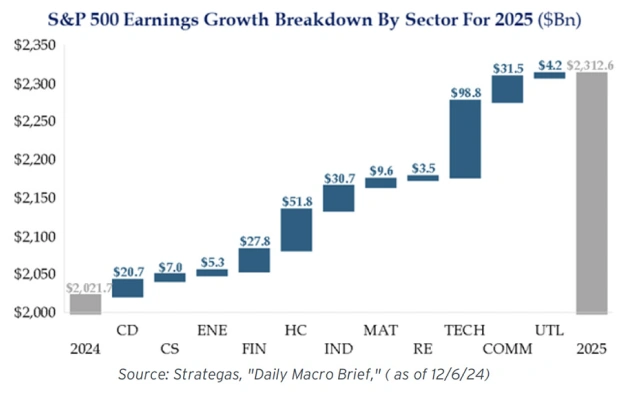

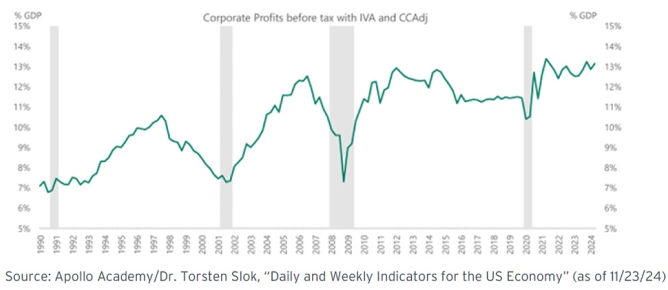

Despite significant mainstream pessimism heading into 2024, the real economy ultimately posted another year of solid growth. Corporate America's fundamentals are still robust: increasingly optimistic management commentary and forward earnings-per-share (EPS) estimates optimistically assume a double-digit increase for 2025, with all sectors expected to participate in the upside. According to Bloomberg data, average 'Street' EPS expectations for the S&P 500 currently stand at $272 for 2025 vs $242 for 2024.

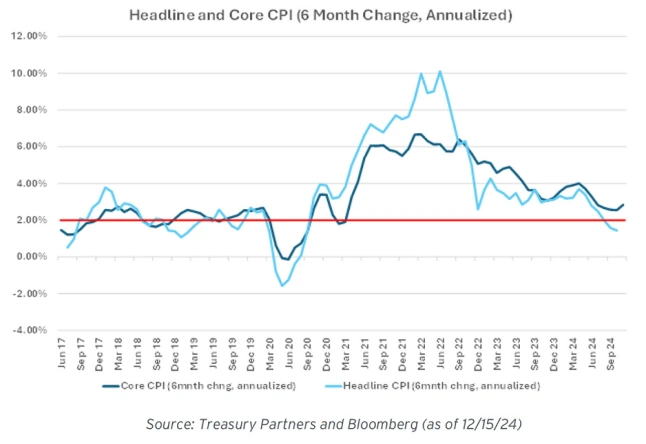

Inflation, while declining, is also potentially plateauing at a level somewhat higher than the Federal Reserve's (Fed) 2% annual target. Although we've turned the page on the historic post-pandemic spike, we haven't quite walked it all the way back either.

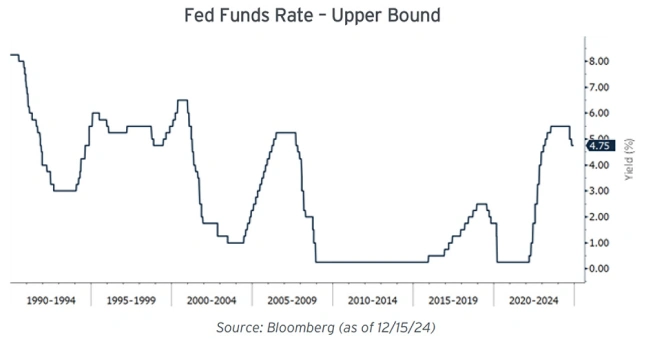

But that hasn't stopped the Fed from kicking off its long-awaited easing cycle. As of this writing, they've cut the Fed Funds Rate by 75 basis points (bps) from 5.5% to 4.75%, justifying the reductions as 'insurance' – that is, with economic growth off its peak and the labor market no longer red-hot, the Fed has deemed it prudent to ease off the brakes. Although we disagree with this decision, note the Fed Funds Rate nevertheless remains near post-2008 highs and at a level that could be considered more 'normal' given the strength in the labor market and economy.

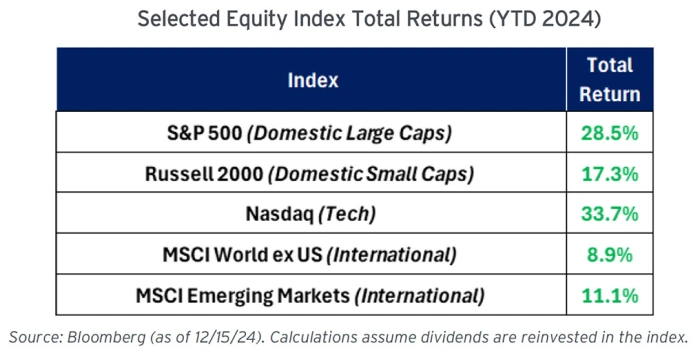

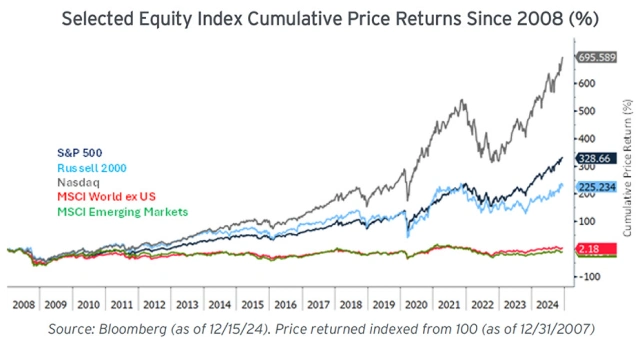

Given this supportive backdrop, it was unsurprisingly a very strong year for equities, with all the major domestic indices posting bumper gains for the second year in a row.

