• Lofty equity valuations paired with low bond yields

• Supply chain bottlenecks leading to downward earnings revisions

• “Transitory” inflation concerns

• Simmering US-China tensions

But these are all “known unknowns” - recognized threats whose true likelihood of materializing is unclear (much less their actual consequences). While important, there’s a practical limit to how much attention and concern they require.

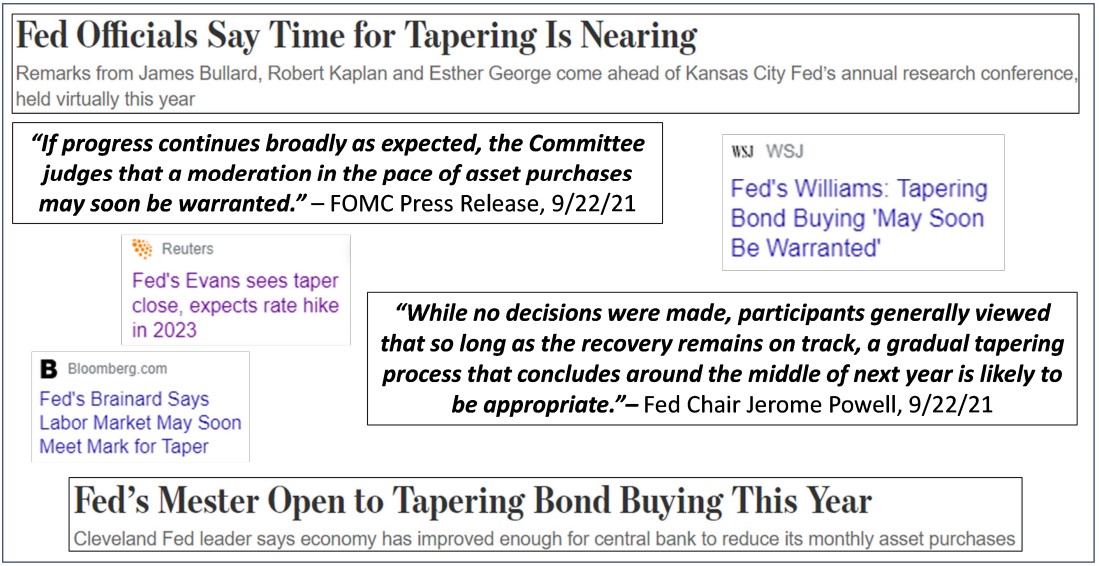

Instead, we’re focused on the implications of a significant “known known”, an event we’re highly confident will come to pass: Fed tapering.

