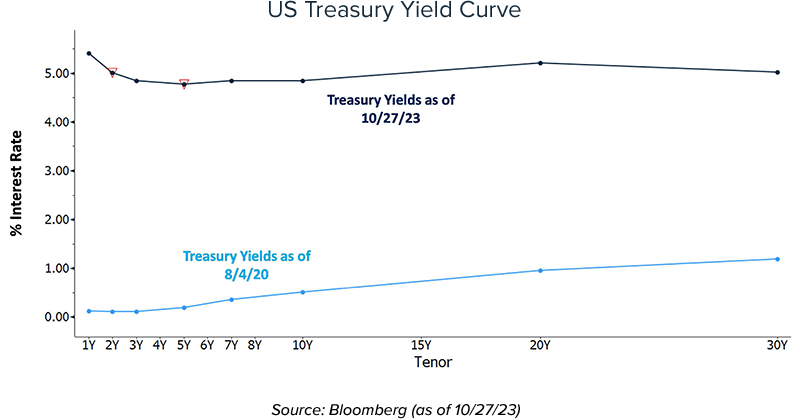

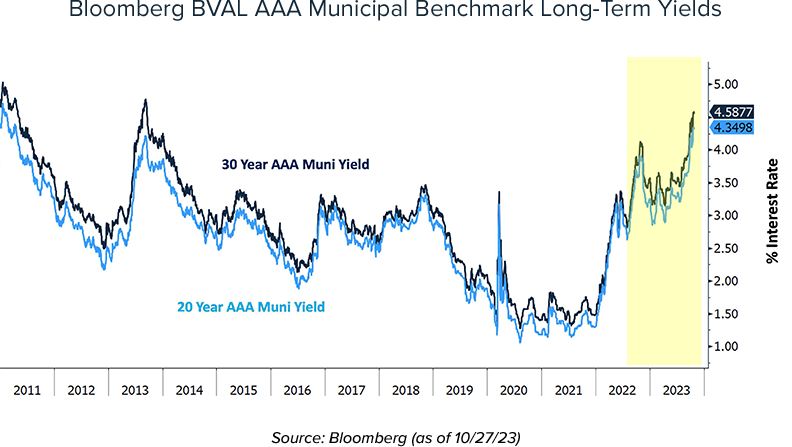

We're now back in an environment where rates are attractive relative to the last 30 years - indeed, the highest since 2008's Great Financial Crisis - and are simply in a different universe compared to the lows of 2020. Meaningful yields are achievable across the maturity spectrum - for example, the entire Treasury curve, from 1 month through 30 years, features yields ranging from 4.65-5.50%. Available levels in credit markets, such as taxable corporate and tax-exempt municipal bonds, have also shifted higher. Currently, 10-year high-grade corporate bonds are trading hands at 5.25-5.75%+ while long-term high-grade municipals are in the range of 4.50%+ to their 7 to 10-year first call dates.

After a long stretch in the wilderness, fixed-income portfolios can once again serve as genuine income-generating assets (as opposed to just a vehicle for principal preservation).

The bond market's 'Boneyard of Broken Dreams' now has plenty of fresh skeletons from those investors who lost their discipline and extended maturities when the risk-reward tradeoff was poor.

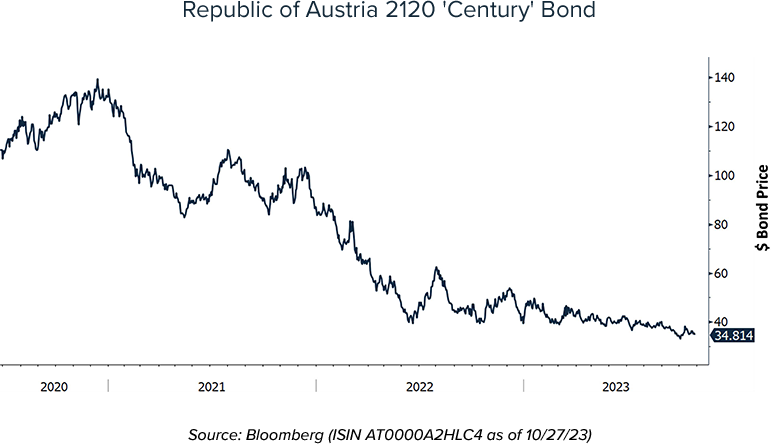

As an extreme example, consider Austria's 100-year sovereign bond, which was originally issued in Q2 2020 at a price of $98 to yield 0.85%. Yes, you read that correctly - investors actually chose to lock-in a sub 1% yield for 100 years.

