Last December, we titled our 2022 Outlook "Volatility Returns", predicting more turbulent markets ahead as the Fed embarked on a new tightening cycle.

What an understatement. Read on for our thoughts.

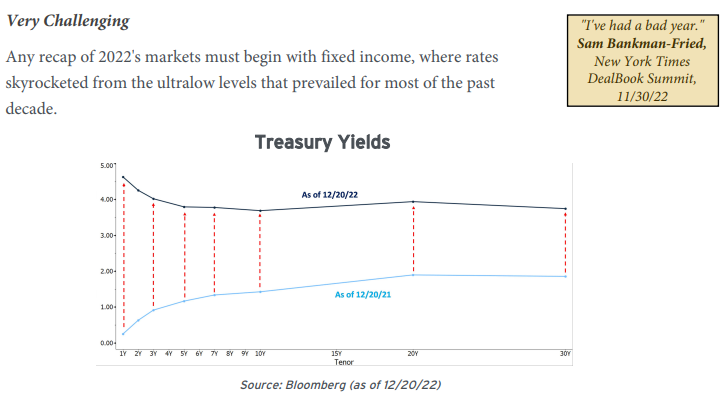

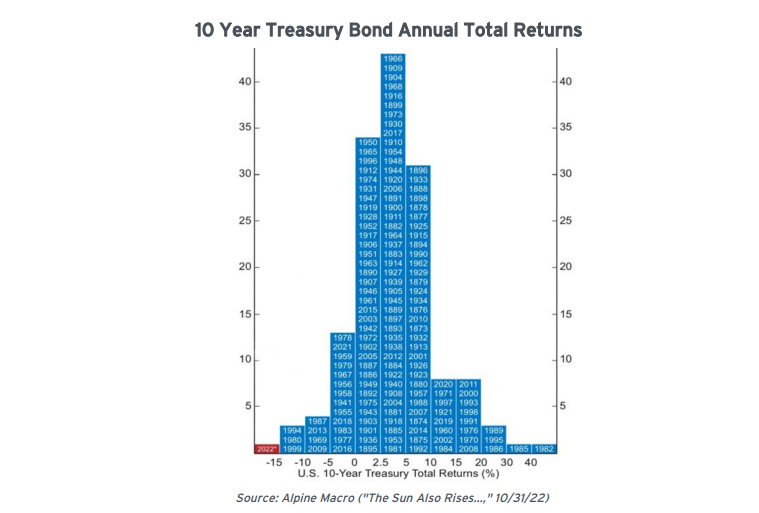

Although Treasury yields in the 3-5% range are nothing remarkable from a long-term historical view, this time they've ushered in a fundamental change in the landscape for all financial assets. In fact, until the most recent bond market rally began in early November, fixed income investors experienced the worst bond market performance ever.

How could it get this bad? It's simple - in no prior instances were starting yields as low as they were. Bonds are reasonably insulated from market gyrations when they offer material levels of income (yield), as coupon payments at least partially offset any price declines from rising rates. Conversely, when yields are meager (as they have been for most of the last 14 years), they can prove just as volatile as equities.

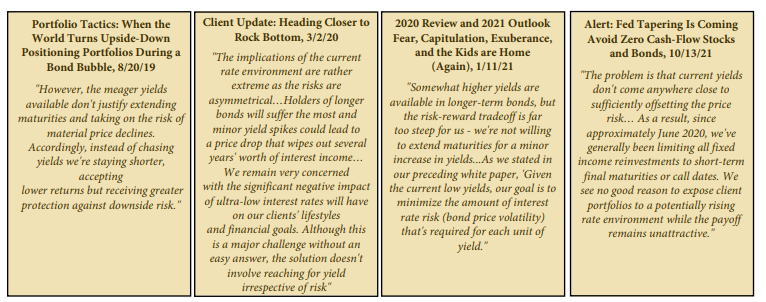

As we pointed out previously, this was exactly the type of scenario we'd warned about for years:

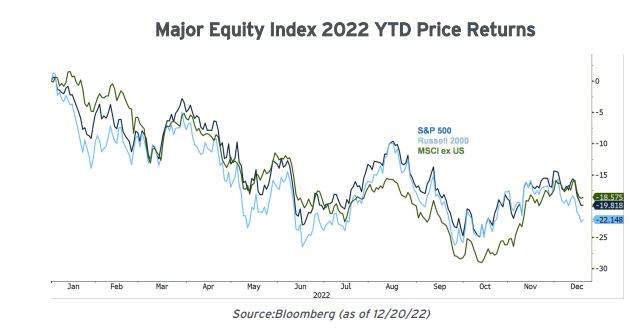

It was also a rough year for equities, with US large-caps (S&P 500), US small-caps (Russell 2000), and International (MSCI ex US) indices all entering bear market territory before rebounding into year-end.

