This year has proven horrible for both equity and fixed income returns. The S&P 500 is down 23% and the major bond indices have all posted double-digit declines. The 'classic' 60/40 stock/bond portfolio, which is supposed to provide protection, is down a whopping 20+%, nearly identical to the carnage back in 2008's Great Financial Crisis. What's an investor to do when there's nowhere to hide?

The good news is that the root cause of this pain - inflation leading to rapidly rising rates - has set the stage for an attractive opportunity, with many more likely to emerge in the future.

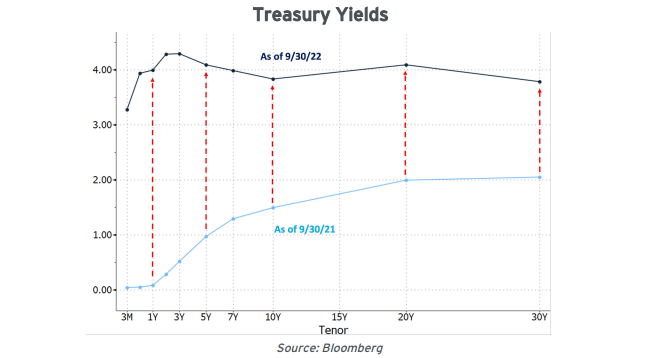

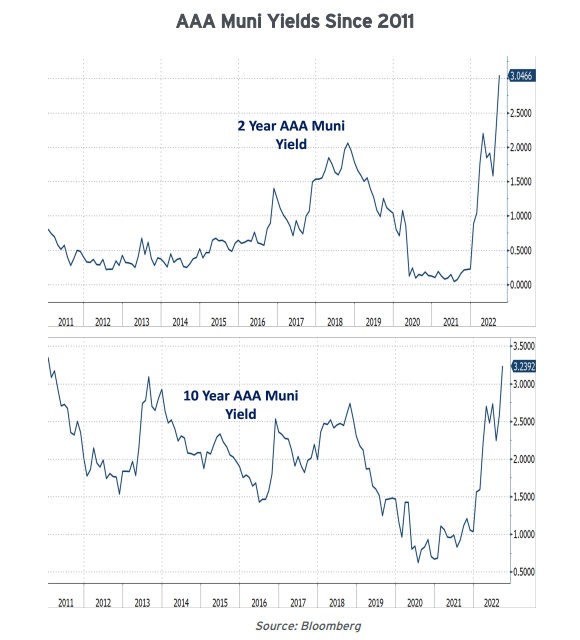

After additional jumbo-sized Fed rate hikes and persistently 'hot' inflation readings, interest rates across the curve spiked to decade-plus highs. The speed of the repricing has been staggering:

• One year ago, the 2- and 10- Year Treasuries yielded just 27 and 150 basis points (bp), respectively

• Now, they fetch 4.25% and 3.75%, respectively

Higher yields result in falling bond prices, and the massive scale of the resulting losses are record-setting:

• Through the end of Q3, YTD total returns on the major fixed income indices are worse than any full-year recorded dating back to the 1970s.

• Investors who bought the then-current 10-Year Treasury one year ago at a 1.50% yield (we certainly didn’t) are now saddled with a -17.5% price loss.

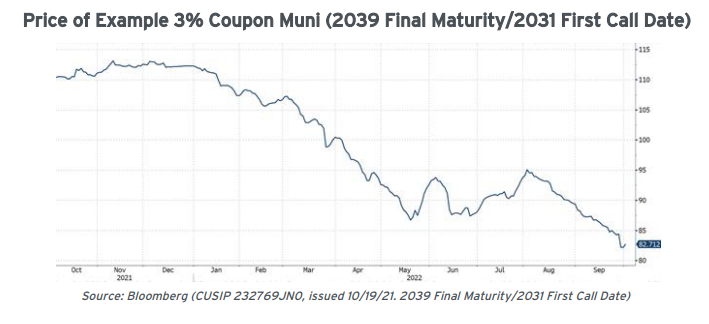

• On the municipal bond side, a representative long-dated 3% coupon muni first issued a year ago at a price/yield of $111.4/1.67%, today trades at $82.7/4.50% - a staggering 25% decline!

Periodic rising rate cycles are natural and inevitable, and declining bond prices always come with the territory. But this cycle is particularly vicious, triggering the worst fixed income losses since the Volcker era (when I started plying my trade) and destroying an inordinate proportion of investor capital. Why did fixed income perform so poorly?

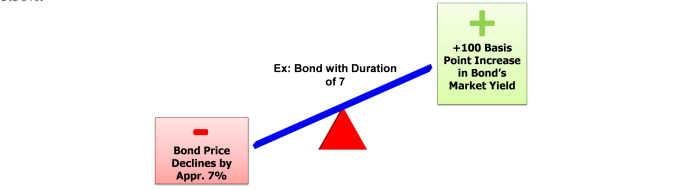

Recall that a bond's maturity, or duration (as we think about it), is a measure of its price sensitivity to changes in interest rates. For example, if rates rise 1% (100 basis points), a bond with a 7-year duration will decline by approximately 7%. Offsetting this price decline are the coupon payments received from the issuer - if the same bond also pays out 3.50% per year, the net total return pencils out to a more palatable -3.50%.

