In recent client meetings, there have been questions regarding our decision to extend maturities. The key counterarguments appear solid at first glance: higher yields are expected with the Fed still tightening, and currently, money market funds are offering returns that are similar to those on longer-dated bonds.

This Alert expands on our rationale, which is based on a fundamental point: markets are forward-looking and lead the Fed. History shows that at certain points in the cycle, short-term markets look past the tightening phase and focus on the follow-on impacts. Current conditions are reminiscent of turning points in previous cycles that signaled lower rates were in the offing. Below we present our recommendations on how to position portfolios. These vary based on Investment Policy (IP) constraints, cash-flow profiles, and investment horizons. For certain mandates, it's time to extend; for others, continued patience is key.

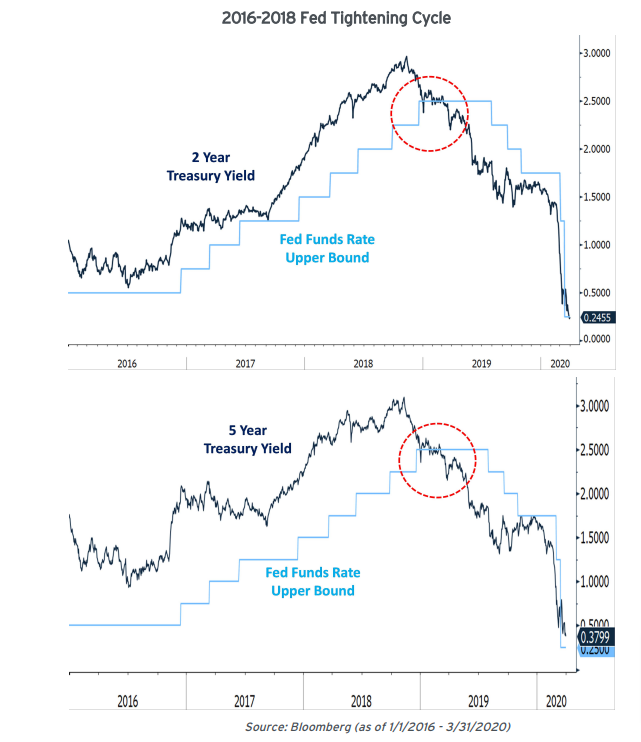

At the critical turning points of any given cycle, a consistent pattern tends to emerge where market developments lead the Fed, not the other way around:

• When investors think we've reached the cyclical trough in the Fed Funds rate, they begin to think ahead to when a stronger economy will bear higher rates. Market yields begin rising to reflect higher odds of liftoff, well before the first Fed hike occurs.

• Conversely, once markets perceive the peak in Fed Funds is drawing near, investors begin placing much greater weight on the expected consequences of elevated policy rates (i.e., a slowing economy). Yields start moving lower ahead of the first Fed cut, anticipating the need for a fresh easing cycle.

As we wrote last month: "…rates typically move in advance of the Fed, both up and down, reacting to the implication of the data that will ultimately drive the Fed's future actions. At this advanced point in the hiking cycle (where many investors think we're close to reaching the apex), each additional tightening in the Fed Funds rate is no longer automatically accompanied by a lockstep increase in market interest rates." (Corporate Cash Alert: 2023 Outlook - Act Now, 1/3/23).