Once again, domestic equities (particularly the S&P 500) handily outpaced their counterparts in both developed and emerging international markets. As clients know, since 2008, we've been severely underweight international developed market equities and have no direct exposure to emerging markets. That's proven to be a significant driver of long-term outperformance – over that timeframe, they've hardly grown (or outright contracted) while each of the major domestic indices have at least doubled in value.

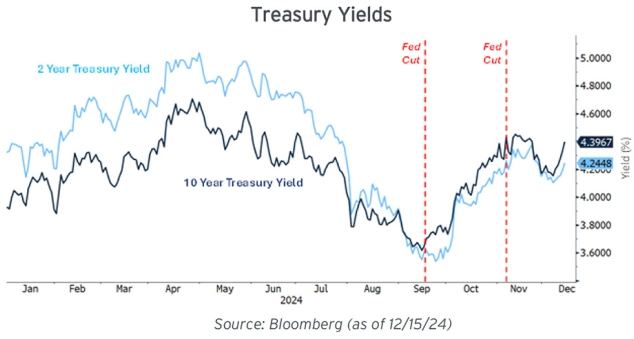

Meanwhile, in fixed income markets, most of the action was concentrated in the second half of 2024. Ironically, both 2- and 10-Year Treasury yields spiked over 75 basis points at the same time the Fed cut the Fed Funds Rate by 75 bps. Far from being irrational, this seemingly odd dynamic starkly illustrated how investors grew increasingly concerned that a prematurely accommodative Fed risked sparking a 'second wave' of inflation.

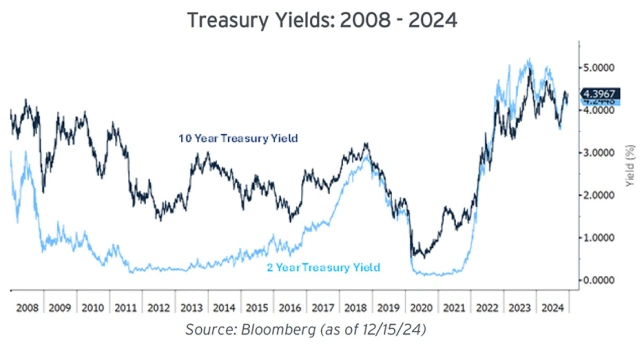

It's important to keep perspective on these moves - we're still logically above the absurd near-zero yield environment that prevailed for much of the past 15 years.

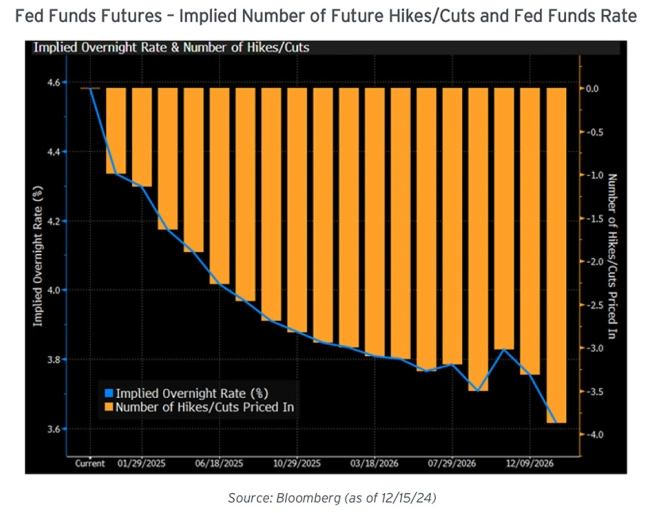

As mentioned earlier, just a few short months ago the Fed started reducing its benchmark Fed Funds Rate. Thus far we've seen 75 bps worth of easing - a 50 bps cut on September 18th and another 25 bps on November 11th – and as this Outlook is being written markets expect further cuts, paired with additional liquidity from halting Quantitative Tightening (QT, whereby the Fed gradually decreases the size of its gargantuan balance sheet).

Remember that Fed easing is typically a tool meant to combat deteriorating economic conditions. Currently the fundamental backdrop is far from 'deteriorating' – real GDP growth stands at a solid 2.7% YoY, inflation is still tracking uncomfortably above the Fed's 2% target (last tick at 2.7% YoY), and the unemployment rate is barely above generational lows (now at just 4.2%).

