Barely a year since it first began, the end of the US pandemic is within sight. Bullish markets have long since incorporated this great news, with essentially all risk assets staging furious rallies after effective vaccines were first announced last November. Since then, investors have priced in a post-pandemic world quickly returning to “normal” while still benefitting from generous fiscal and monetary support.

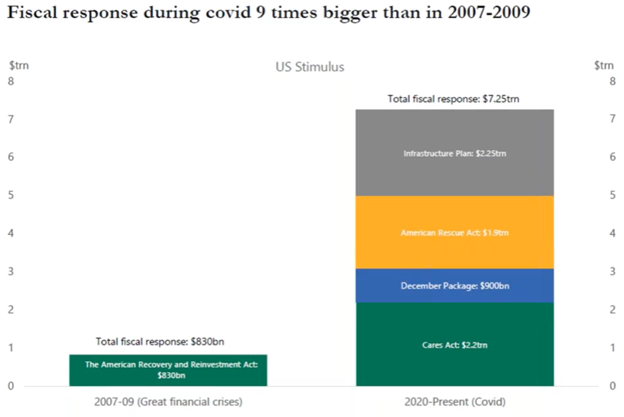

But all the excitement around reopening makes it easy to forget we’re still living through a massive social and economic experiment. Nobody in modern times has ever witnessed liquidity and aid this widespread and plentiful, even during the depths of the worst historical crises. The fact that the money spigots are still flowing this strongly in the midst of a roaring economic recovery indicates we’re in uncharted waters. There’s nothing “normal” about this environment.