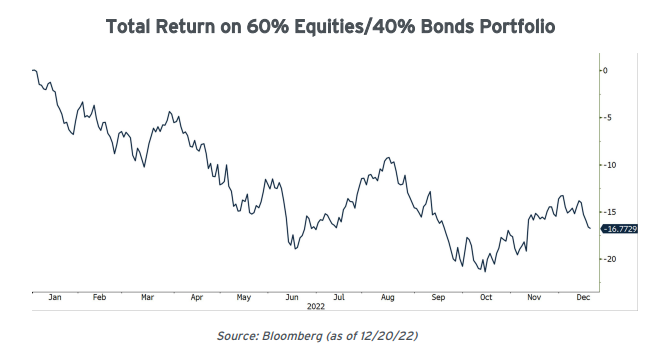

With both bonds and equities reeling, there was practically nowhere to hide from the pain. Through mid-October, the typical '60 stocks/40 bonds' portfolio was down over 20%, the worst performance since 2008's Great Financial Crisis.

Cause…

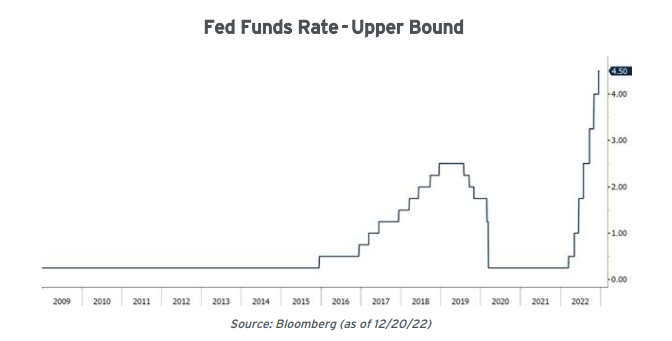

The roots of 2022's financial carnage can be traced back to three misguided Fed policies. The most obvious error was maintaining an 'emergency' 0% Fed Funds rate for years after the Great Financial Crisis of 2008, long past the point when such extreme measures were justified.

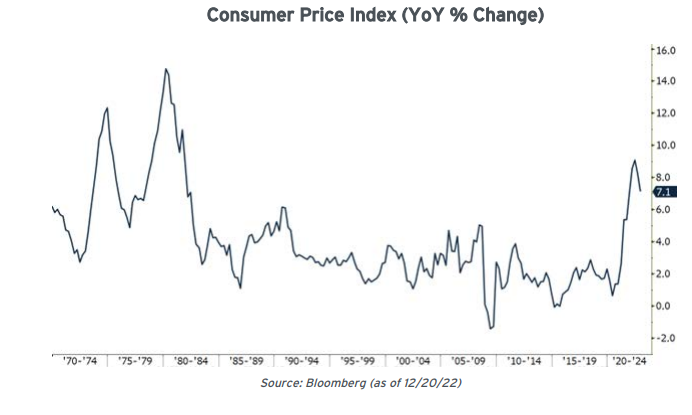

That wasn't because the Fed fell asleep at the wheel, but rather an intentional decision. Having been obsessed with the notion that <2% inflation was a problem itself, in mid-2020 the monetary mavens at the Fed established a new 'inflation smoothing' framework that called for allowing>2% inflation "for some time" to average things out. Intellectually, it was as defensible as burning leaves in your backyard while hoping the flying embers don't start a brushfire elsewhere.

