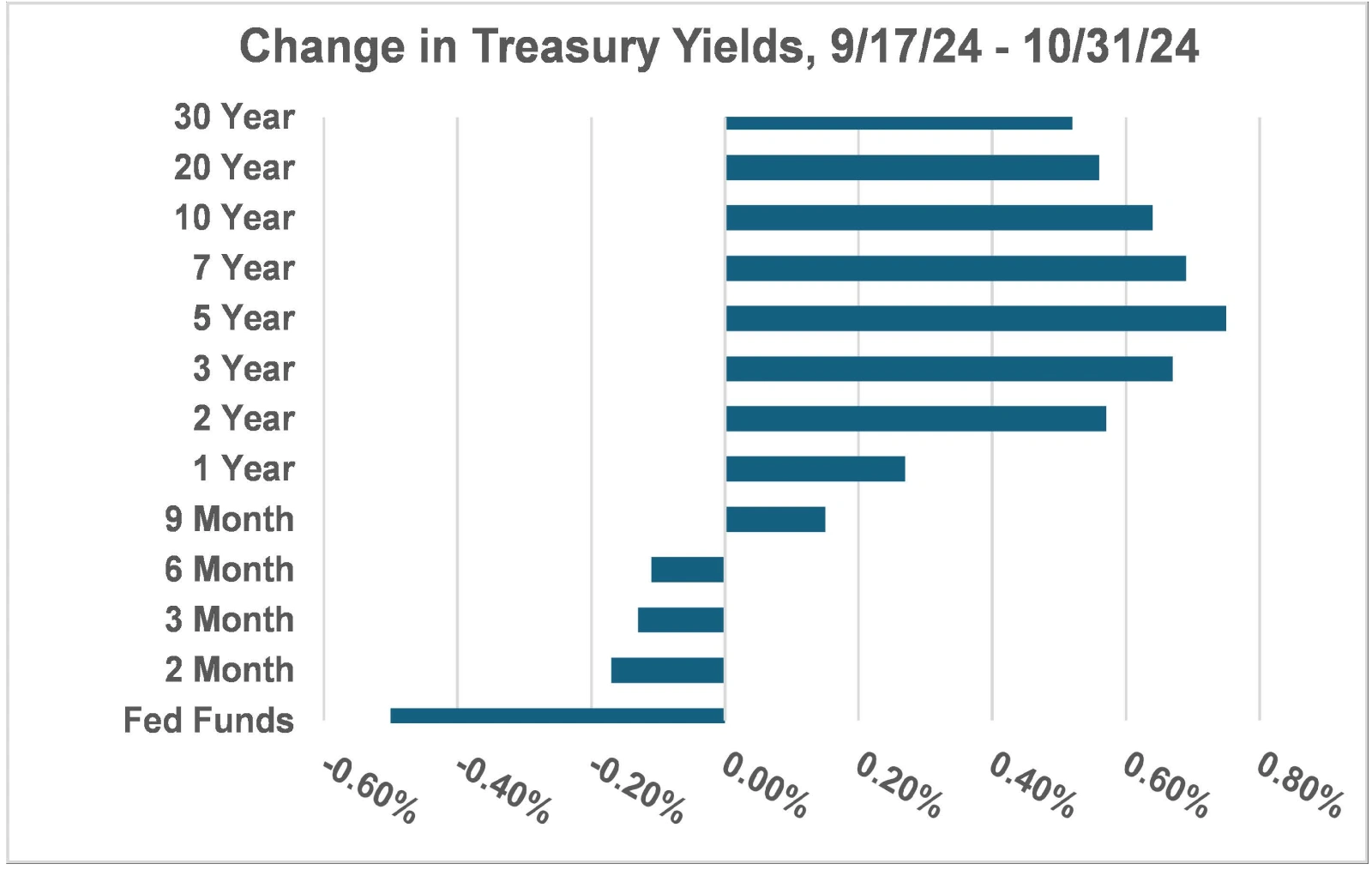

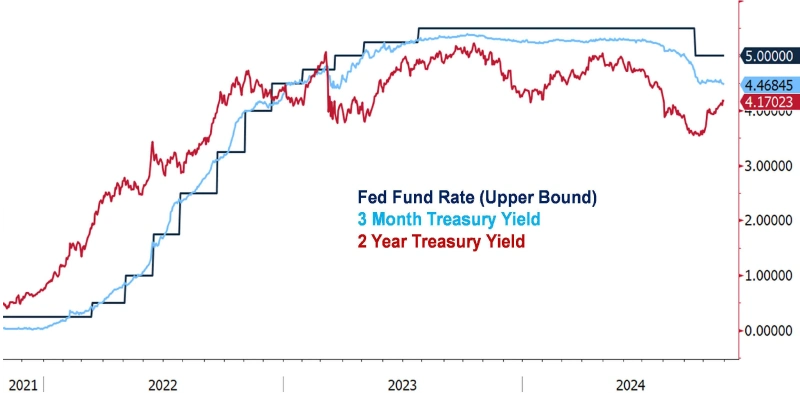

On September 18th, the Fed cut the Federal Funds rate by 50 basis points, giving the market exactly what it wanted. But beware of what you wish for - over the subsequent 7 weeks, longer-term rates have risen by over 60 basis points while the short-end of the curve moved lower. What's goin' on?

With the pace and magnitude of further near-term cuts seemingly in conflict with the strength of the underlying economy, how should CFOs and Treasurers be thinking about positioning corporate cash portfolios for today's unsettled environment? Read on for our latest thoughts.