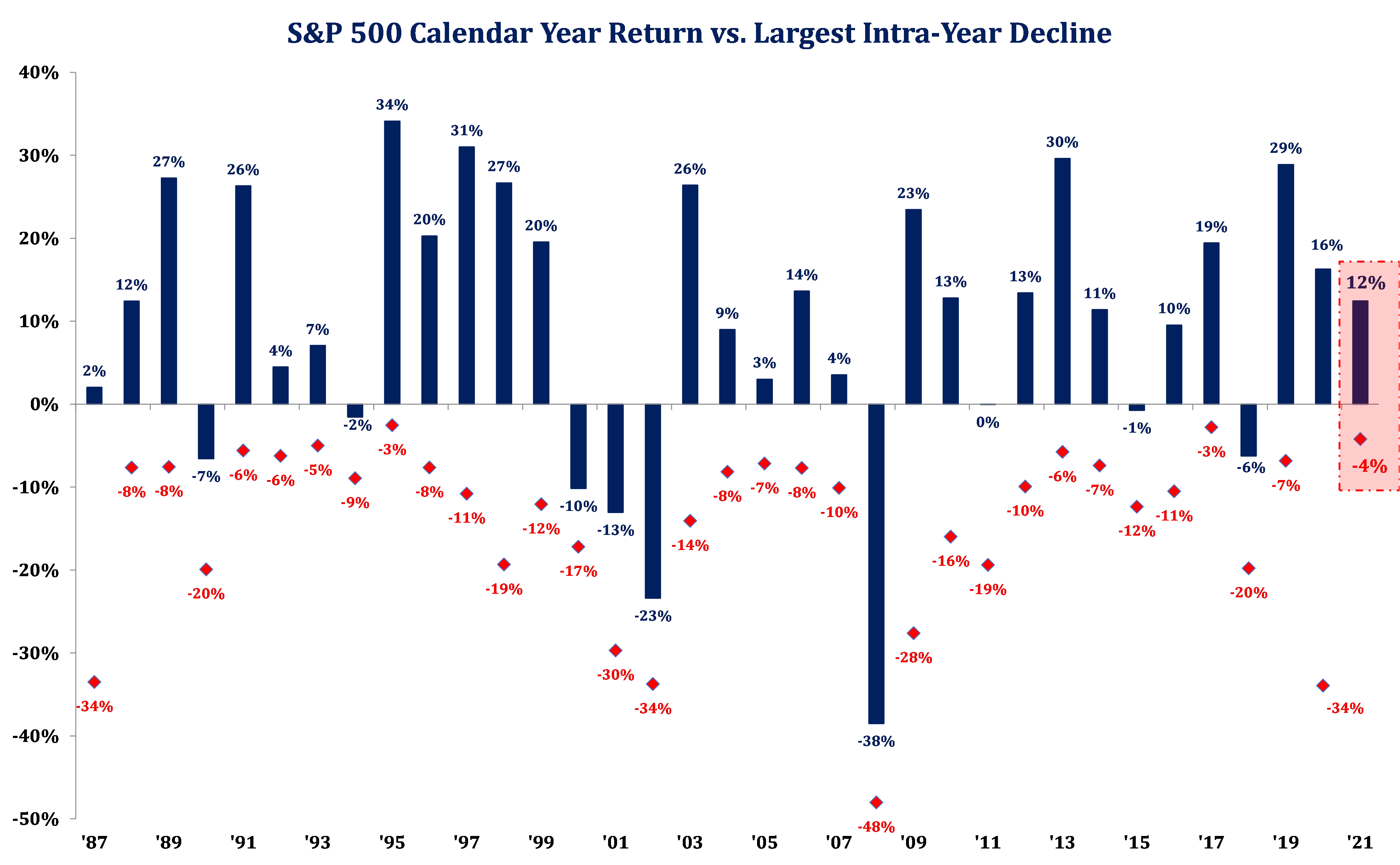

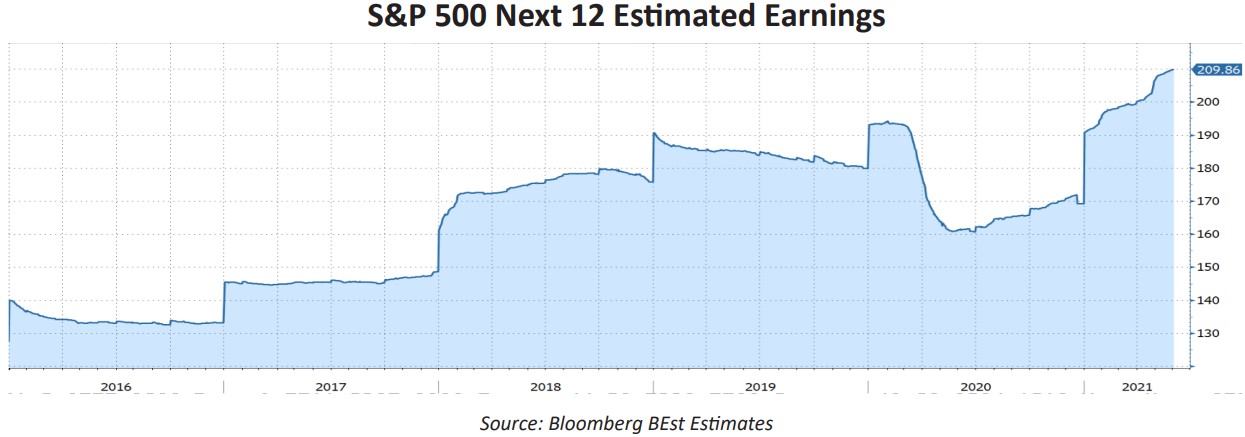

Equities have already posted solid performance this year, with the S&P 500 at a healthy +13.8% total return through 6/15. Importantly, since the start of the year, the index’s Price/Earnings ratio has actually declined 2 turns; current and future expected earnings have easily outpaced the price gains.

It’s been relatively smooth sailing to boot, as we’ve reached new all-time highs with relatively low volatility.