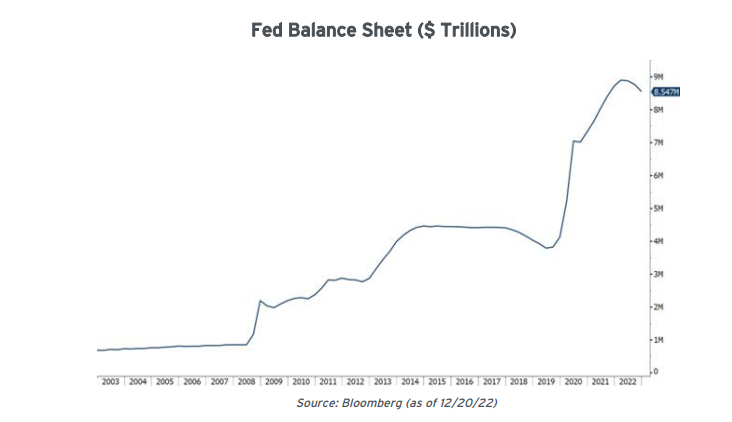

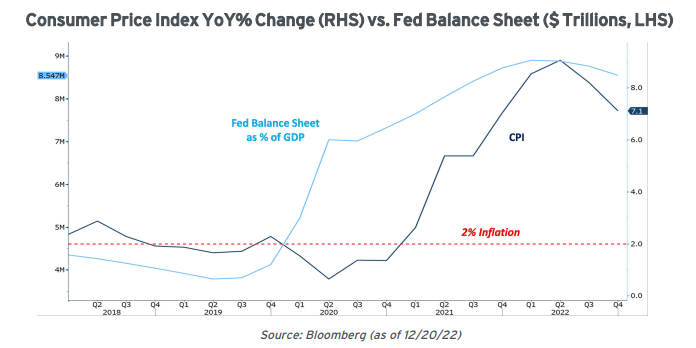

Concurrently, their relatively hidden (but arguably more impactful) policy of Quantitative Easing kept chugging along on autopilot, injecting massive amounts of liquidity into the financial system.

"In a move that Chairman Jerome Powell called a 'robust updating' of Fed policy, the central bank formally agreed to a policy of 'average inflation targeting.' That means it will allow inflation to run 'moderately' above the Fed's 2% goal ‘for some time’ following periods when it has run below that objective." "Powell announces new Fed approach to inflation that could keep rates lower for longer," CNBC, 8/27/20

For an institution that styles itself as an economic 'firefighter', this left the financial 'forest' full of dry tinder, waiting for a spark. That spark came from an inflation shock for the ages, initially prompted by post-pandemic supply chain shortages and commodity-price spikes resulting from Putin's uninvited foray into Ukraine.

Amazingly, the Fed's institutional inertia was so strong that they kept expanding the size of their balance sheet for nearly a full year after inflation started flashing red!

The scale of the problem eventually became too large to ignore, and at the beginning of the year the Fed realized they had to aggressively respond to a situation spiraling out of control. The pendulum swung and the Fed hiked at the fastest pace in decades.

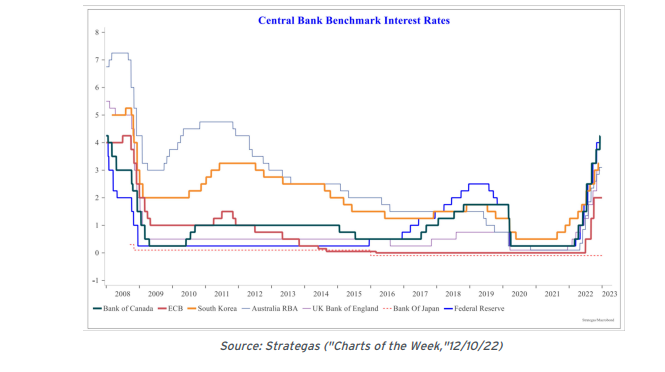

As an aside - it's not just a domestic story. Inflation has become a global scourge, and most of the world's major central banks have now also significantly hiked their own official rates. It's not an exaggeration to say that 2022 caught the entire globe offside.

…and Effect

The first significant 'live-fire' Fed tightening cycle since the 2008 Great Financial crisis is a bona-fide paradigm shift. In that vein, recall what we wrote a year ago:

The resulting shakeout caught many investors by surprise. Here are some illustrative examples.

"As with any paradigm shift, this has implications for those assets which benefitted most from the prior regime: low-cash flow stocks and bonds." Alert: Fed Tapering is Coming, Avoid Zero Cash-Flow Stocks and Bonds, 10/13/21.