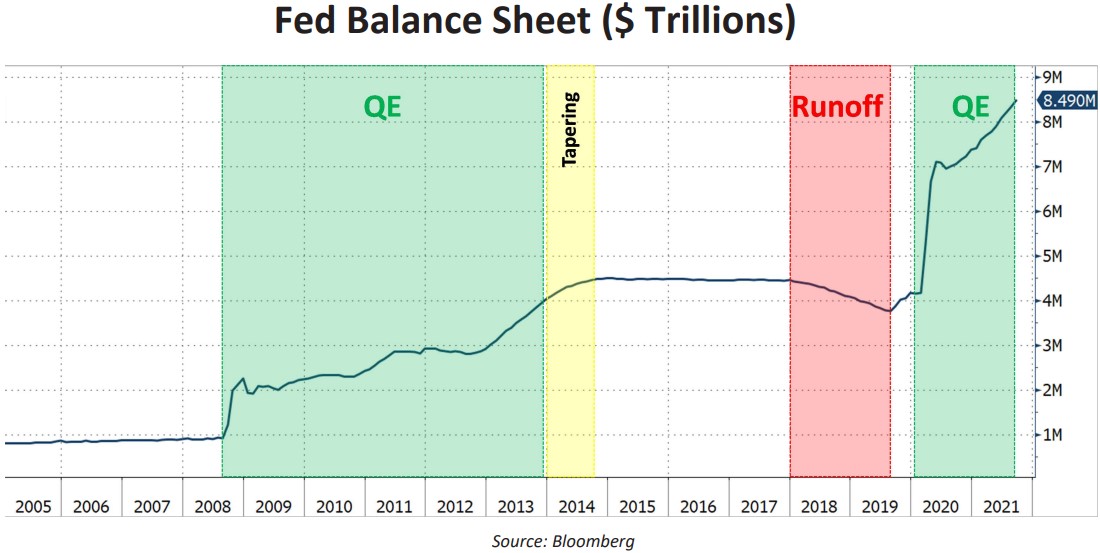

Since the Great Financial Crisis of 2008, after cutting the Fed Funds rate to zero, the Federal Reserve has largely relied on a tool of monetary policy called Quantitative Easing (“QE”). When the Fed judges further monetary stimulus is needed, QE allows it to print dollars and directly purchase existing bonds in the open market. Purchased bonds are kept on the Fed’s balance sheet, out of circulation (likely to their maturity).

The Fed has been purchasing $120 billion of bonds every month since March 2020. This has massively swelled the liquidity in the system and arguably, driven all asset prices higher.

But every tide makes a high-water mark before it turns, and the US is about to reach that point.

While timing and the pace of tapering is uncertain (November, December or January?), it’s generally accepted that the Fed will soon begin tapering the pace of its asset purchases.

Importantly, tapering doesn’t mean an end to QE – it’s merely the process of gradually reducing the pace of new purchases until stopping altogether. But it is undoubtedly the first (small) step in the monetary tightening process, marking a notable change in the tide of liquidity. As with any paradigm shift, this has implications for those assets which benefitted most from the prior regime: low-cash flow stocks and bonds.

Despite all the terminology and technical complexity, the core principle behind loose monetary policy is simple; ensure ample access to cash at a low cost. Interest rates are essentially the price of renting money today that’s returned sometime tomorrow, an “exchange rate” for capital between present and future. Low rates (or a low exchange rate) mean money today is plentiful and can be rented at a low cost that encourages capital investment.

Within this analogy, low cash-flow stocks and bonds are the largest ‘money-renters’ of them all.

As ownership stakes, stock prices reflect the market’s valuation of a business’ current and assumed future cashflows. Typically, higher cashflows lead to a higher valuation, but there’s a difference between present and future earnings. Whether distributed to shareholders (via dividends or buybacks) or reinvested in the company, current earnings are proof positive that a business is viable as profits are already achieved.

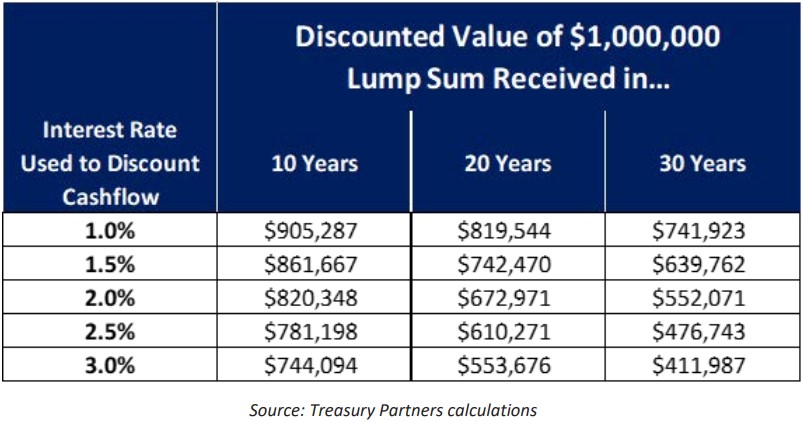

Future earnings are a different animal; no matter how “rigorously” they’re modeled or forecasted, the future is inherently uncertain. Future earnings must be discounted to account for the possibility things go wrong; the greater the uncertainty, the greater the discount necessary to determine a fair present value. The size of the discount is directly related to interest rates – lower rates translate into a lower discount, and vice versa.