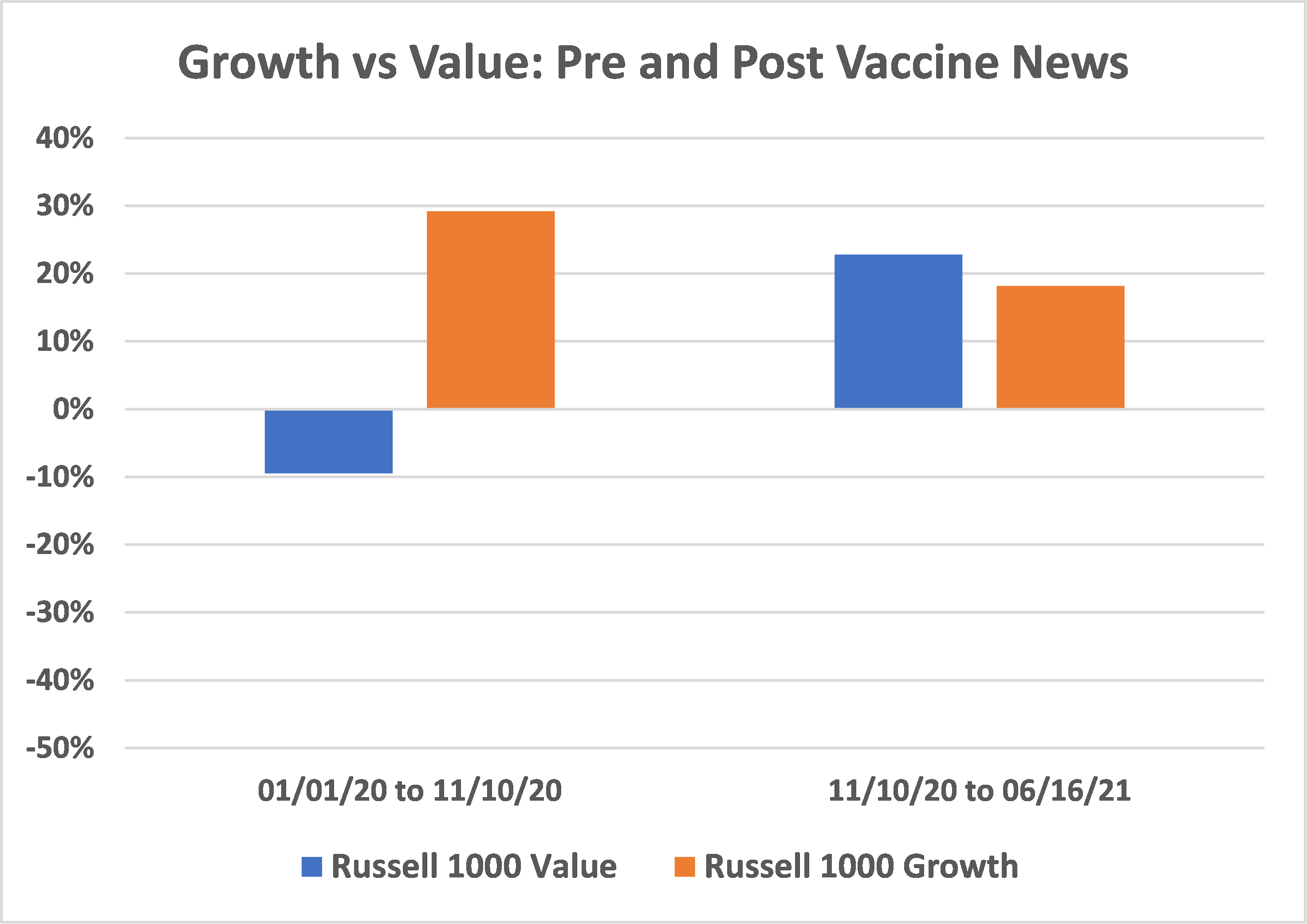

This cheery surface masks a roiling rotation underneath. For the first time in several years, Value has handily outperformed Growth: through 6/15 the Russell 1000 Value’s +18.1% YTD total return more than doubles the Russell 1000 Growth’s +8.9%. The justifying narrative is that reopening disproportionately benefits those sectors that were hurt the most during last year’s lockdowns – e.g. transportation, leisure, materials, and other cyclicals – which are Value names. This is a logical rotation during this recovery and has actually been happening ever since news of effective vaccines first came out last November

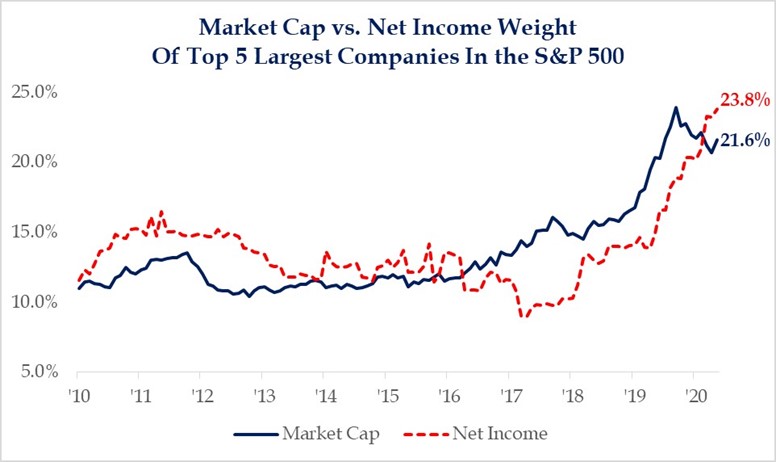

Importantly, the market shows no signs of losing faith in the business prospects of the mega-cap tech companies. The five largest companies within the S&P 500 – Facebook, Amazon, Alphabet, Apple, and Microsoft – are far from speculative ventures with irrationally-large valuations. Rather, they’re remarkably high-profit enterprises that have demonstrated their mettle and are poised to continue dominating their sectors. Their seemingly outsized market caps properly reflect their outsized share of earnings.