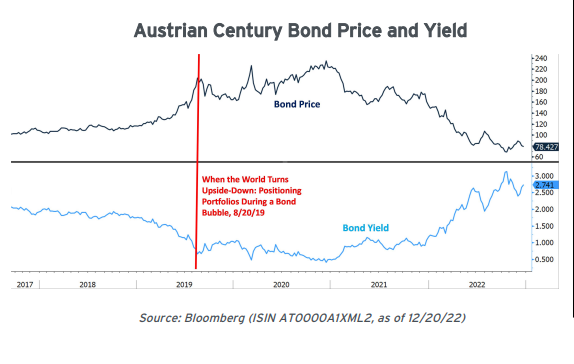

Austrian 100 Year Bonds

Austria issued 100-year bonds in 2017 which rocketed in value during the ultralow rate era but have since proceeded to crash back down to Earth.

A few years ago, we discussed the risks:

What happened afterwards? Well, at first it got even more extreme - at its peak in late 2020 the bond priced at $224 to yield 0.41%. We couldn’t imagine investing in Austria - or any issuer - for 100 years at these meager rates. Nevertheless, investors who bought at the top are now nursing a -67% price loss.

"The Republic of Austria has a 2117 maturity bond that currently trades at a yield of just 0.70%. Investors who buy this "century bond" give up the right to their principal for their lifetimes and are rewarded with less than a 1% guaranteed annual return. Keep in mind that the Austrian state has ceased to exist twice in the last hundred years. Meanwhile, bond math tells us that if its yield rises to just 2% (a level it reached about a year ago), its price would decline by half." When the World Turns Upside-Down: Positioning Portfolios During a Bond Bubble, 8/20/19

Look Out Below

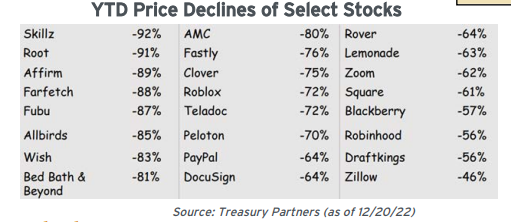

Similarly, the most speculative types of stocks - those with little or no current earnings or cash flow and optimistic but unproven business models - have transitioned from yesterday's Covid-era darlings to today's cautionary tale. As our 2022 Mid-Year Outlook explained:

The scale of the potential downside seemed enormous to us, and subsequent events validated those fears.

"The most speculative equities (those with untested business models and little/no current profits) tend to be growth companies, whose valuations are often based on optimistic assumptions of far-off success and monetization" 2022 MidYear Review and Outlook; Where's the Bottom? 7/7/22

Real Economy

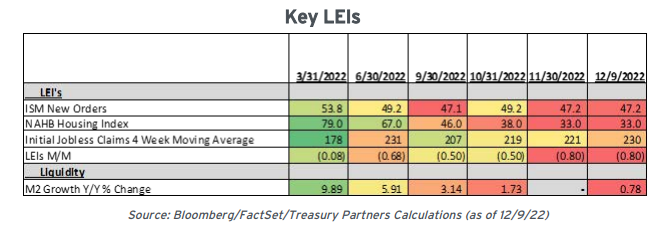

There's little doubt the real economy is slowing, and potentially approaching recession. This is a natural outcome from fighting inflation.

The resulting fallout will occur over several stages:

• Mortgage rates spiking from 3 to 7% will slow the housing market - something which is already happening.

• Higher borrowing costs will crimp spending, leading to a drop in new orders along with other key leading economic indicators (such as new building permits).

• Manufacturers will downshift production in response to both declining corporate spending and softening consumer demand. Consumer demand for services, on the other hand, will remain robust - likely a manifestation of continued post-pandemic behavior shifts. We're also seeing clear signs of this bifurcation - ISM Services readings are holding up much stronger than those for ISM Manufacturing.

• Slowing economic activity will lead to reduced corporate profits and lower forward EPS estimates.

• The labor market will be the last to turn. We expect that the pace of new jobs creation will eventually succumb to these pressures and slow. Eventually wage growth should moderate, further relieving inflationary pressures.