I simply don't understand the rationale for easing in the current environment, particularly as my own personal 'dashboard' of indicators tells me markets are firing on all cylinders:

Domestic equity markets keep making endless new highs while investor sentiment increasingly assumes the party won't stop

The price of gold is soaring

Companies are still earning record profits

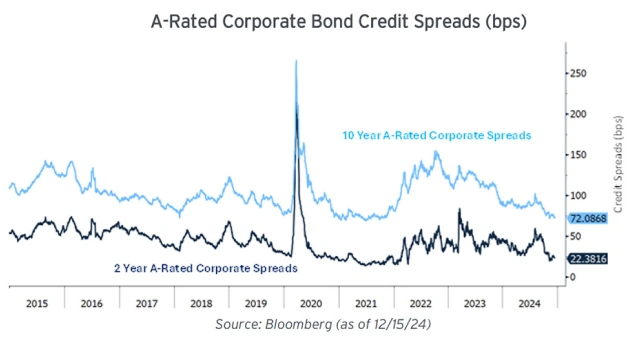

Corporate credit spreads (a measure of investors' perceptions of corporate bond risk) are pinned to the floor

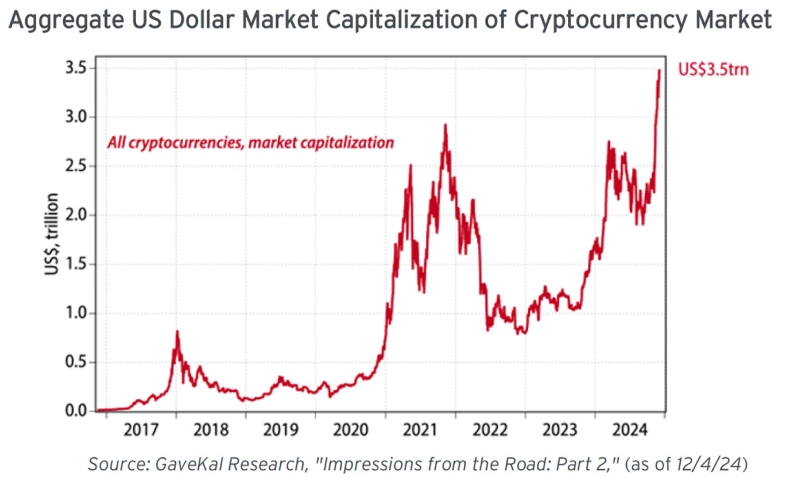

Cryptocurrency valuations are at record highs

There's more: record household net worth, all-time high stock prices, elevated valuations across asset classes, and a healthy banking sector. Oh, how things have changed in my 40+ years of observing the markets.

If anything, this evidence points to the potential for a cyclical boom rather than an imminent bust - so why is the Fed so eager to add fuel to a healthy fire?

Maybe these cuts are ultimately just 'insurance' to mitigate the impacts of any worst-case scenarios, such as widely anticipated commercial real estate defaults or a wave of leveraged companies struggling to pay the interest on their overleveraged balance sheets.

But then again, perhaps my views are simply outdated. They've been shaped by a 40+ year investment career, much of which coincided with a seemingly bygone time when monetary policy supported capitalism vs. simply being a cheerleader for ever-rising markets. Over the past couple years, I'd hoped the Fed had finally moved on from the deeply broken mindset that fueled its flawed Zero Interest Rate Policy (ZIRP) era. But by cutting rates as 'insurance' during an otherwise vigorous economy, are we once again back to preventing capitalism from weeding out the weakest businesses?

For now, we remain long domestic equities, with our eyes wide open towards the risk of overstimulation.

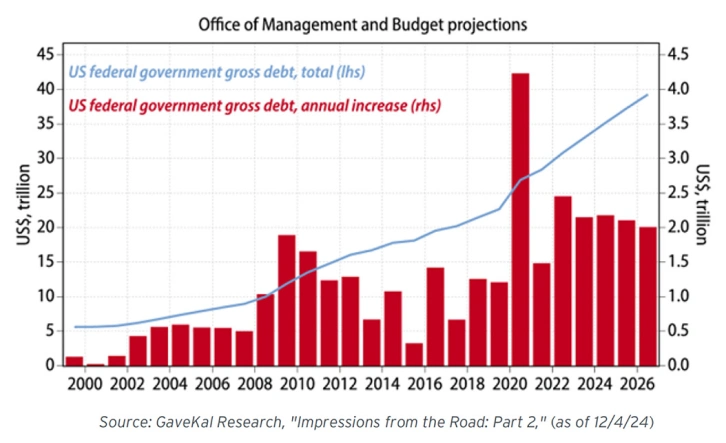

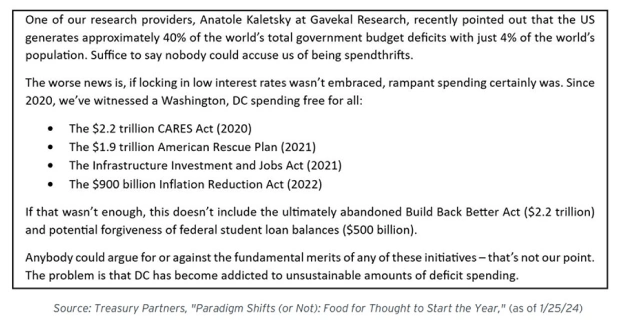

Meanwhile the very concept of consequences continues to be ignored in Washington, DC. Whether led by either side of the aisle, regardless of unified or split control of government, the growth of the already enormous pile of federal government debt has only kept accelerating.