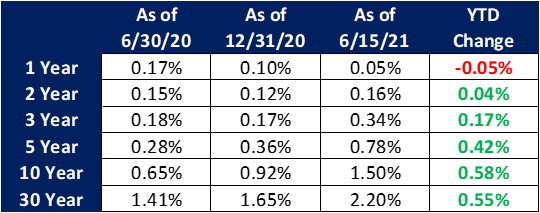

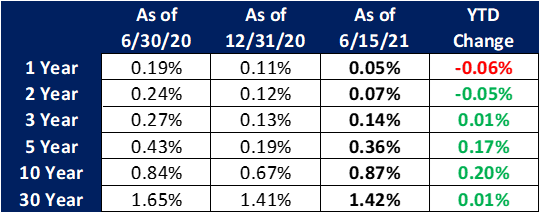

While equities have performed well, 2021’s proven more challenging for bonds. Long-term rates have risen (driving down bond prices) while short-end yields have remained essentially unchanged, pinned near zero by a Federal Reserve that isn’t likely to tighten monetary policy anytime soon.

Long-end yields have been propelled higher by expectations of accelerating growth spurring higher inflation (more on this later). Many investors who “capitulated” and reached to extend into longerdated bonds last year (especially last summer) have already experienced painful price losses. Despite the significant YTD increases in yields, we still consider long-term bonds exceptionally unattractive. To protect client capital, we’ve been reinvesting in shorter maturity/call structures rather than chasing unattractive longer-term yields at these levels.

While municipal yields have also risen, the move has been more subdued. The primary drivers are increased demand for tax-advantaged investments (ahead of potential income tax hikes) and recognition that over $350 billion of federal aid to state and local governments is an unprecedented boon to already-strong muni credits. There’s lingering value in some tax-exempt short-call “kicker” bonds whose yields to call dates still exceed those available in short-term taxable alternatives. We continue to buy these when available.

The combination of ultra-low rates, massive fiscal stimulus, and widespread vaccine distribution has potentially paved the way for a booming multi-year expansion (perhaps even global synchronized growth as the rest of the world gets vaccinated).

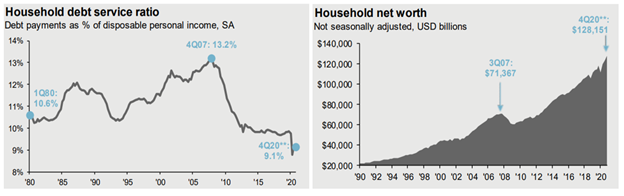

It’s unlike any other episode in modern economic history; Americans are emerging from their COVID “bunkers” richer, less indebted, and flush with cash they can immediately spend. It’s looking increasingly likely the next few quarters of GDP growth may be the strongest in 40 years.