Equities

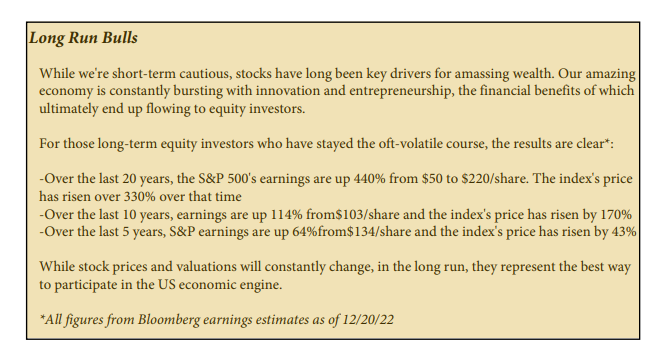

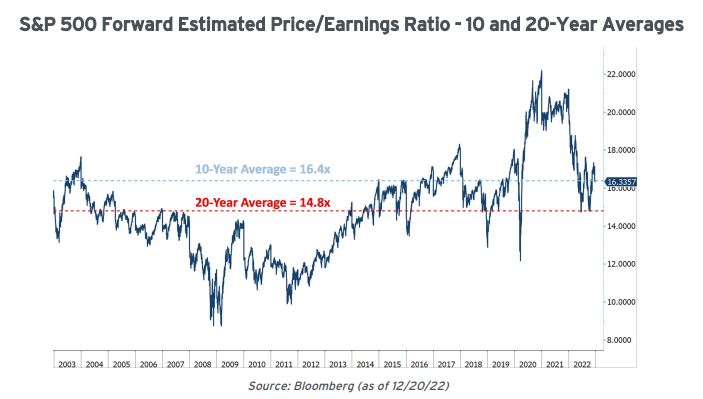

At this writing, the S&P 500 is well above its intra-year low, and trading at a bit under 17x next year's $233 EPS estimate. For context, the 2022 calendar-year EPS estimate is approximately $222, translating into a trailing P/E of nearly 18x.

In blunt terms, that means the market is expecting a $10+/share increase in corporate profits against a backdrop of significantly higher rates and a softening economy. That's rather wishful thinking (to put it mildly). We'd rather believe in more reasonable expectations.

Worryingly, multiples don't seem to be in position to provide any significant help to offset any EPS downside. As seen below, P/Es remain elevated versus 20 year averages. Declining bond yields typically help support multiples, but with Powell & Co. focused on making sure the inflation beast is tamed, they can’t be counted on to start cutting rates anytime soon.

Adding onto the 'wall of worry' is that several of the key Leading Economic Indicators ("LEIs) we look at continue to deteriorate, making new lows for the year reflecting a clear softening trend. As LEIs typically demonstrate a high degree of correlation with the near-term performance of the S&P 500, this noticeable turn lower is a harbinger for reduced EPS and equity performance.

In short, both current EPS estimates and multiples strike us as overly optimistic for an environment where the Fed is tightening and economic conditions are expected to slow. The nearterm upside potential seems unfavorable and we're maintaining a cautious outlook.

Fed Policy

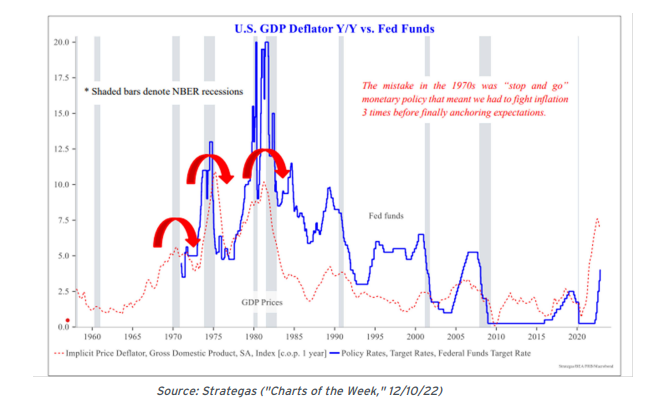

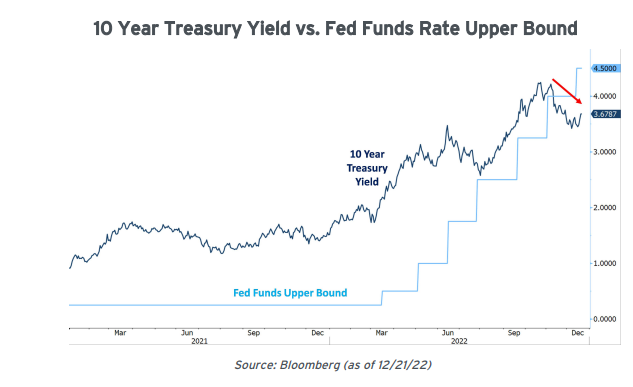

We expect Fed Funds to peak above 5.00% in the first half of 2023, when the Fed likely pauses its tightening campaign. Depending on the pace of disinflation, our current expectation is for Fed Funds to remain at this level for the entirety of 2023. During this period, inflation should moderate. As we first indicated this past August, one of our trigger points for reassessing risk assets (read: becoming more aggressive) will be when the Fed Funds rate is at or above the inflation rate