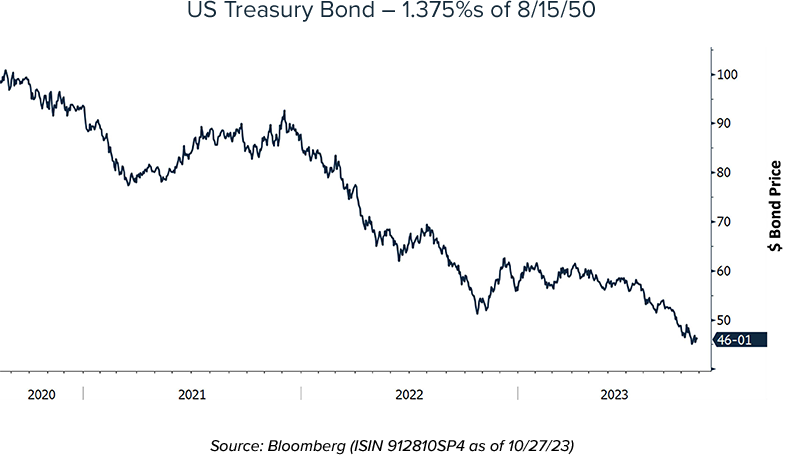

Closer to our shores, the 30-year US Treasury yield bottomed out in the summer of 2020 at approximately 1.35%. Now yielding over 5%, its price has declined by over 50%.

Clearly, extending maturities should only be considered in times when the rewards outweigh the potential risks, which wasn't the case then. We repeatedly pointed out the dangers of doing so during the low interest rate environment (for example, see Alert: Fed Tapering Is Coming - Avoid Zero Cash-Flow Stocks and Bonds, 10/13/21).

Now we're once again focused on the elevated yields available in long-term municipal bonds, which are trading at levels that do justify the risks of committing to long-dated positions.

In the 2 years leading up to last year's spike in rates, we'd largely opted to stay in shorter-term bonds, refusing to take on excessive duration (price) risk. But recently, we've shifted towards extending maturities, and have gotten more aggressive as tax-exempt yields creep ever closer to 5%.

Our rationale for this major change in strategy is informed by several interrelated reasons. Most importantly, the elevated rate environment has drastically improved the relative value argument for holding long-dated bonds vs. equities. Over the past 50 years, the annualized long-term pre-tax total return on the S&P 500 has been approximately 8-10% (depending on which reinvestment options are assumed). However, during this period equities have periodically dished out some stomach-churning drawdowns.

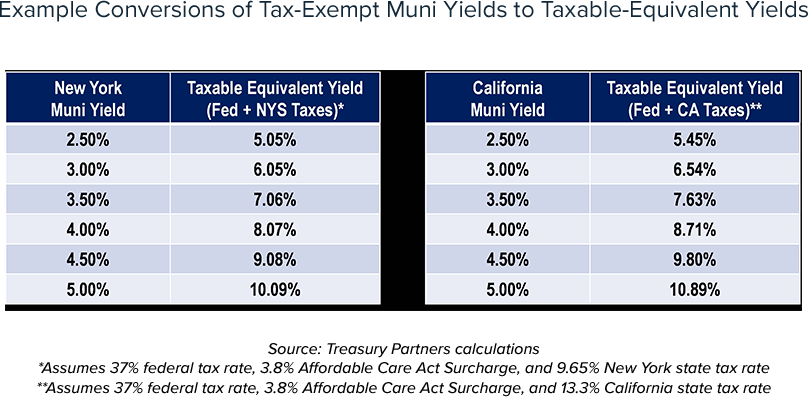

Now, it's possible to lock in high-grade muni yields at 4.50%+ for the next 7-10 years, equivalent to those 8-10% long-term equity returns on an after-tax basis, but with a lower volatility profile. Remember - municipal income is exempt from federal taxes (both regular income taxes and the 3.8% Affordable Care Act surcharge), and under certain conditions state and local income taxes as well.

Further to the point, if tax rates rise, the value of tax-exempt muni bond income will only become more valuable. For what it's worth, we think that's a real threat; Washington's huge deficits will have to start narrowing and rate increases on high earners are sure to be a point of intense debate in the years to come.

We're often asked why it makes sense to invest money in longer-term maturities if similarly high (sometimes even higher) yields are available in shorter-term bonds. The simple answer is reinvestment risk - if the economy slows due to continued Fed tightening or a sputtering business cycle, rates would likely decline. In such a scenario, those who stayed short will be faced with rolling over maturing principal into a lower-yield environment: those who extended will continue enjoying the current high yields for years to come.