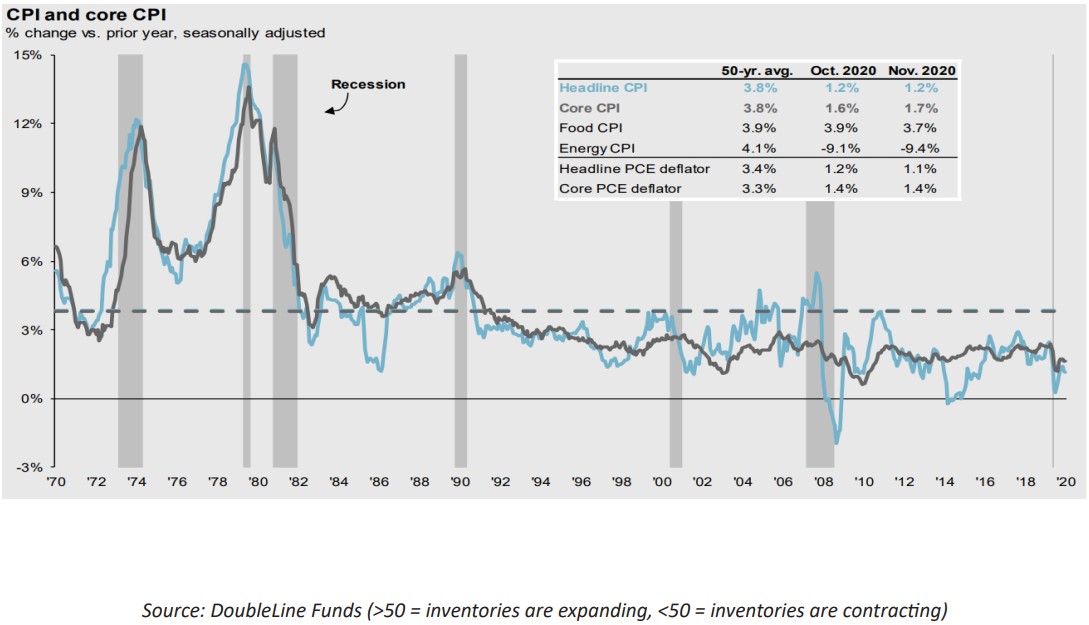

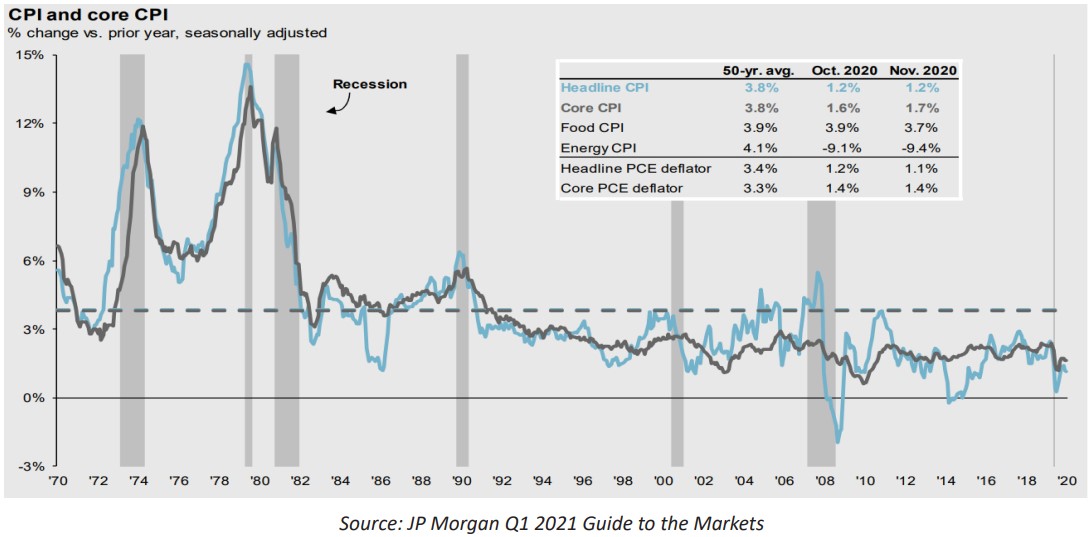

It’s little wonder inflation has recently become a popular topic of discussion. Major data releases are confirming what we’ve all experienced in our daily lives – the price spikes in everything from used cars to kitchen appliances are the largest we’ve experienced in many years.

We think the root cause traces back to the speed of our economy’s bounce-back catching supply chains unprepared. Businesses that spent the first few months of the pandemic drawing down inventories have fallen behind while rapidly pivoting back to meet roaring consumer demand.