"History indicates that the Fed typically does not stop tightening until the Fed Funds rate exceeds the rate of inflation. We are far from meeting that threshold at this juncture." Corporate Cash Alert: Board the Plane, 8/15/22

A chastened Fed has publicly committed to prioritizing fighting inflation over preventing recession. That means in addition to the pre-requisite of Fed Funds being above the inflation rate, cuts are unlikely until formal inflation statistics post significant multi-month declines - regardless of economic weakness. This is informed by the history of how Fed officials acted the last time we were in such an environment.

Fixed Income

Given this scenario, shorter-term interest rates (for example, 1-3 year maturities), which are highly correlated to the Fed Funds rate, should remain elevated for most of 2023. However, as the Fed continues to tighten, short term rates will not move higher in lockstep.

Longer-term maturities will act differently. Unlike short-term rates, long-term yields are a function of many variables, including expectations of the extended economic cycle. As a result, we expect levels on 10+ year bonds to decline, reflecting the expectation of moderating inflation and economic activity. That explains why yield curves sometimes invert _ it's simply markets looking ahead to a future that could be very different than the current economic climate.

This scenario is exactly what's playing out with today's inverted curve. After reaching 4.25%+ only a few weeks ago, the 10 Year Treasury has fallen to the 3.60% area. Remember that rates typically 'take the stairs up and the elevator down,' which is exactly what happened since we published our late October Client Alert :

For now, this cycle is behaving similarly the last hiking cycle of 2015-2019. As clients know, we’ve acted based on this thinking and have been aggressively extending maturities since late September.

"History shows that long-term bond yields often reach their peak before the last Fed rate hike of a cycle." Alert - What to Do Now? Action Plan for the Worst Bond Market in 40+ Years, 10/20/22)

Expect the Unexpected

Rapid and extreme Fed tightening cycles typically cause unexpected 'breakages' in the financial system. While we've already had a few close calls (the cryptocurrency meltdown, UK's pension bailout crisis, Credit Suisse getting rescued, Japan sacrificing $120 billion in foreign reserves to unsuccessfully support the yen, etc.), that doesn't mean we're out of the woods yet.

You've probably heard me say "When fishing with dynamite, the biggest fish are the last to float to the surface." As painful as this year's been, the Fed still hasn’t finished hiking, which means they're not done tossing dynamite. The biggest wounded fish may not yet be apparent. We're keeping our eyes wide open.

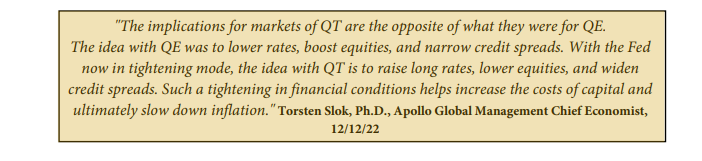

Wild Card - Quantitative Tightening

There's more dynamite going into the water than you might think - remember that Quantitative Tightening ("QT"), the reduction of the Fed’s balance sheet, is also occurring in the background. Although unwinding the novel experiment that was Quantitative Easing ("QE") is itself an experiment, there's plenty of cause for concern:

The Bill Starts Coming Due

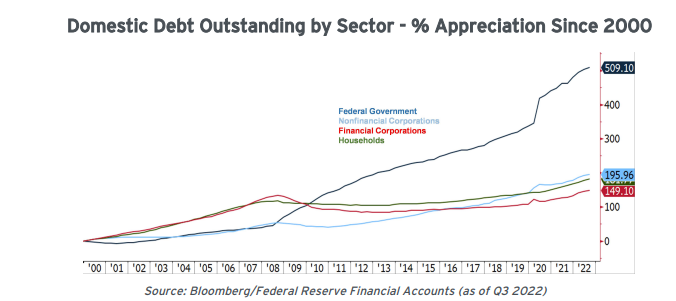

Consider this - while the outstanding stock of debt in every sector has grown significantly in the past couple of decades, the increase in the US government’s obligations is by far, the largest.