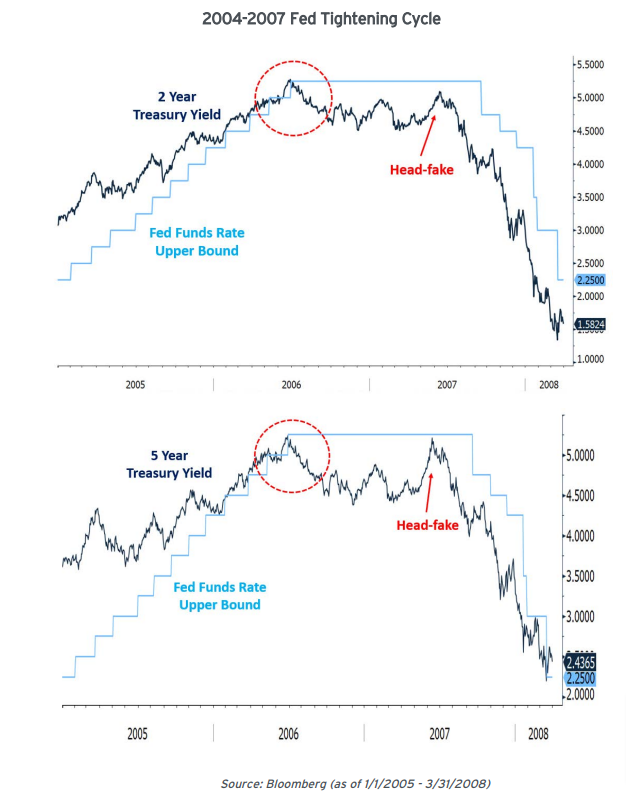

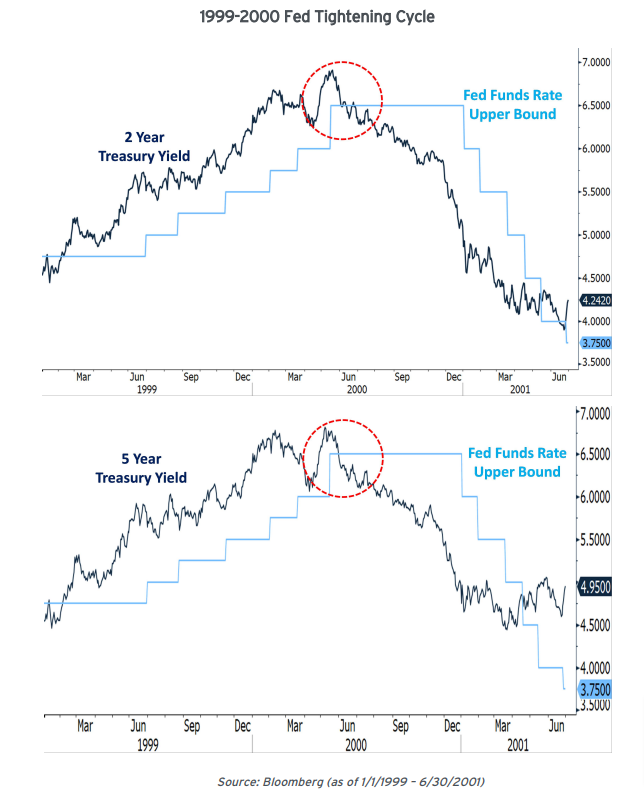

The end stages of the preceding three tightening cycles illustrate precisely this dynamic. Notice how (in all cases), as rates were rising, the market rates were above the Fed Funds rate and moved in lockstep to stay comfortably higher than the policy rate. Then, at a certain point in each cycle, the upward momentum in 2-5- year yields stalled and eventually outright declined, ultimately settling at levels below the then-current Fed Funds rate. Although 'head-fakes' sometimes happened, once this critical crossover moment occurred (where market rates were less than the policy rate), it would ultimately prove to presage lower short-term rates and subsequent cuts in Fed Funds.

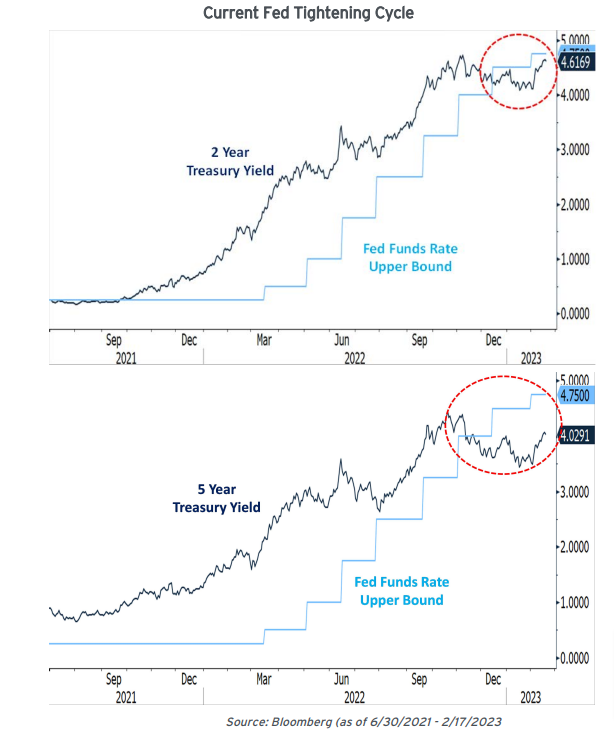

Armed with the knowledge of these historical patterns, consider where we stand today:

• After a rapid sequence of jumbo rate hikes throughout 2022, yields across the curve are materially higher than they have been in many years.

• As we got closer to the widely-expected cyclical peak, longer-dated Treasury yields stopped increasing in lockstep with the Fed Funds increases.

• Recently, those yields crossed below the Fed Funds rate.

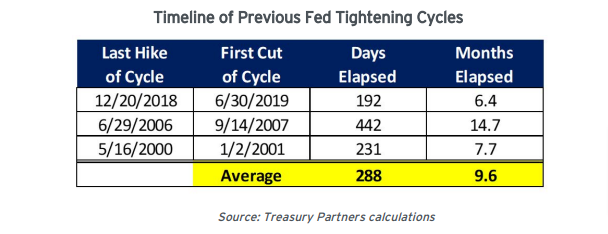

As you can see, market action in 2022 is similar to prior periods and now operating on the assumption that we’re near the end of this hiking cycle, and the next substantive move will be lower. However, this doesn’t mean there won’t be a long period of digestion between the last rate hike and the first rate cut. Looking at the previous 3 tightening campaigns, the Fed maintained its peak policy rate for an average of nearly 10 months (288 days).