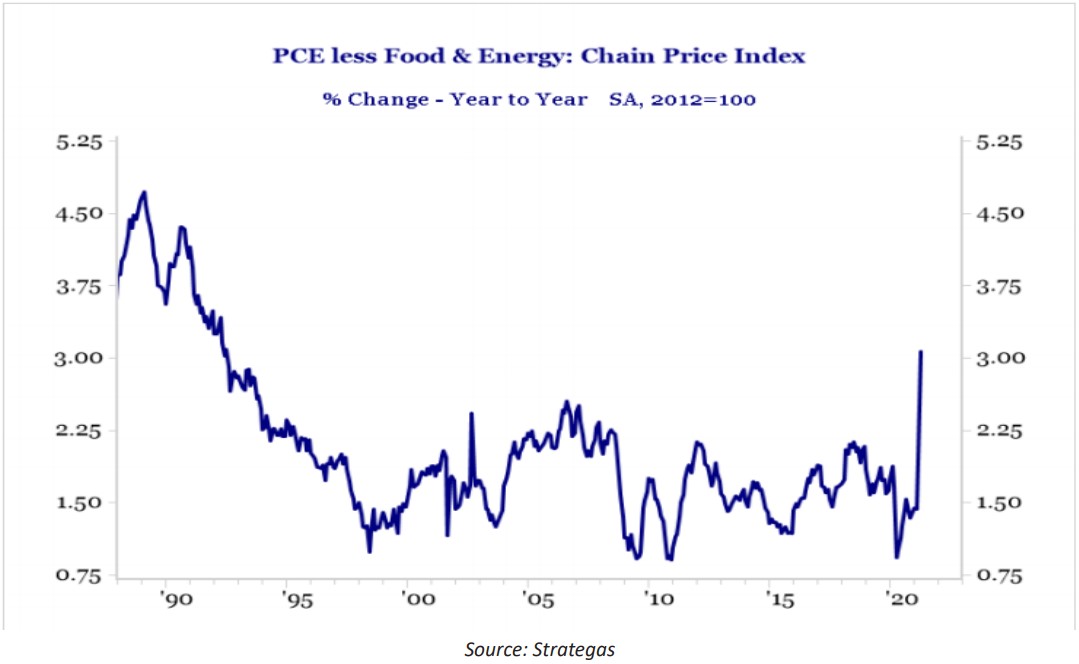

While unpleasant, we share the Fed’s view that it’s likely to prove short-lived. These temporary shortages/bottlenecks are likely to resolve - or at least plateau - as supply chains and labor shortages adapt over time. Simultaneously, the countervailing economic forces pushing toward long-term disinflation (such as accelerating technological innovation and automation) have helped keep inflation measures persistently tame for the past few decades. They haven’t gone anywhere and remain as potent as ever.

We won’t rehash these points here – for more detailed musings on inflation, please visit my LinkedIn profile to read the most recently posted article (“Here is what many investors are missing about inflation fears”, 6/1/21).

Unlike the housing and leveraged debt crisis of 2008/2009, we don’t see any specific credit market threats large enough to potentially derail markets. Our most immediate concern is the market’s reaction to having the fiscal and monetary “punch bowls” pulled away.

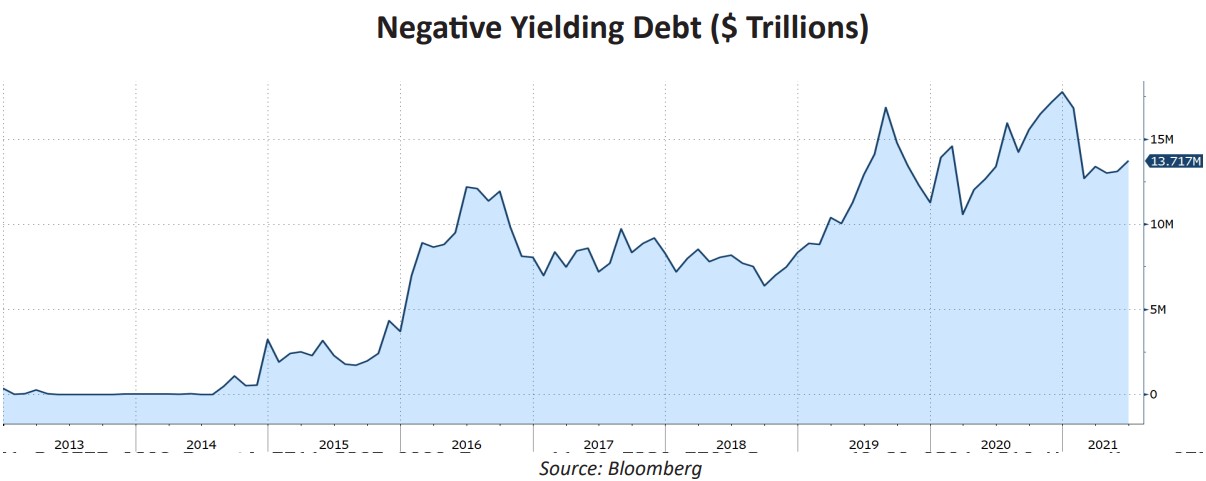

As we’ve highlighted for years, interventionist central banks have manipulated fixed income markets into extreme valuations. In step with this paper’s main theme, there’s nothing “normal” about a global financial system filled with negative-yielding debt ($13.7 trillion at last click), regardless of how many years this unusual phenomenon has persisted. Let’s not forget all the other distortions that abound - 0% interest rates, massive Quantitative Easing bond purchases, and 10-30 year debt that yields less than the nominal inflation rate. These all sum up to a radical experiment that has suppressed price discovery in the bond market and resulted in relative overvaluations in the equity markets.