The fiscal spigot has gushed particularly hard the past few years:

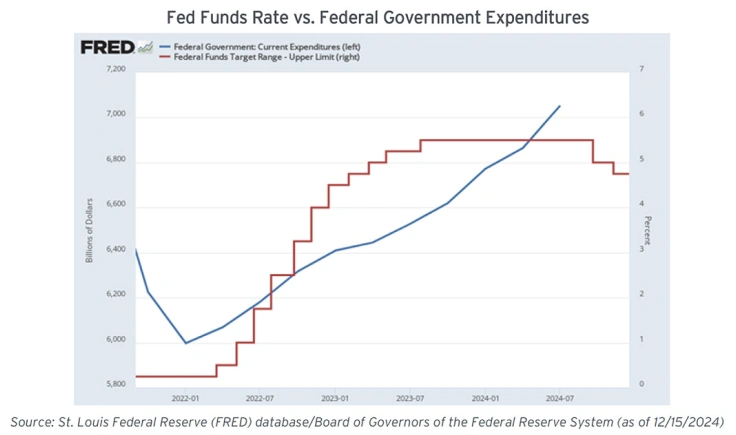

But what's especially striking about the current environment is that over the past several years, we've seen increasingly profligate deficit spending at the same time the Fed was rapidly raising rates - a highly unusual pairing of loose fiscal policy with tight monetary policy.

Until now I couldn't have imagined a world where the Fed hikes 5 percentage points (500 bps) in just 18 months to break the back of surging inflation, yet the economy barely breaks a sweat. My decades of experience counseled that a tightening of that magnitude should've resulted in at least some slowing of economic activity.

However, I now understand there was a missing piece to the puzzle that I hadn't considered: the possibility that monetary and fiscal policy could be so divergent for so long. It's now clear to me that fiscal/deficit spending on a massive scale can outweigh the dampening impact of higher base rates from Fed tightening. The improbable economic resilience we're now seeing despite historically fast and sharp Fed tightening is largely due to the offsetting impact of ultra-stimulative federal largesse. In turn, the solid economy - with its still-growing corporate earnings - has fueled the bumper gains in risk assets (eg; stocks, real estate, Bitcoin, etc.).

But the landscape is shifting as the Fed is now back to easing while the politicians keep spending. Loose monetary and fiscal policy is the new order of the day – does that mean markets are off to the races once more?

The end of election season doesn't mean politics will recede into the background – if anything, from a market-watching perspective we're just now shifting from the prelude to the main event!

2025 promises to be a year of headlines from DC, as the new administration and Republican-controlled Congress assumes power and begins to tackle an ambitious slate of political priorities. At this early juncture, it's very difficult (and obviously premature) to handicap how everything will ultimately shake out. We certainly expect increased volatility over the next 4 years due to the potential for major (and sudden) shifts in far-reaching policies.

Lots of ideas that promise to have at least some market impacts are on the table, each with differing implications for risk assets:

Potentially beneficial policies for domestic equity markets include:

Conversely, possibly harmful policies for stocks involve:

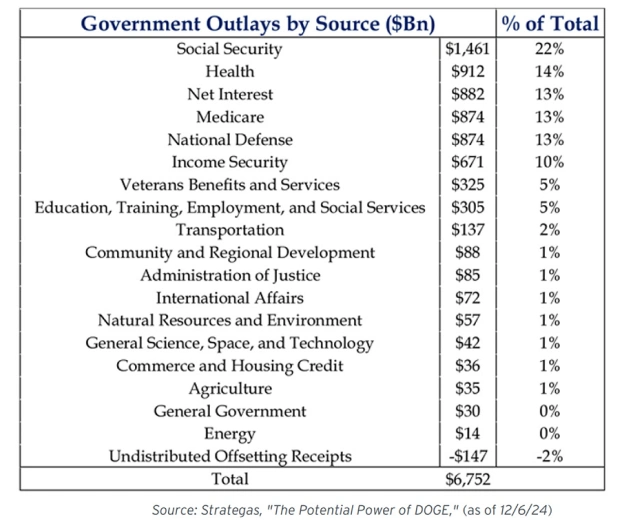

Thus far markets have taken a benign approach, focusing far more on the potential pros rather than the cons. But many of the vague campaign promises that will now seek to become policy realities are mutually contradictory. For example, DOGE's purported goal to cut "at least $2 trillion" of federal expenditures is impossible without also walking back the pledge that major social spending programs won't be reduced (note that Social Security, Medicare/Medicaid, Net Interest, and Welfare payments cumulatively make up >70% of spending). A choice ultimately must be made, but it's anybody's guess which one it will be.

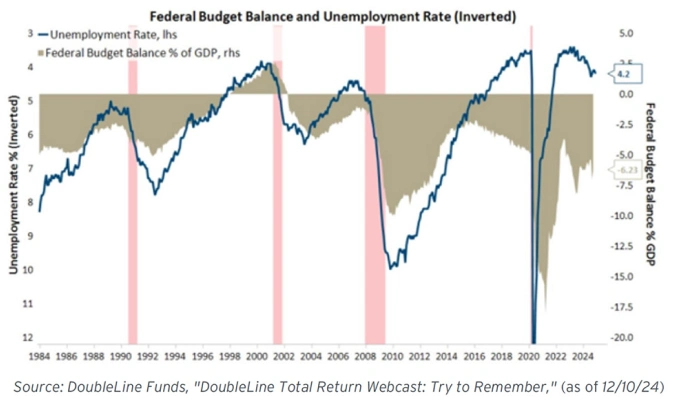

Another important observation: some policies could have opposing ramifications for equity and bond markets. For example, still-high spending paired with tax cuts is likely positive for stock market valuations, but it also means an even-wider mismatch between federal revenues and expenses. Our nation is already running annual budget deficits of 6-7% of GDP (approximately $2 trillion), a level previously witnessed only during wartimes and periods of true national emergency. Moreover, these deficits are occurring during a period of strong economic growth and near-full employment - imagine how much worse it will get if the economy meaningfully slows and unemployment ticks higher!