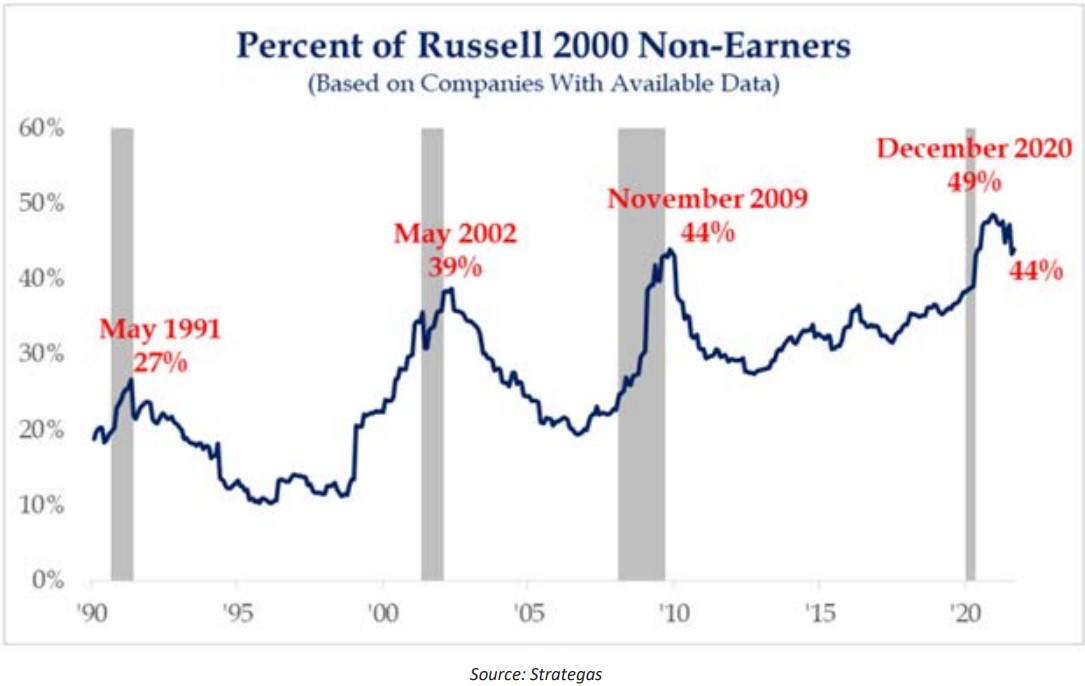

Accordingly, QE and ultra-low rates have greatly benefitted the stock prices of those companies with little-to-no current earnings but plenty of future optimism. But now that rates - and therefore discount factors - could potentially start rising, those assumed future earnings are about to become less valuable.

This is a problem for more equities than commonly realized. The proportion of public companies with no current positive earnings – and therefore valued solely on the basis of hoped-for future earnings – has ticked notably higher over the past 15 years.

A bond is simply a defined stream of cashflows (interest payments) received according to a predetermined schedule until maturity, when the much larger principal/face value that the borrower “rented” from the lender is returned. As is commonly known, bonds are sensitive to changes in interest rates, and the lower the coupon and the longer the final maturity, the more sensitive the bond’s price becomes to even small fluctuations in current interest rates. This makes intuitive sense; low (or even zero!) coupon bonds which won’t return their principal for many years are similar to low cashflow stocks whose hoped-for earnings are concentrated in the distant and uncertain future.

As we’ve discussed many times in previous white papers, this factors into a bond’s “duration,” a measure of price sensitivity to changes in market rates. As a result, it’s normal for high duration bonds to have greater price volatility than low duration bonds.

