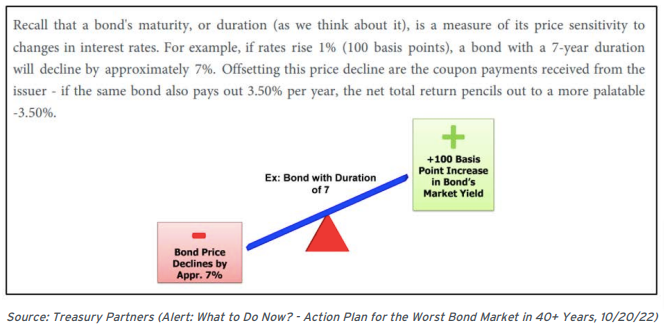

Last October, we noted bond markets - particularly municipals - were offering investors an excellent opportunity to lock-in elevated yields for the long haul (Alert: What to Do Now? - Action Plan for the Worst Bond Market in 40+ Years, 10/20/22). In that Alert, we also addressed the common wisdom that it's unwise to extend maturities while the Fed's still tightening (hint: markets move ahead of the Fed) and explained why it was time to act.

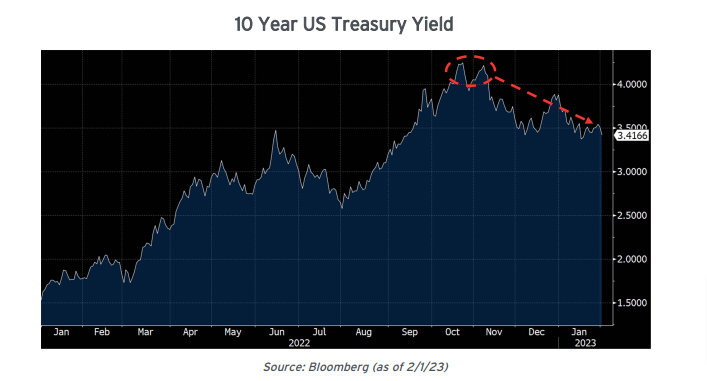

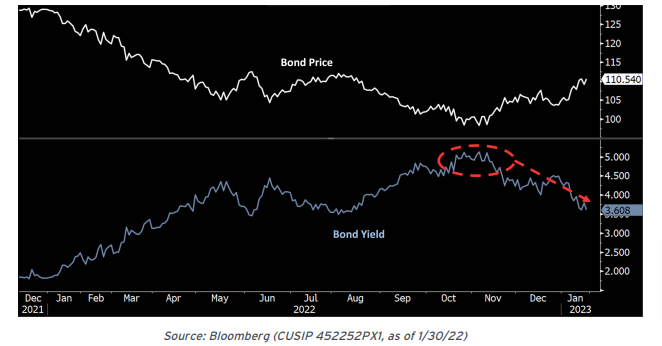

Since then, yields have declined substantially - for example, the 10-year Treasury has dropped 85 basis points from 4.25% to 3.40%. That move is more than enough to alter the riskreward characteristics of buying long-term bonds at current levels and we're adjusting our strategy. Read on for our current thoughts.

Flashback

As longtime readers know, from the summer of 2020 to the summer of 2022 - when yields across the curve were near historic lows - we hardly touched any long-term debt, wary about taking on price risk for meager yields.

Starting around Q4 2022, we altered our cautious stance and began extending maturities in light of the seismic change in the investment landscape: rates had rocketed higher due to surging inflation. At long last, bonds had again reached the point where they could add investment - and not just capital-protective - value to client portfolios.

Specifically, for years investors had been forced to choose between low duration/nearly-zero yielding bonds and higher duration/meager-yielding bonds. The latter struck us as poisoned fruit because of its asymmetric value proposition:

• There was hardly any room for price appreciation, as yields couldn't realistically fall much lower.

• Conversely, the potential capital destruction (price declines) from rising rates was unacceptably high.

It was a 'heads we lose, tails we lose' scenario and ultimately would have added risk to overall portfolios. We wanted no part of it.

But as the Fed kept jacking the Fed Funds rate higher to combat inflation, long-term bonds started trading at levels that offered investors a much more appealing tradeoff. Consider that:

• If rates kept rising, downside was now more limited, since higher starting book yields provide protection against bond price declines.

• If rates fell - a scenario usually paired with a slowing economy, lower corporate earnings per share, and declining stock prices - long-term bonds would appreciate in price, providing some offset against equity losses.

The case for owning long-term bonds had dramatically improved and we acted aggressively to capture the opportunity in client portfolios, where appropriate.

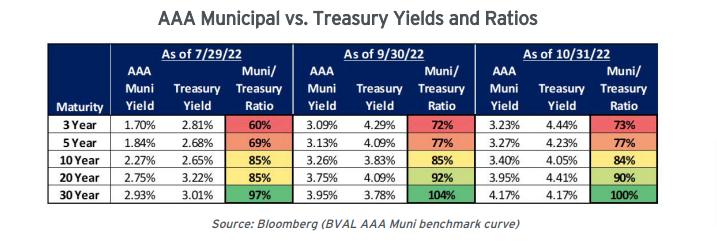

This improved risk-return proposition in bonds was particularly apparent in the municipal market. A unique technical factor - forced selling by bond mutual funds - amplified the rise in yields, leading to particularly tantalizing rates in longer-term munis (details are in Alert: What to Do Now? - Action Plan for the Worst Bond Market in 40+ Years, 10/20/22). As the below table shows, both absolute yields and relative value measures (meaning, the Muni/Treasury yield ratio) noticeably spiked from late summer through the middle of Q4 2022 - with the greatest value apparent in the longer maturities.