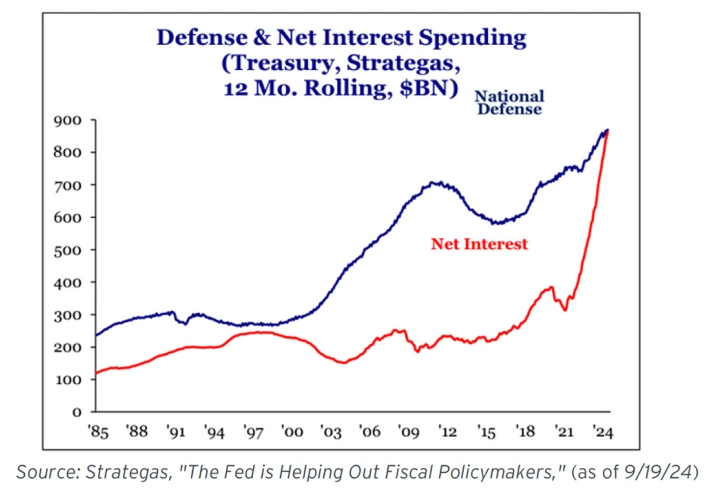

Higher deficits mean more federal debt, and the pile of outstanding Treasuries has kept growing and growing for decades. It's already accumulated to the point where its tremendous size now generates concerning technical dynamics and mounting questions about who's willing to keep buying (and at what price). The burden of servicing the national debt is increasing, and our obligation to meet interest payments is beginning to crowd out spending capacity needed to fund other core governmental priorities (such as the national defense budget).

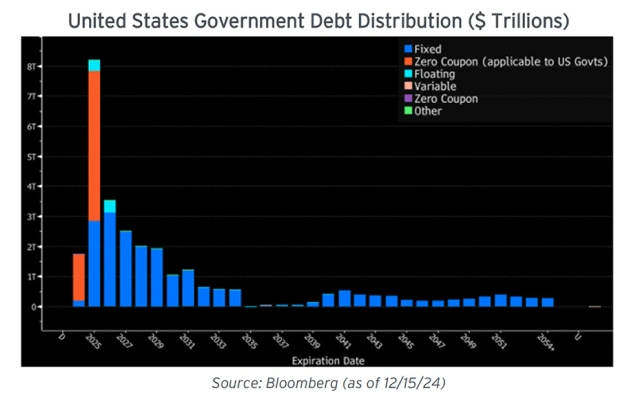

At some point on our watch, there's a growing tail risk that enough Treasury investors will revolt and demand higher interest rates. With over 50% of our federal debt maturing within the next 3 years, there's always several trillion dollars' worth of bonds that need to be refinanced within a fairly short period of time. If the 'Bond Vigilantes'* emerge from their long hibernation and demand higher yields to keep financing our government deficits, all markets would be impacted. Naturally, we're keeping a close eye for any nascent signs of storm clouds on the horizon.

*Coined by economist Ed Yardeni in the 1980s, a 'Bond Vigilante' is a bond trader who threatens to sell, or actively sells, a large amount of bonds to protest or signal distaste with the bond issuer's policies

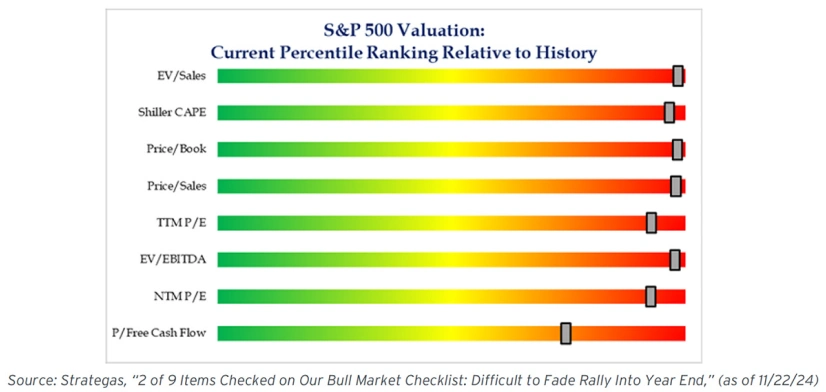

After a long run of heady returns, it's no surprise that domestic equity valuations look stretched. By virtually any metric one chooses, the S&P 500 appears richly valued.