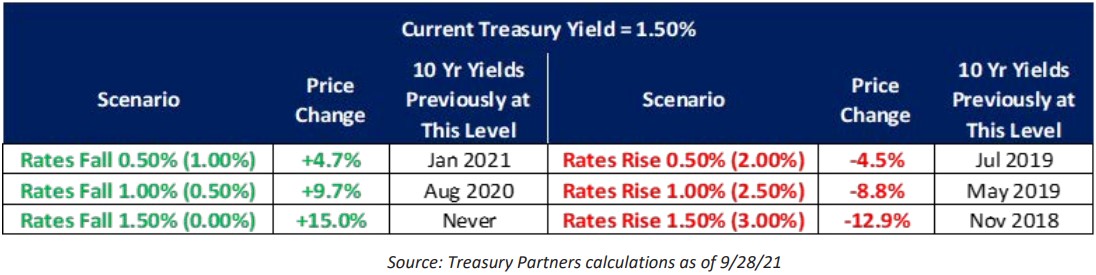

The problem is that current yields don’t come anywhere close to sufficiently offsetting the price risk. Consider the 10-year Treasury, whose current yield and coupon are both approximately 1.50%; it’s undeniably a low coupon, long final maturity, high duration bond. Take a look at this bond’s price change if rates rise or fall within a narrow 0.00-3.00% band. As you can see, if rates rise 1%,the bond’s value declines by nearly 9%, certainly not an appropriate tradeoff for a “safe” investment.

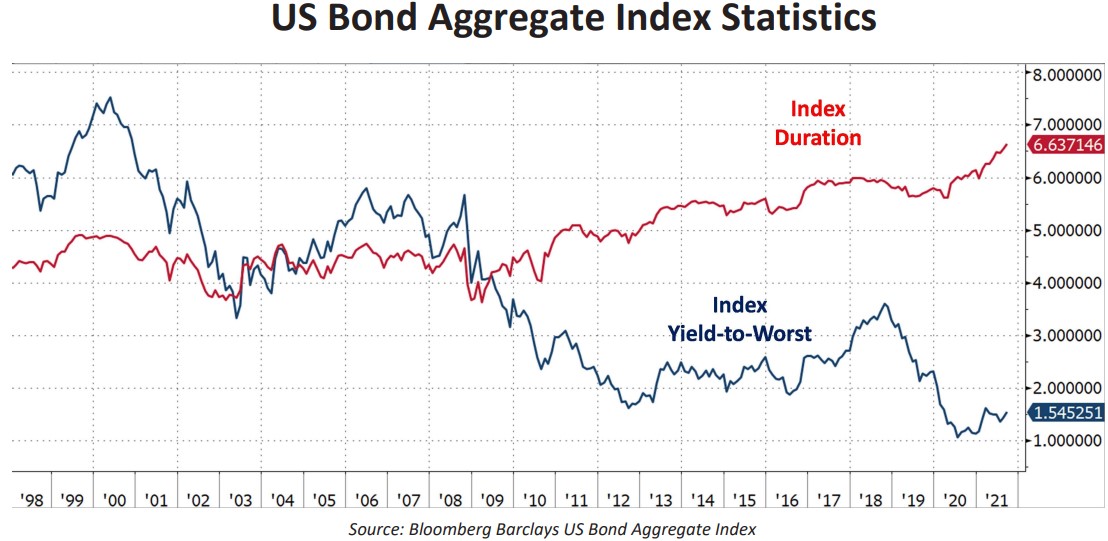

Like low cashflow stocks, low cashflow/high duration bonds are a more common problem than they used to be. Ideally, investors are looking to maximize the amount of yield they are paid for each unit of duration risk they must accept; as the chart below shows, the yield/duration ratio is the lowest in a generation. This makes fixed income investing potentially risky in the current environment.

Longtime readers know our white papers are typically less jargon-filled and technical than this one. However, there’s a good reason we’ve highlighted the numbers this time; the situation speaks for itself better than any narrative could.

Thanks to years of QE and ultra-low rates throughout the world, asset prices are elevated. Low cashflow stocks and bonds in particular have benefitted tremendously, as lenient discount factors lead to elevated prices that reflect little skepticism of far away and uncertain payouts. We believe many investors who’ve benefitted from several years’ worth of strong price appreciation in such securities don’t fully appreciate the current risks levels.

But with tapering imminent and monetary policy beginning to (ever so slightly) tighten, the conditions that led to this boom are primed to fade; those risks will become more apparent. The tide is starting to recede.