Thus far the overarching macroeconomic theme of 2024 has been resilience. The US economy has posted solid YoY real GDP growth, keeping the solid post-pandemic expansion going.

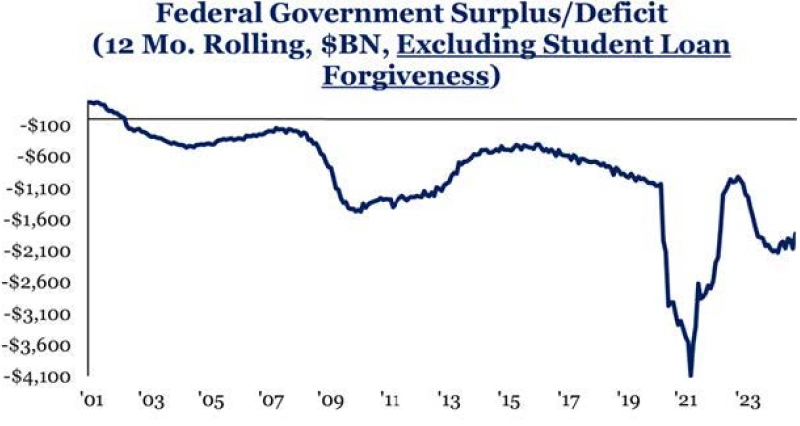

On the face of it, this is a surprising development in the wake of 500 bps of historic (and rapid) Fed tightening meant to forcefully restrain growth. However, largely offsetting this tighter monetary policy has been simultaneously ultra-loose fiscal policy: the post-pandemic federal deficit has stayed steady at a gargantuan $2 trillion on a rolling 12-month basis. Effectively serving as persistent near-term fiscal stimulus, it's very likely a driving force behind the real economy's continued strength.