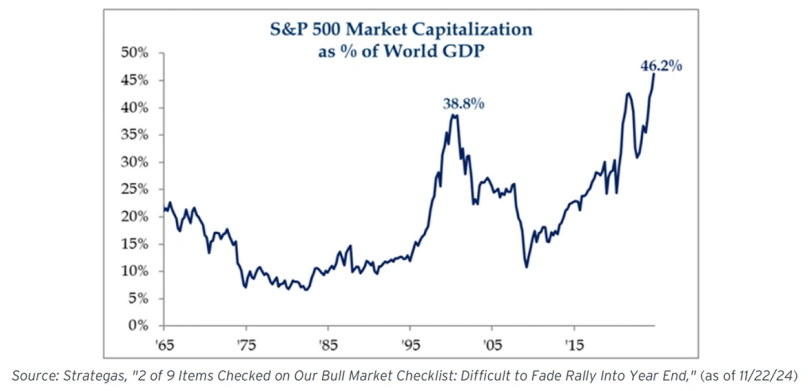

Furthermore, domestic large-cap stocks have outperformed so much for so long that they now represent a staggering proportion of the entire world's equity market capitalization.

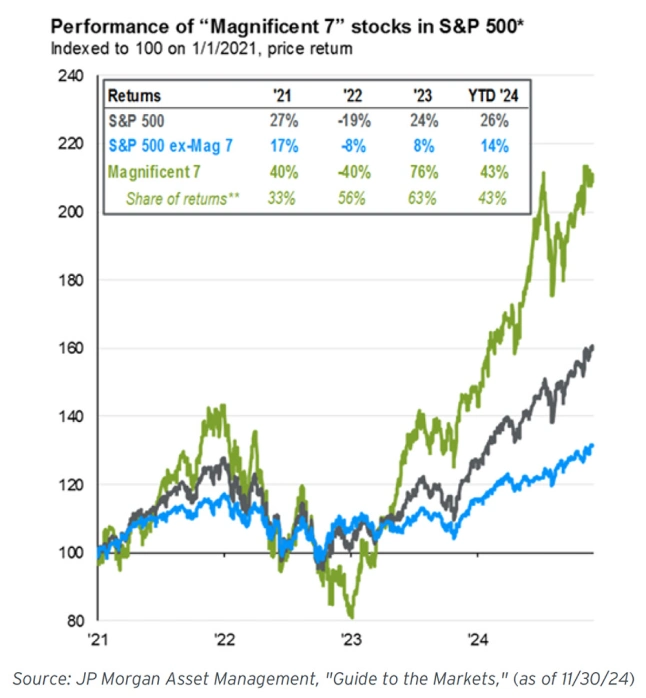

Diving into the details underpinning this amazing multi-year bull run is illuminating. As we've repeatedly pointed out in past white papers, the so-called 'Magnificent 7' group of mega-cap tech stocks has driven much of the index's S&P 500's post-pandemic performance.

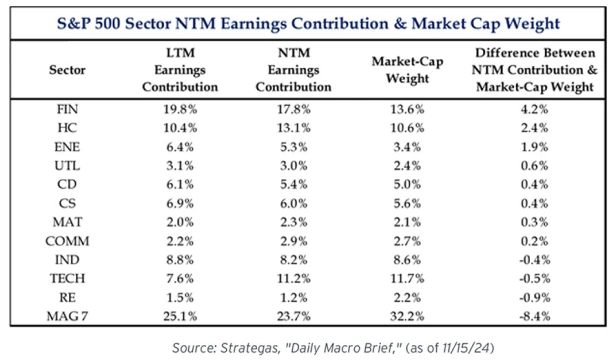

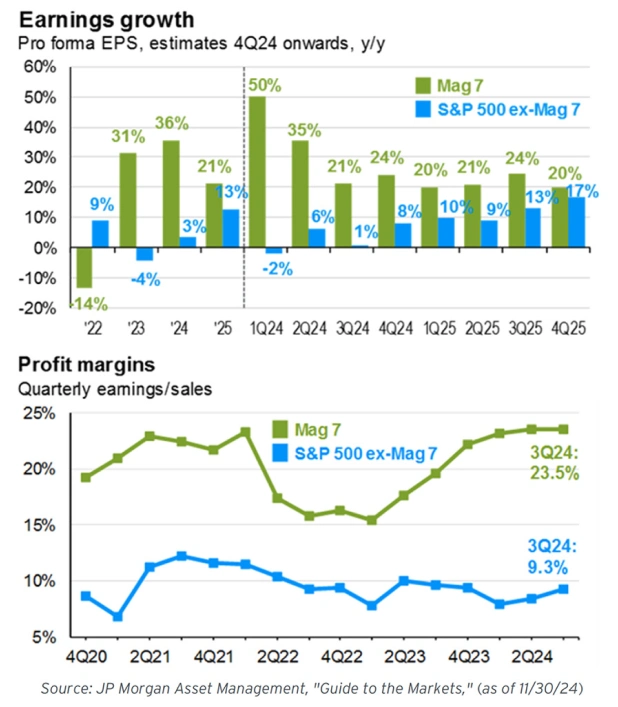

Now representing over 1/3rd of the index, this handful of companies are poised to have outsized impacts on returns going forward. Once again, their Price/Earnings (P/E) multiples are elevated, and their cap weight now far exceeds their proportionate contribution to earnings.

However, not only are several of these businesses genuine cash-generating behemoths the likes of which modern economies have never seen - they are also still managing to grow those massive earnings at a faster pace than the index's other 493 constituents. With billions of customers around the world, primarily recurring revenues, and deep moats around their core businesses, they continue to dominate market activity.

With the Mag 7 still generating enormous profits, as well as all the fundamental macro and micro tailwinds at play in the current economic environment, we'll continue to own a concentrated allocation to a select group of these names, both directly as well as through ETFs.