As a result, since approximately June 2020, we’ve generally been limiting all fixed income reinvestments to short term (less than 4 years) for final maturities or call dates. We see no good reason to expose client portfolios to a potentially rising rate environment while the payoff remains unattractive.

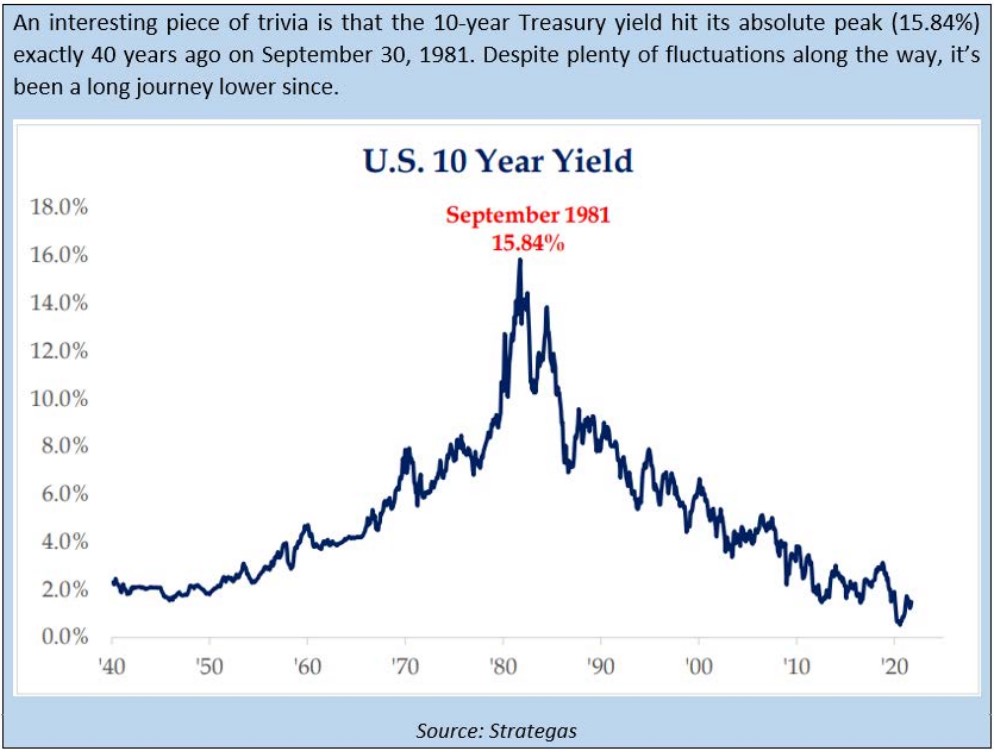

Will the lower-rates ‘supercycle’ continue, or are we approaching a new era? Either way, we’ll keep working to construct bond portfolios to prioritize preservation of capital over chasing yield. As always, we’re honored by your trust and confidence, and appreciate the opportunity to manage your wealth.

For over 37 years, corporations, high-net-worth individuals, family offices, trusts, foundations and endowments have sought our help to construct diversified portfolios positioned to perform throughout market cycles. Among other industr y recognitions, Barron’s has ranked us in the top tier on its annual listing of “America’s Top 100 Financial Advisors” every year since the sur vey was introduced in 2004.

Speak with Our Barron’s Top-R anked Team Today.

Treasury Partners is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is neither indicative nor a guarantee of future results. The investment opportunities referenced herein may not be suitable for all investors. All data or other information referenced herein is from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other data or information contained in this presentation is provided as general market commentary and does not constitute investment advice. Treasury Partners and Hightower Advisors, LLC or any of its affiliates make no representations or warranties express or implied as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Treasury Partners and Hightower Advisors, LLC assume no liability for any action made or taken in reliance on or relating in any way to this information. The information is provided as of the date referenced in the document. Such data and other information are subject to change without notice. This document was created for informational purposes only; the opinions expressed herein are solely those of the author(s) and do not represent those of Hightower Advisors, LLC, or any of its affiliates.