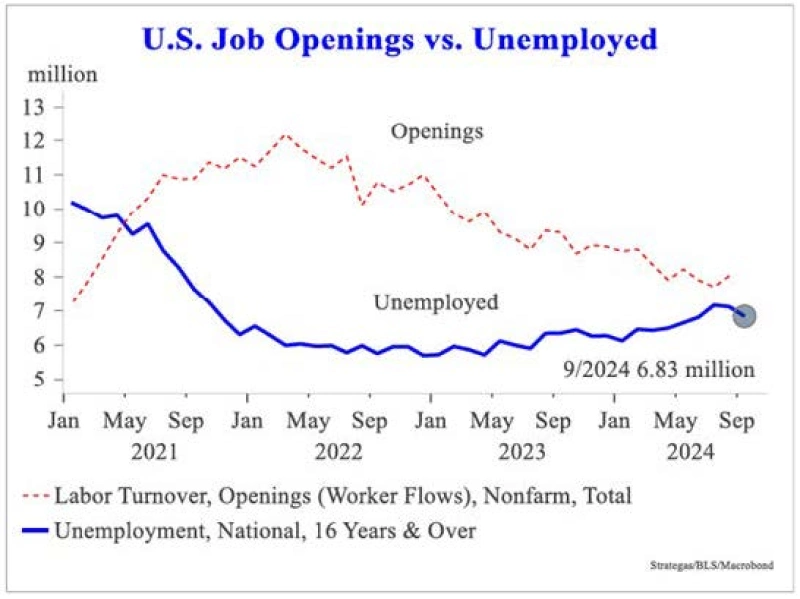

The Q3 corporate earnings reported thus far appear very encouraging, indicating healthy underlying business activity supported by still-robust consumer spending. Labor market data are also signaling a benign backdrop, with healthy growth in payrolls, still-low unemployment figures, and total job openings that continue to surpass the number of job seekers.

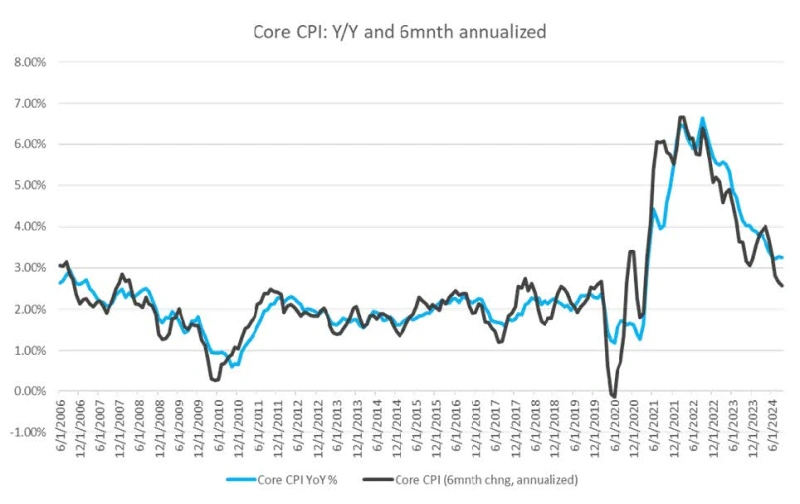

Inflation has maintained its steady decline from 2021-2022's generational highs, with the 6-month annualized change in core CPI now well within striking distance of 2%.