As we've been writing about for years, a decade of 'financial repression' dramatically skewed interest rates lower, which tilted the risk-reward proposition against bondholders. Continuing the example, there's a world of difference between owning a 7-year duration bond with a 3.50% yield compared to a 1.00% yield. For the former, a 100 bp (1%) rise (and corresponding 7% price decline) wipes out the equivalent of 2 years' worth of income return; for the latter, it's enough to negate 7 years' worth of income. Not a good deal.

Basically, the Fed's long-running experiment in keeping rates nailed to zero meant that fixed income markets entered 2022 chock-full of risk due to their high-duration, low-yield characteristics. Inject unrelenting inflation readings and an aggressive Fed and it leads to massive declines in bond prices.

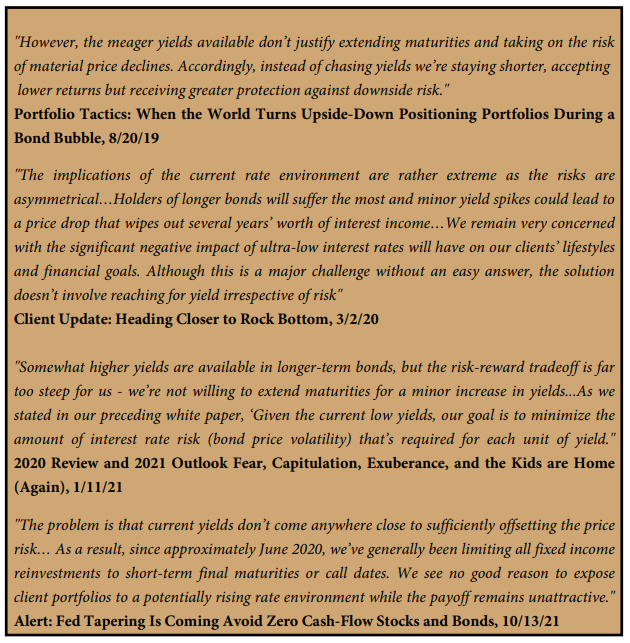

Longtime readers and clients will know that we pounded the table over and over again about precisely this risk that has now come home to roost.

Most Treasury Partners client asset allocations are structured using a 'three-dimensional' approach: investments in stocks (to capture market-correlated returns), hedged strategies (seeking less marketcorrelated returns), and bonds (generally geared to provide income or principal safety - 'ballast' - to an overall portfolio).

Fixed income's ability to provide income or ballast is directly related to the absolute level of rates. If investors seek safety and 'ballast' in a low-yielding environment, they must greatly lower the durations of their bond portfolios (i.e., hold shorter-maturity debt). This was the central problem confronting us in the 'financial repression' years and informed our multi year strategy of avoiding extending durations in client bond portfolios. We simply couldn't have been any clearer in our client advice and outlook.

But things are different now. Given where we are today, the risk-reward is much more attractive, and extending durations actually results in much-improved yields that better compensate for the price sensitivity.

Naturally, inflation plays a big role in future Fed policy, and predicting where inflation is ultimately headed (and on what timeframe) is fraught with uncertainty. But at some point, the economy will inevitably slow, which typically leads to rates marching lower (and bond prices moving higher). At current levels, unlike the last decade of financial repression, bonds provide the benefit of ballast by effectively hedging what we think is the most serious threat to investors in the coming years - the possibility of an economic slowdown or recession.

The best defense against this scenario is a strong offense - locking in today's attractive yields for the long term. Today's municipal bond market presents the most visible opportunity to do just that. Munis are now posting absolute levels we've only seen during the very depths of illiquidity-driven crises, such as the March/April 2020 COVID-related panic, the last time we aggressively extended client durations.

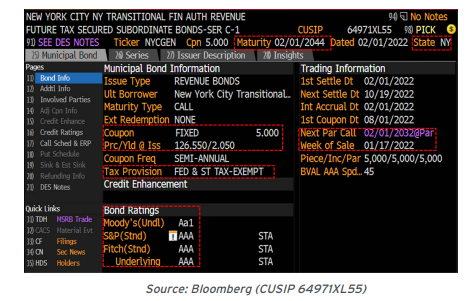

In fact, the benchmark levels in the charts above don't tell the full story. Long-dated, high-grade municipals are now offering 3.50-4.50% tax-exempt yields, levels we've rarely seen in the last 15 years. As an example, the below highly-rated NY muni with a 2044 final maturity callable in 2032 now trades at approximately $105.7/4.25% yield (exempt from both federal and NY state/local taxes). 3 For context, this bond was first issued in February 2022 at $126.5/2.05%. As a result, it's down 16% in price in just 8 months. Similar pricing and yield examples exist in many states around the country.