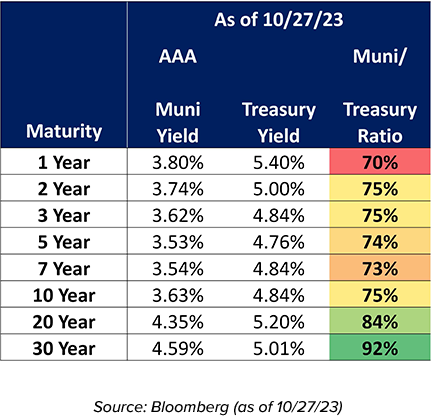

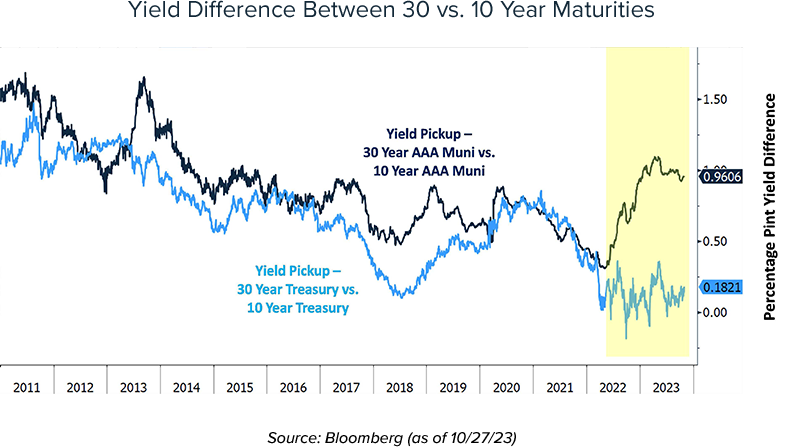

Moreover, the relative value of municipal bonds compared to taxable alternatives (such as Treasuries) is significantly stronger on the longer end of the curve. As measured by the Municipal/Treasury ratio, 20 and 30-year AAA rated munis are trading at 84-92% of (nominal) Treasury yields which are markedly more attractive than 1-10 year AAA munis that offer just 70-75%.

And unlike Treasuries and corporate bonds, take a closer look at the absolute level of yields - note that munis offer a sizeable yield pickup for extending maturities, compared to the flat Treasury curve. In simple terms, the municipal market is currently rewarding those investors willing to commit principal for the long-term.

The decision to extend maturities isn't one we've made lightly.

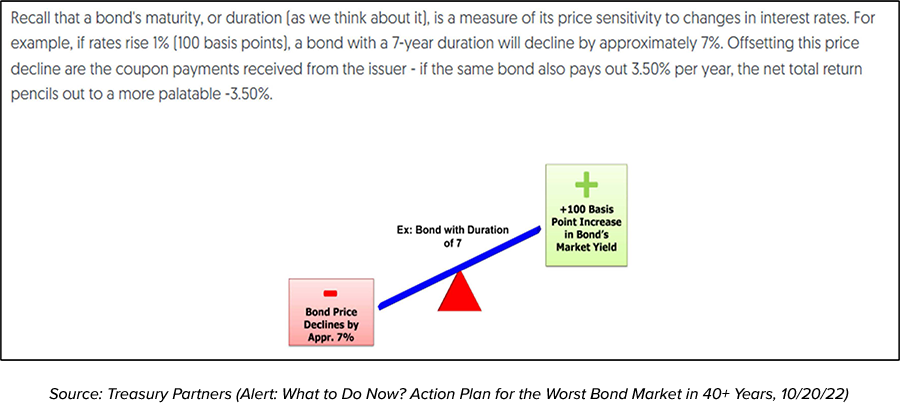

All else equal, extending means accepting more duration (or price) risk - if rates continue rising, longer-dated bonds will generate higher price losses than those with shorter maturities (and vice versa). For example, an investor who purchases a 10-year bond at current levels will face an unrealized price decline of approximately 8% if rates increase another 100 basis points (1%) from where they sit today. Conversely, a 2-year bond would only suffer a decline of less than 2%. Put differently, the 10-year bond faces more than four times the price risk of the short-term bond.

Of course, this is a double-edged sword: if the next major move in rates is lower (which we continue to expect will be the case), long-term bonds will benefit from greater price appreciation than short-dated positions. Importantly, a decline in interest rates is typically associated with a slowing economy that could result in reduced corporate earnings and lower stock prices. In this scenario, long-term bonds could provide a greater degree of overall portfolio protection against a contracting economy.