That being said – we cannot ignore the fact that this radical experiment has been exceedingly effective in achieving its immediate goals. While yields and spreads throughout the world remain thoroughly suppressed, rising asset values have meaningfully increased investor wealth levels, an extension of the central bankers’ obvious (but unspoken) post-financial crisis playbook. Given this achievement, they’re likely to maintain their manipulations for an extended period, meaning significant and lasting spikes in rates are unlikely for the foreseeable future. There’s little hope for acceptable levels of return on already-meager fixed income yields.

But the bond market’s loss is the equity markets’ gain, and we’re maintaining our existing overweight to stocks. It’s not just because “there is no alternative” – rather, companies are seizing the post-COVID opportunity and putting up impressive earnings growth (looking at the chart, it’s almost as if the pandemic swoon never happened). Strong earnings, in turn, are rewarded by generous multiples, bolstered by expectations that ultra-low rates are here to stay (which encourages rich valuations). It’s no secret that at the S&P 500’s current 20x forward earnings multiple, stocks are overvalued compared to historic standards. But given our optimistic growth outlook, we expect earnings growth to ultimately outpace the increase in multiples and add more fundamental support to current valuations.

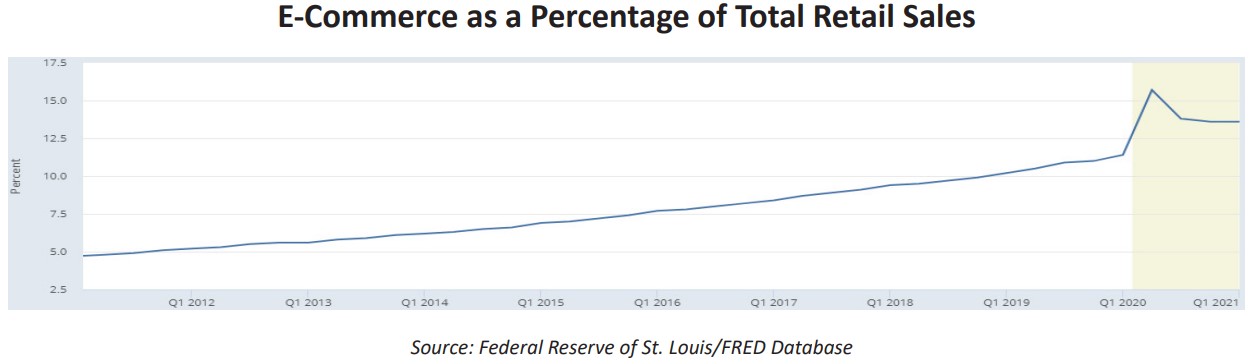

Within equity allocations, we’re still retaining exposures to our “top-tier” mega-cap tech stocks. Despite their YTD underperformance vs. Value sectors, our core thesis remains intact; much of both today’s and tomorrow’s economy is already highly dependent on these massive firms’ products and services. They possess relatively little risk of competitive pressures and the pandemic has further cemented the importance of technology in our lives. New innovations and habits are here to stay, and even the most tech-unsavvy among us have further embraced technology (this writer included).

At the same time, we’ve trimmed some of our Growth overweight and added Value exposure. For many clients, our ability to reposition their portfolios is somewhat limited by the tax consequences that would arise from realizing massive equity gains from previous periods of strong Growth stock performance. While we expect the Value sector will continue to perform well in the near-term, in the long run the tech giants are far likelier to generate more impressive earnings and growth.

Here are the top-of-mind risks we’re monitoring:

• US Boycotts Olympics? Beijing is scheduled to host the upcoming Winter Olympics in February 2022. Although such spats are usually irrelevant to markets, negative US diplomatic actions could provoke reprisals that include real trade-related economic consequences. Basically, a boycott might throw more ice onto our emerging cold war.