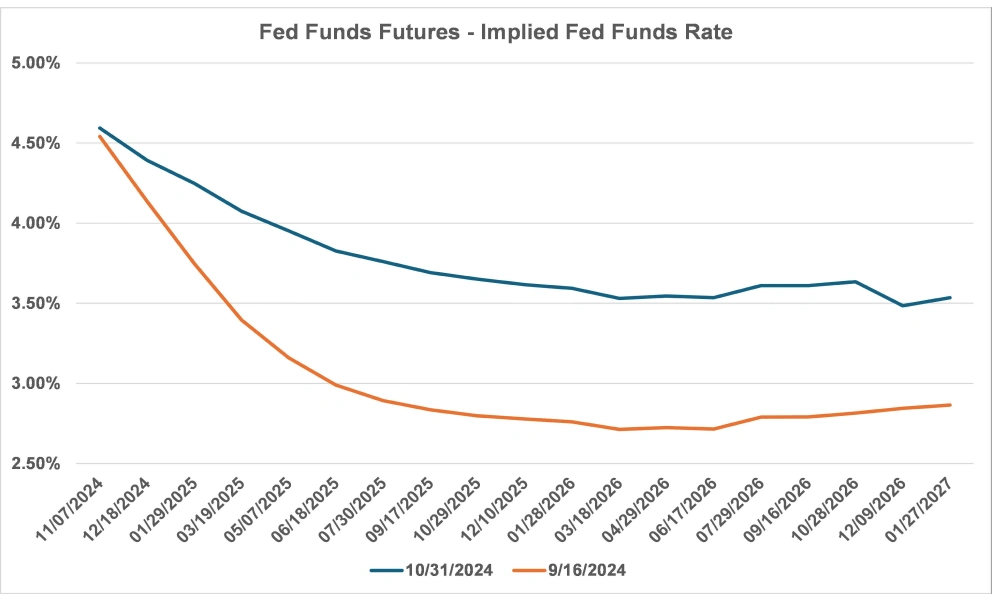

The recent spate of 'Goldilocks' economic data has spurred significant volatility in front-end rates, as markets have been forced to hurriedly adjust their previously pessimistic outlook.

While we didn't (and rarely) concur with the path implied by Fed Funds futures, it's illustrative that just before the last Fed meeting futures assumed nearly 5 cuts before the end of this year, followed by another 5.5 cuts in 2025. Now expectations have been dialed back considerably, as current pricing implies just 2 more cuts by year-end without any subsequent 'catchup' in 2025.

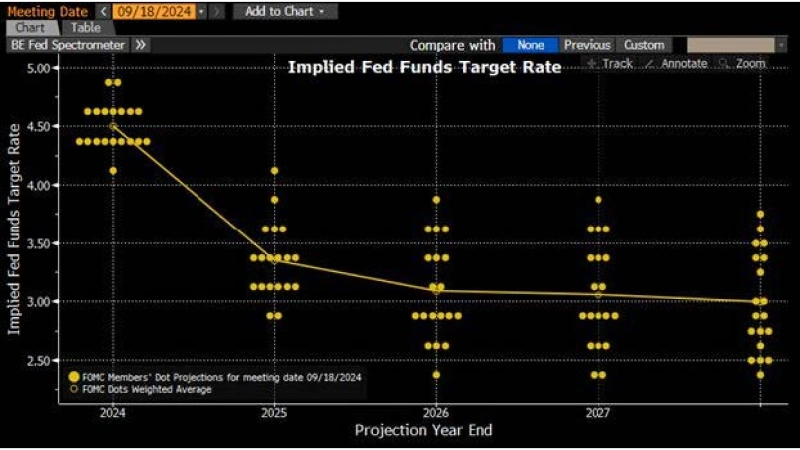

This less-aggressive forecast is now more in line with the Fed's own thinking, as the latest Fed "Dot Plot" assumes the Fed Funds rate will shake out in the mid-to-low 3% range by the end of both 2025 and 2026, respectively.

The most visible result of this realignment is that rates on the very shortest maturities (3- and 6-month tenors) have declined while those on longer maturities (9+ month tenors) have increased. This "steepening" effect is fairly typical once a Fed cut cycle has begun, as the market intently focuses on incorporating any perceived shifts in the expected path of further cuts until reaching the terminal rate.

It's important to step back and take stock of the big picture: despite the resilient and still-growing economic backdrop, Fed decision makers have signaled that they expect the next moves in front-end rates will be lower, not higher.

At the same time, given healthy growth, robust labor conditions, and declining inflation, there doesn't appear to be a need to aggressively cut rates, especially when profligate fiscal policy continues to run deficits and cushion the downstream effects of higher post-pandemic yields. We expect the runaway budget deficits to continue under a second Trump Administration. Monetary and fiscal policy continuing to be at loggerheads is the main driver of our expectation for short-term rates to only gradually decline over the next few quarters.

What seems clear to us is that this remains a good time to extend maturities, particularly for those portfolios that are still relatively concentrated in the very front end of the curve (i.e. <1 year). The longstanding inverted curve has made staying short a painless decision until now, but it's no longer prudent as the curve will likely normalize' at this point in the cycle.

Specifically, if the Fed gradually reduces the Fed Funds rate, we'd expect the <1 year part of the curve to move lower, increasing the degree of reinvestment risk for highly liquid portfolios.

Extending in an inverted curve environment is always a leap of faith, but history tells us that it pays to prepare for the hurricane (lower rates) well before the first storm clouds start becoming visible on the horizon.