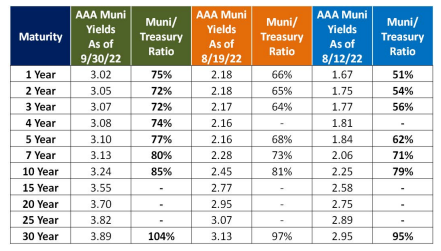

First and foremost, these eye-catching yields are primarily a consequence of higher Treasury yields; as Treasuries go, ultimately so will municipals. This past summer munis traded at particularly expensive relative valuations compared to similar-maturity Treasuries. Over the past couple of months, the overvaluation has retraced and the value in munis is far more apparent.

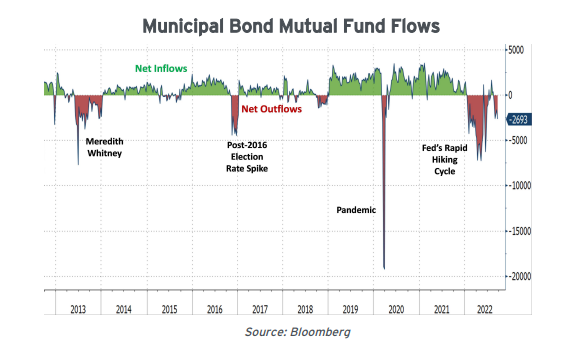

The other main factor driving muni valuations is a unique dynamic within the muni market itself - forced selling by municipal bond mutual funds. For technical reasons, they play an unusually large role in dictating price swings in the muni market and in 2022 they've endured large and consistent net outflows which created forced selling to meet redemption requests.

Less demand paired with increased supply usually leads to bargains, and longtime readers and clients know that I'm a passionate fisherman and won't hesitate to enjoy 'bottom-fishing' the muni market.

It's important to note that this market repricing happened despite a still-strong muni credit backdrop, rather than because of deteriorating issuer fundamentals. Moreover, credit defaults in high-grade munis (what we buy) have historically been vanishingly rare.

I've had a front row seat to many rate cycles dating back to 1982, and one of our core takeaways is that bond investing is ultimately an 'opt-in' decision. When absolute yields were ridiculously low, we 'opted-out' from broadly extending maturities and maintained below-average portfolio durations. Our hard earned lessons from past bear markets are at the forefront of our thinking, especially when it comes to the capital that's meant to serve as the 'safe' money within client asset allocations.

We're starting to take advantage of this higher rate environment by 'opting-in' and purchasing longer dated, high-grade municipal bonds within client portfolios. A key consequence is that account durations will rise. But at these levels we're comfortable with the duration-yield tradeoff. To summarize our decision:

• If inflation rages and rates continue to rise, bond prices will decline but any unrealized price losses can be meaningfully offset by locked-in 4% income returns.

• Conversely - if the economy slows meaningfully, inflation will likely cool, leading to falling interest rates and higher bond prices.

• Long-term nominal returns on the S&P 500 have historically averaged 10%. Today, long-dated municipal bonds can generate tax-exempt income that's the equivalent of an 8%+ fully-taxable return (for max taxpayers in high-tax states). As investors realize how much this risk/reward relationship has shifted, we expect to see assets reallocated from stocks to bonds. We want to be 'early' and front-runn this dynamic.

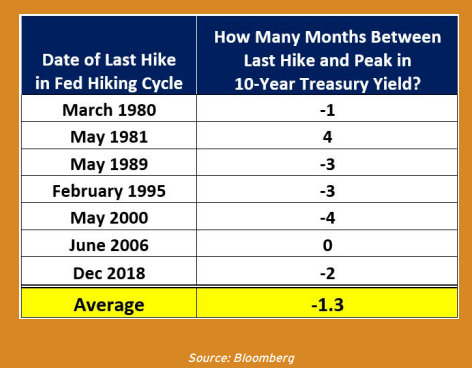

• Finally, some clients have suggested delaying our timing - that it's better to wait because inflation and rates are still rising, and a better entry point is still to come. We disagree, history shows that long-term bond yields often reach their peak before the last Fed rate hike of a cycle.

Our playbook is clear: 1) start gradually legging into municipal bond positions now while inflation remains elevated, 2) get more aggressive when inflation starts to moderate, and 3) maintain elevated credit quality today to guard against tomorrow's recession risk.

I must say that after 40 years of managing money, I still feel thrilled identifying turning points which lead to investment opportunities that we can capture for the benefit of our clients. My team and I greatly appreciate the confidence you place in our decision making and for the great honor of managing your wealth.

Treasury Partners is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is neither indicative nor a guarantee of future results. The investment opportunities referenced herein may not be suitable for all investors. All data or other information referenced herein is from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other data or information contained in this presentation is provided as general market commentary and does not constitute investment advice. Treasury Partners and Hightower Advisors, LLC or any of its affiliates make no representations or warranties express or implied as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Treasury Partners and Hightower Advisors, LLC assume no liability for any action made or taken in reliance on or relating in any way to this information. The information is provided as of the date referenced in the document. Such data and other information are subject to change without notice. This document was created for informational purposes only; the opinions expressed herein are solely those of the author(s) and do not represent those of Hightower Advisors, LLC, or any of its affiliates.