In 1982, my first year in the business as an aspiring young trainee (adorned with a full head of hair), US GDP was $3 trillion, and the outstanding value of tradeable Federal debt was still under $1 trillion. Forty years later, US GDP is approaching $26 trillion, an eight-fold increase - not bad. However, Federal debt now tops $30 trillion, a 30-fold increase! Clearly, if anyone cares to look at the numbers it's obvious that debt is increasing at a much faster pace than GDP, an unsustainable trajectory.

To be clear, the mighty engine of the US economy, as well as the US dollar serving as the global reserve currency, have been instrumental in helping us get to this point. By importing boatloads (literally) of goods from a globalized world and settling the bills with our ubiquitous currency, our trading partners have long had little choice but to recycle their USD back into Treasuries. Life is good when you have a (more or less) captive buyer base to purchase your IOUs! Add a Federal Reserve that's more than happy to print money to gorge on Treasuries (via Quantitative Easing), and it's not hard to see how it was easy to pile up this debt.

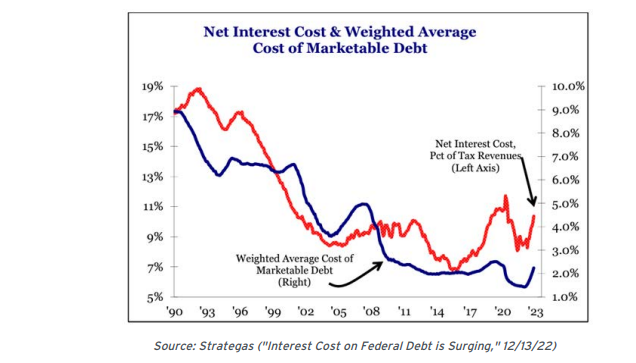

Who knows how long this merriment can continue, but the fact is that a large portion of this debt binge occurred during the ultralow rate environment, when the actual cash-flow cost of supporting it was relatively contained.

Speaking of the ultralow rates era - as we know, plenty of economic actors took advantage of what turned out to be an historic opportunity to optimize their debt loads for the long run. Homeowners ran to their banks and secured 2.50-3.50% 30-year fixed rate mortgages. Corporations went on an unprecedented borrowing spree and 'termed out' (extended maturities) their debt. Austria (as indicated previously) issued 100-year bonds. Brilliant.

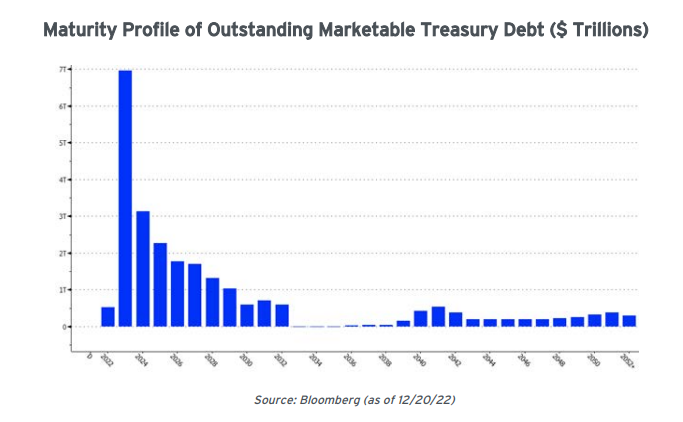

But what did Washington do? Nothing. Our merrymakers didn't 'term out' our borrowing - the weighted average maturity of all Treasuries is just 6 years, and over half of the principal matures (and needs to be rolled over into new bonds) within the next 3 years. As a result, this year's spike in rates will lead to increased interest costs which will consume an ever-growing bite out of Washington's budget.