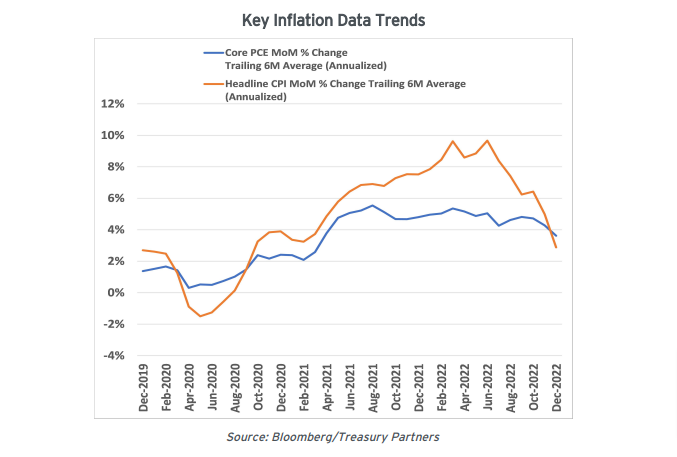

Headline inflation - the original impetus for the rapid tightening - remains high, but notably has decelerated from its peak levels. If one digs into the data to average month-on-month figures over the last six months, both headline CPI and core PCE have now ticked below 4% to retrace much of the post-pandemic spike.

Contingent on economic developments, we expect the Fed to raise the Fed Funds rate to the 5.25-5.50% range (the equivalent of another 2-3 hikes from its current 4.75%). Naturally, additional upside surprises in the data could force the Fed to tighten further, but significant upward risk above 5.50% is a lower probability event. Conversely, our experience is that after the lag effects of the rapid tightening begin taking noticeable effect, rates turn lower (often in a hurry).

Our positioning recommendations vary according to client circumstances and portfolio constraints:

"In our experience of investing through forty years of market cycles, one of the most consistent patterns is that all parabolic moves (in this case, higher) eventually tend to get walked back (in this case, move lower). Stated differently, rates might tick higher - but once the bond market gets a whiff of a slowdown, rates will likely decline significantly, irrespective of Fed policy. It pays to take advantage of these absolute levels while they're still available ." (Corporate Cash Alert: 2023 Outlook - Act Now, 1/3/23)

Cash Burns and Short Final Maturity Limits: Based on our outlook, we believe all corporate cash clients can benefit from maintaining 3–6-month maturities as the Fed continues to tighten. Investors focusing on this portion of the yield curve will be squeezing the last drops of toothpaste out of the tube over the next few months.

This maturity range is attractive relative to money market funds and preserves flexibility to take advantage of higher 6–12-month rates that will likely be available after expected additional Fed hikes through June 2023. This strategy is particularly suited for mandates with 1-year maximum final maturity constraints and clients with cash burns who won’t have the ability to reinvest.

Longer Final Maturity Limits: Clients with longer maximum final maturity constraints are advised to deploy funds out longer-term. For these portfolios, we urge readers to carefully consider what the preceding charts tell us; while levels may move slightly higher in the next few months, the next significant move in yields (likely in 2024) will be lower. Rather than holding out for another 25 or 50 bps of potential upside over a short 3–6-month window of opportunity, extend maturities now and lock in elevated rates for 3-5 years.

Positive Cash Flow: Companies boasting positive cash flow must remember that growing liquidity lowers portfolio duration and heightens exposure to the negative implications of a declining rate environment. In effect, positive cash flow benefits during a rising rate environment (by allowing for sequential reinvestments at continually higher rates) but suffers in a declining rate environment (since principal payments are reinvested at lower book yields). Front-run this dynamic - extend maturities now.

Don't Forget Roll-Down: Additionally, depending on the slope of the yield curve, investors could benefit from 'roll-down' protection on their longer-dated positions. For example: one year from now, investors who bought today's 4.40% 3- year Treasury will instead be holding a 2-year maturity with a 4.40% purchase yield. Although there’s no guarantee this seasoned 4.40% 2-year bond won't be below then-current market rates, the automatic math behind 'rolling down the curve' typically offers some natural protection in an upward sloping yield curve.

Bottom Line: The overarching risk-reward tradeoff remains favorable. Rates can potentially rise somewhat higher from this point; but with the appealing absolute rates and the potential for rolldown protection, extending maturities is a viable strategy for those willing to forego some potential upside in exchange for certainty.

Treasury Partners is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is neither indicative nor a guarantee of future results. The investment opportunities referenced herein may not be suitable for all investors. All data or other information referenced herein is from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other data or information contained in this presentation is provided as general market commentary and does not constitute investment advice. Treasury Partners and Hightower Advisors, LLC or any of its affiliates make no representations or warranties express or implied as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Treasury Partners and Hightower Advisors, LLC assume no liability for any action made or taken in reliance on or relating in any way to this information. The information is provided as of the date referenced in the document. Such data and other information are subject to change without notice. This document was created for informational purposes only; the opinions expressed herein are solely those of the author(s) and do not represent those of Hightower Advisors, LLC, or any of its affiliates.