AI: the two small letters heard 'round the world.

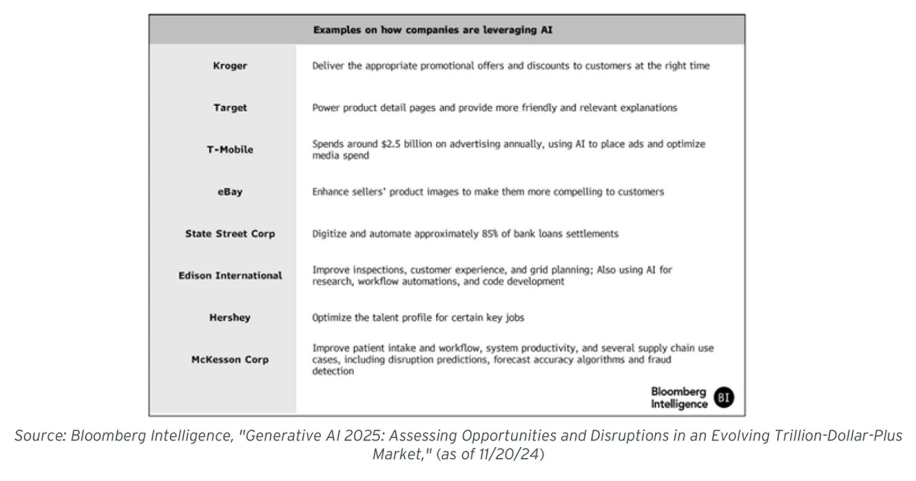

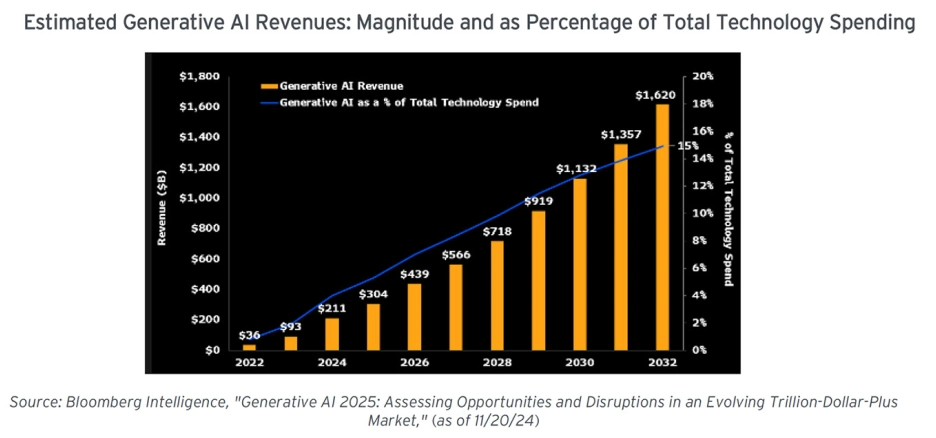

In the span of just 2 short years, AI has become the hottest trend in markets, 'generating' fervor that's helped fuel at least a portion of the speculative froth in certain corners of the markets. At the same time, companies across many different industries are busy experimenting with various test-case applications of basic AI tools and models, trying to get a feel for if (and how) they can help introduce operational efficiencies to their businesses. There's increasing evidence there are at least some important but routine tasks that can already be improved by utilizing the early-stage AI technology that's now available. Humble beginnings to be sure, but all first steps invariably are.

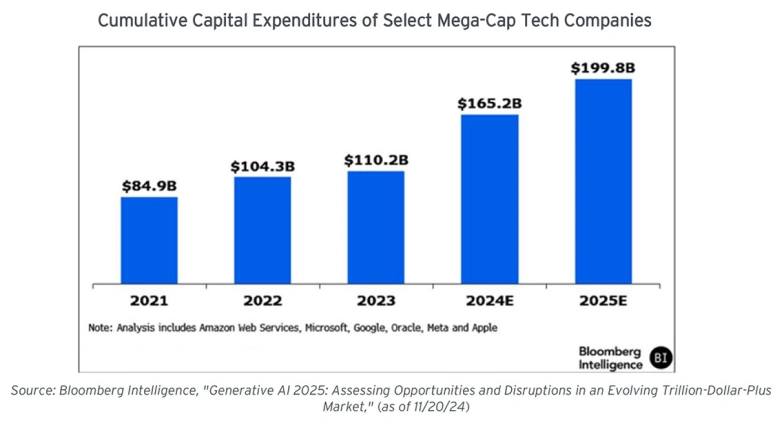

However, our eyes remain wide open as we witness hundreds of billions of dollars being devoted to a still-emerging technology that's mostly unproven in large-scale real world applications. Sooner or later, someone will have to run the numbers and determine whether the returns on these massive investments are worth it. For now, we recognize that the largest spenders are those companies that A) are already generating massive profits from their existing core businesses, and B) hold truly staggering amounts of cash that's available to fund forward-looking 'moonshots.' If there really is a bright future for AI, mega-cap tech is in a market-leading position to benefit. It should be noted that I haven't come down with the apparently contagious malady of 'AI-Euphoria'.