While we were tantalized by the municipal bond rates in September, we were positively drooling by October. The reason was simple - in addition to spinning off a steady stream of attractive income, long-dated munis at such elevated levels offered another portfolio benefit. The average long-term annual return on broadly diversified stocks is historically 8-9% on a pre-tax basis; a 4% yield on a high-grade muni can translate into an 8%+ pretax equivalent return (depending on investor domicile and tax bracket). In our thinking, pretax equity market returns were available without the volatility of the stock market. Importantly, these attractive levels were achievable without having to compromise on credit quality.

We felt the value was so apparent that we were concerned the window to act would prove fleeting. Again, as we wrote last October (Alert: What to Do Now? - Action Plan for the Worst Bond Market in 40+ Years, 10/20/22): "As investors realize how much this risk/reward relationship has shifted, we expect to see assets reallocated from stocks to bonds. We want to be 'early' and front-run this dynamic."

Unfortunately, yields across fixed income markets have since tumbled (particularly when the calendar flipped to 2023). The main culprit is growing anticipation of a softening economy, fading inflationary pressures, and accordingly lower Treasury rates.

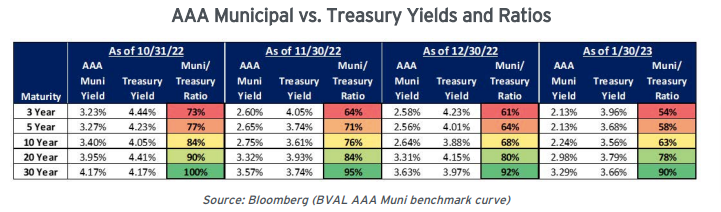

As a result, the investment calculus for adding long term bonds has (once again) changed. When we first began increasing allocations to munis and extending durations it was a contrarian bet; now we're witnessing a massive demand-driven scramble for increasingly scarce bonds which has eroded the value proposition driving our original decision to aggressively extend maturities.

For example, longer-dated bonds we recently purchased at yields from 4.0-4.50%+, at the time anywhere from 105-120% of comparable Treasury rates, now trade at 3-3.60%, the equivalent of just 85-105% of Treasuries.

For the past several months our thinking was clearly way out in front of the pack; now that same strategy is smack in the middle of the pack. So, we're changing our approach.

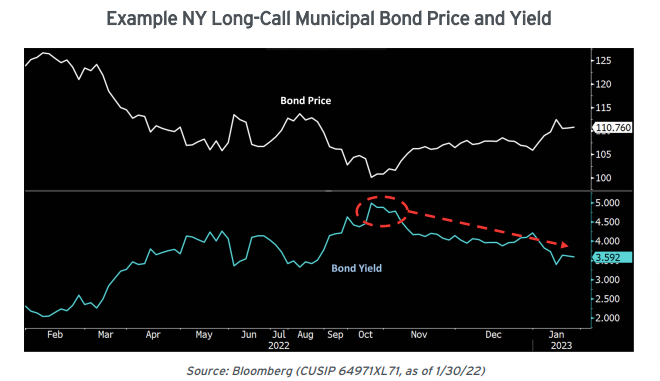

Naturally, bonds that were acquired at higher levels are now locked in at above-market yields and have already generated meaningful price gains. But as we look forward, today's market realities counsel a more cautious approach.

It's important to note that this doesn't mean fixed income markets have reverted back to the punishing realities of the ultralow-rate era. The duration/yield tradeoffs in current bond pricing, though off their recent peaks, aren’t necessarily terrible. Longer-dated positions can still prove attractive in certain portfolios and circumstances, but it no longer makes sense to seek maximum durations in client portfolios. A more balanced approach to filling in a portfolio's effective maturity ladder - a more typical positioning strategy - is how we're structuring portfolios now.

"In our experience of investing through forty years of market cycles, one of the most consistent patterns is that all parabolic moves (in this case, higher) eventually tend to get walked back (in this case, move lower). Stated differently, rates might tick higher - but once the bond market gets a whiff of imminent recession, rates will likely decline significantly, irrespective of Fed policy. It pays to take advantage of these absolute levels while they're still available." Corporate Cash Outlook 2023: Act Now, 12/22/22

As a result, we've begun adding lower-duration (shorter maturity) bonds. For example, in our taxsensitive portfolios, rather than emphasizing a minimum of 7-10 years of call protection, we're taking on less interest rate risk by adding munis that are 2-6 years away from their first call date. While certain longer-term callable munis can still add value to portfolios, generally speaking, at current valuations, the entire muni bond curve is significantly less attractive than a few months ago. In our taxable portfolios, we continue to find value in various sectors and specific issuers within the corporate bond market in 3-10 year maturities. We're also adding corporate bonds opportunistically to our muni portfolios, where appropriate.

Our eyes are wide open to identify the next opportunity. We greatly appreciate the trust and confidence you place in us and will continue to work hard to earn that honor.

Treasury Partners is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is neither indicative nor a guarantee of future results. The investment opportunities referenced herein may not be suitable for all investors. All data or other information referenced herein is from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other data or information contained in this presentation is provided as general market commentary and does not constitute investment advice. Treasury Partners and Hightower Advisors, LLC or any of its affiliates make no representations or warranties express or implied as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Treasury Partners and Hightower Advisors, LLC assume no liability for any action made or taken in reliance on or relating in any way to this information. The information is provided as of the date referenced in the document. Such data and other information are subject to change without notice. This document was created for informational purposes only; the opinions expressed herein are solely those of the author(s) and do not represent those of Hightower Advisors, LLC, or any of its affiliates.