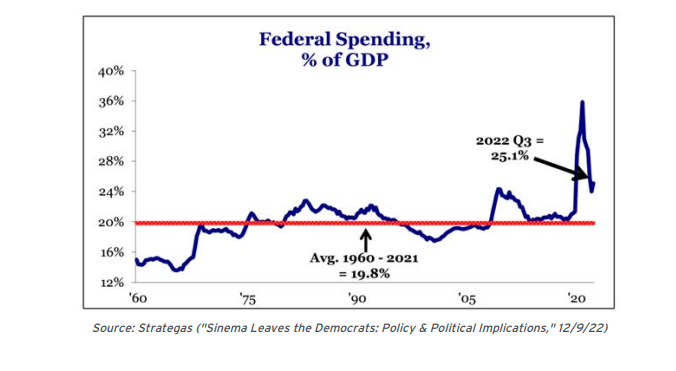

What does this mean? Just like the Fed’s monetary policy tools are constrained by the need to focus on fighting inflation, the federal government's ability to enact new fiscal stimulus is limited by the increased cost of financing. As it is, Federal spending represents approximately 25% of GDP. Add higher interest costs, greater deficits, and more Treasury issuance to fund existing deficits, and we have an unsustainable roadmap.

To reiterate - at current levels we think the near-term risk/reward in stocks is weighted towards the downside. Earnings estimates are far likelier to degrade as the underlying economy inches closer to recession, and multiples likely can't increase so long as the Fed continues to 'pull away the punch bowl' and apply the brakes to economic activity.

Until that value proposition improves, we're maintaining below-average core equity positions within client asset allocations. We'll likely get more aggressive when certain inflection points become apparent, such as unexpectedly sanguine corporate earnings updates and evidence of accelerating disinflation (especially when the Fed Funds rate is at or close to exceeding the inflation rate).

A key reason we feel comfortable with reduced equity allocations is because the opportunity in fixed income remains compelling. Within bond portfolios, we're still focused on extending maturities and capturing today's elevated long-term rates. What we wrote in late October's Alert continues to inform our strategy:

Despite the recent move lower in rates, the absolute level of yields is still attractive, especially relative to the meager yields over the preceding 14 years. From an asset allocation standpoint, the portfolio 'ballast' of locked-in 3.00%-5.00%+ rates can help meaningfully offset equity market downside.

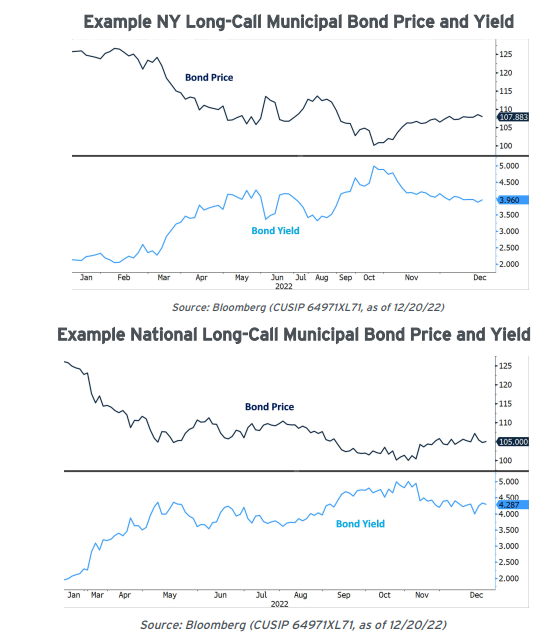

For clients who can benefit from tax-advantaged income, longerterm municipal bonds continue to offer excellent risk-adjusted yields without having to sacrifice underlying credit quality. The prices/yields available represent a night-and-day difference from where they were in early 2022.

"But at some point, the economy will inevitably slow, which typically leads to rates marching lower (and bond prices moving higher). At current levels, unlike the last decade of financial repression, bonds provide the benefit of ballast by effectively hedging what we think is the most serious threat to investors in the coming years - the possibility of an economic slowdown or recession. The best defense against this scenario is a strong offense - locking in today's attractive yields for the long term." What to Do Now? Action Plan for the Worst Bond Market in 40+ Years, 10/20/22

We're all settled into our special new offices in 300 Madison Avenue, just steps away from Grand Central Station in the heart of Midtown Manhattan (actually, we moved diagonally across the street from our old place). Clients are encouraged to stop by for your next portfolio review and take in the unobstructed NYC skyline views from the 29th floor.

In the meantime, as always, we continue working hard to help you achieve your financial goals. Throughout these turbulent times, we've never lost sight of our primary mission - safeguarding you and your family's wealth over the long-term. Know that we’re honored by the trust and confidence you place in us.

Our best wishes to you and your family for a wonderful holiday season and a happy, healthy, and refreshing New Year.