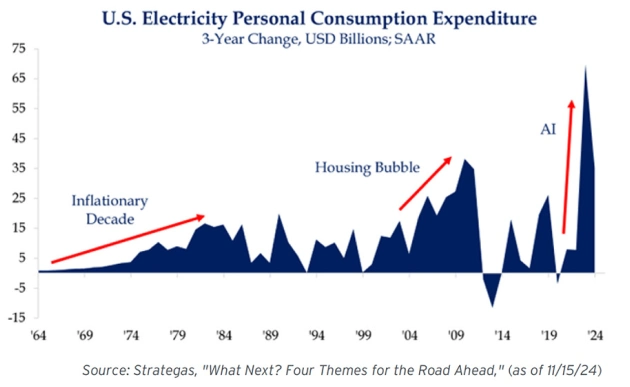

But there's more – all that capex isn't just for software and intangible intellectual property! The underlying servers and computing hardware require a tremendous amount of warehouse space, raw materials, and power to function. The AI wave's tendrils are deeply intertwined in these related areas, leading to boom times for high-end chipmakers and propelling the largest electric grid build-out of our lifetimes. The aftershocks are even reverberating in geopolitics, as the struggle for crucial resources (e.g. rare-earth metals) and chipmaking knowledge/supremacy are influencing political decisions throughout the world.

Where will all this ultimately lead? For now, it's too hard to tell. Either way, AI is already a narrative-driving force that has the potential to become one of the defining market themes of our lifetimes.

In general, we're positioning for a 2025 that initially looks a lot like how we're ending 2024.

We anticipate continued solid growth in both the real economy as well as corporate earnings, both of which should benefit from the boost being provided by an accommodative Fed, stimulative policy from DC, and continued economic momentum. Of course, we're keeping a close watch on political developments that could shift the outlook either way (e.g. tax cuts, tariffs/trade wars, progress on regulatory relief, etc.). But at this juncture, trying to reconcile what may happen with what's likely to happen is just unproductive speculation until we receive more clarity.

Accordingly, we're maintaining full equity positions, keeping the existing focus on domestic stocks with an underweight to international stocks (and complete avoidance of direct emerging market exposure). Despite the now-yawning gap between the key measures of domestic and international equity valuations, the fundamental reasons why this gap exists remain in place (more competitive corporate landscape, better demographics/labor market dynamism, Tech sector dominance, etc.). Until we see clear and lasting signs these fundamental drivers of outperformance are changing, we don't see any reason to shift our thinking.

Base rates remain reasonably close to the highest levels we've seen in 15+ years, which means bond portfolios can still be structured to generate meaningful levels of income.

We're also still somewhat cautious on corporate credit exposures, with reduced appetite for taking on additional credit risk. The combination of insatiable investor demand with a benign economic environment has steadily driven corporate bond spreads (the difference between similar-maturity Treasury and corporate bond yields) lower. Absolute yields are still attractive, and we can build out conservative bond portfolios without taking on extra risks (for little extra reward) from stretching into lower-rated credit.

Most importantly, given the long-term yields that can still be locked-in via bond holdings, the amount of incremental portfolio risk that needs to be taken (via allocations to equities and alternative investments) to reach overall target returns is lower than in years past. Put simply, clients are no longer forced to accept as much volatility and risk of permanent principal loss when seeking reasonable overall rates of return from their invested wealth.

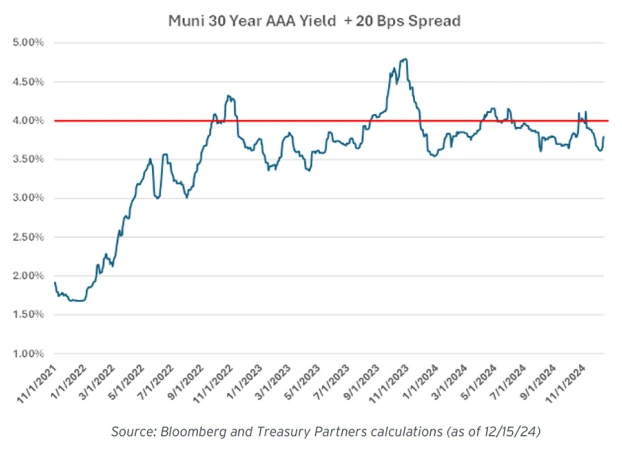

The municipal bond market continues to provide opportunities to capture compelling value for our tax-sensitive clients.

Over the past couple years, there have been roughly five occasions when it's been possible to add long-term municipals at 4%+ tax-free yields. For example, we loudly rang the bell this time last year:

After more than a decade in the post-2008 wilderness of ultra-low yields, we're still excited to have finally found a way to responsibly secure meaningful yields for our clients during these periods when municipal rates spike. In practice, sometimes the window of opportunity is open for short periods, and we aggressively seek to add before it shuts once more. As we write this Outlook, the window is closed for the moment, but we're constantly watching our screens awaiting our next opportunity to add 4%+ yielding municipal bonds.

Somehow, it's always surprising to reach the end of another year! We always enjoy the annual ritual of producing this Outlook, taking time to step away from the screens to reflect and highlight what's worth focusing on in the year ahead.

It's our great honor to manage your family's wealth, and we'll never stop feeling grateful for the trust and confidence our clients place in us. As always, we'll continue to work hard to keep that trust.

On behalf of myself and the entire Treasury Partners team, thank you. Our best wishes to you and your family for a wonderful holiday season. Here's to a happy, healthy, and enjoyable 2025!

*Not one word of this whitepaper was written using Artificial Intelligence.