• Fed “Blinks.” Although the Fed has emphasized they plan to keep monetary policy loose for the foreseeable future, this isn’t set in stone. It’s hard to understate the degree to which an easy Fed has supported asset valuations throughout markets, and the timing and method of pulling away the punch bowl could lead to market volatility.

• Not-So-Transitory Inflation. One factor which might cause the Fed to “blink” is hotter-thananticipated inflation readings persisting into 2022. If inflation proves “stickier” than expected, it will challenge many of the pillars supporting the market’s currently benign outlook. This tail risk would represent a serious development: likely consequences include spiking rates, pressured equity multiples, and a return of volatility.

• Fiscal Cliff. When the fiscal and monetary support inevitably tails off, it will be essential for organic economic activity to compensate by continuing to grow at a brisk pace. Our expectation is that record high household net worth, $2 trillion of personal savings, and a sustained pickup in jobs growth will be sufficient to support this transition. If they’re not and growth starts rolling over, it’ll be a sign of unexpectedly weak underlying fundamentals.

• Tax Changes. While markets are anticipating somewhat higher corporate and personal taxes, the magnitude of change remains uncertain. This could impact valuations across asset classes.

I’m happy to report that we recently began our long-awaited – and fully vaccinated - return to the office. It conjured up my childhood memories of returning to school after a long hot summer of fun. While my suits fit just fine, it’s the necktie which won’t leave me alone. I’ll get used to it. But I’m absolutely thrilled to see our team up close again after such a long time apart. Not a meeting goes by where someone doesn’t relish in the fact that we’re not communicating through a screen.

We’ve planned several team events and I sense that our spirits and culture are high. I’m proud of the herculean efforts of our 26 members in meeting the exacting standards we set in managing your wealth.

Having battled COVID last March but luckily suffering no (known) lingering effects, my heart goes out to those who lost their lives or continue to deal with chronic symptoms from this elusive disease. I remain extremely humbled and gratified at the confidence you placed in us throughout these un-precedented last 18 months. During this period, I learned a lot about human and market behavior, and I’ll stash this new knowledge along with the other lessons learned from 39+ years of market watching. Once we’ve had some more time to settle in, we can’t wait to begin welcoming you back for in-person meetings.

For over 37 years, corporations, high-net-worth individuals, family offices, trusts, foundations and endowments have sought our help to construct diversified portfolios positioned to perform throughout market cycles. Among other industr y recognitions, Barron’s has ranked us in the top tier on its annual listing of “America’s Top 100 Financial Advisors” every year since the sur vey was introduced in 2004.

Speak with Our Barron’s Top-R anked Team Today.

Treasury Partners is a group of investment professionals registered with Hightower Securities, LLC, member FINRA and SIPC, and with Hightower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through Hightower Securities, LLC; advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past perfor - mance is not indicative of current or future performance and is not a guarantee. The investment opportunities referenced herein may not be suitable for all investors. Yield and market values will fluctuate with changes in market conditions. Prices and availability are subject to market conditions. Projected cash flows will change as bonds mature. Some bonds may be called prior to maturity. The investment return and principal value of an investment security will fluctuate with market conditions so that, when redeemed, the value of the investment may be worth more or less than the original cost. The information herein has been obtained from sources considered to be reliable, but the accuracy of which cannot be guaranteed. Municipal bonds are subject to risks related to litigation, legislation, political changes, local business or economic conditions, conditions in underlying sectors, bankruptcy or other changes in the financial condition of the issuer, and/or the discontinuance of the taxation supporting the project or assets or the inability to collect revenues for the project or from the assets. They are also subject to credit risk, interest rate risk, call risk, lease obligations and tax risk. The market for municipal bonds may be less liquid than for taxable bonds. Income from some municipal bonds may be subject to the federal alternative minimum tax (AMT) for certain investors. Investing involves risk, including possible loss of principal. All data and information reference herein are from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other information contained in this research is provided as general market commentary, it does not constitute investment advice. Treasury Partners and Hightower shall not in any way be liable for claims, and make no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information, or for statements or errors contained in or omissions from the obtained data and information referenced herein. The data and information are provided as of the date referenced. Such data and information are subject to change without notice. This document was created for informational purposes only; the opinions expressed are solely those of Treasury Partners and do not represent those of Hightower Advisors, LLC, or any of its affiliates.