However, while a rise in interest rates would lead to a decline in bond prices, the key offset comes from the income return - the book yields investors lock in when a bond is purchased. As the earlier examples of the 100-year Austrian bond and the low-coupon 30-Year Treasury showed, when rates were ultra-low the income returns were insufficient to offset the unprecedented price declines. Investors who disregarded the risks and took the plunge at those levels are now stuck earning peanuts for decades to come unless they're willing to take major losses to unwind their positions.

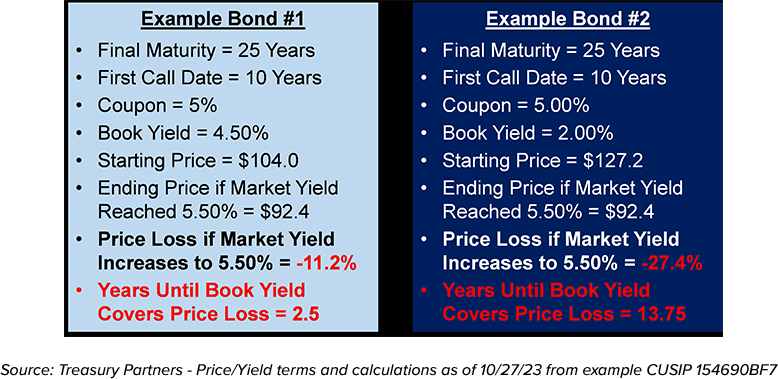

But today's 4.50-5.00%+ yields set the stage for an entirely different dynamic, as these income returns can meaningfully offset even substantial negative price returns. To illustrate, assume an investor buys a 25-year municipal bond that’s callable in 10 years and currently yields 4.50%. If rates rise another 100 basis points (such that the bond subsequently trades at a yield of 5.50%), the bond's price will decline by approximately 11%, which with a 4.50% book yield would be offset in only 2.5 years.

If instead the investor had bought that same bond at a book yield of just 2.00% per year, in a 5.50% world that position would be sitting on a 27.4% decline. But the key point is that in the scenario, the investor's meager 2.00% book yield wouldn’t make up for the magnitude of the price loss for another 13+ years!

While neither scenario is desirable, the former is far more tolerable than the latter. Of course, with separately managed accounts unrealized price changes are just that - unrealized, and only relevant if the bond is sold. In many cases, especially when attractive yields are locked in, the bonds are held until maturity or until they're called away (and history shows that, with exceptional frequency, higher-coupon municipals are typically called far before their legal final maturities).

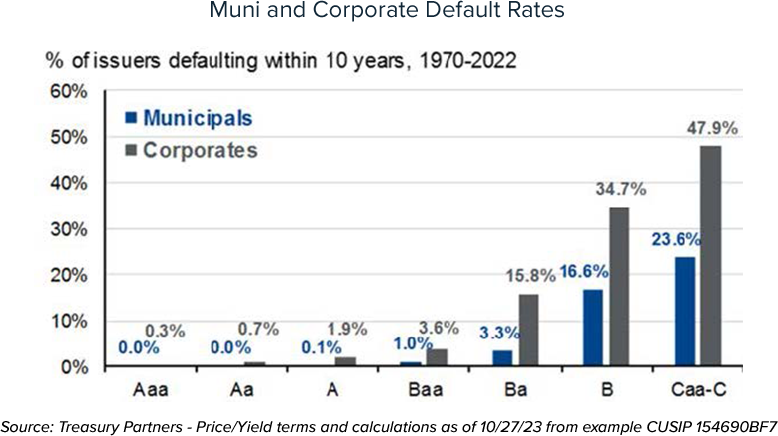

Relatedly, extending also means accepting the credit risk of specific issuers for years to come. The good news is that these elevated yields can be realized without having to sacrifice any of our rigorous standards on credit quality. While subject to change, our portfolios typically have AA-rated average credit quality with some individual positions carrying single-A ratings. Decades of experience and data show that high-grade bonds such as these have negligible risk of default.

After a decade of contending with artificially-low yields in fixed-income markets, the return to a more normal rate environment has created attractive new opportunities. We're thrilled that our clients can once again benefit from bond portfolios that can provide both capital protection and meaningful tax-free income returns for years to come.

All this is happening as we head into an environment of growing geo-political risk, slowing inflation, declining economic activity, and a Fed that's getting closer to the end of its historic tightening campaign. The fundamental signs are pointing in the same direction – that we're likely near the peak in rates, and that the next major move will be lower. We'll keep extending to capture the today's elevated yields while they're still available.