Two months into the Great Lockdown, most aspects of the investment climate and our day-to-day lives remain disrupted: water is more expensive than oil, one in five Americans are unemployed, and restaurant reservations on OpenTable have declined by 99% 1. Here’s our current thinking in a world where everything’s suddenly turned upside-down.

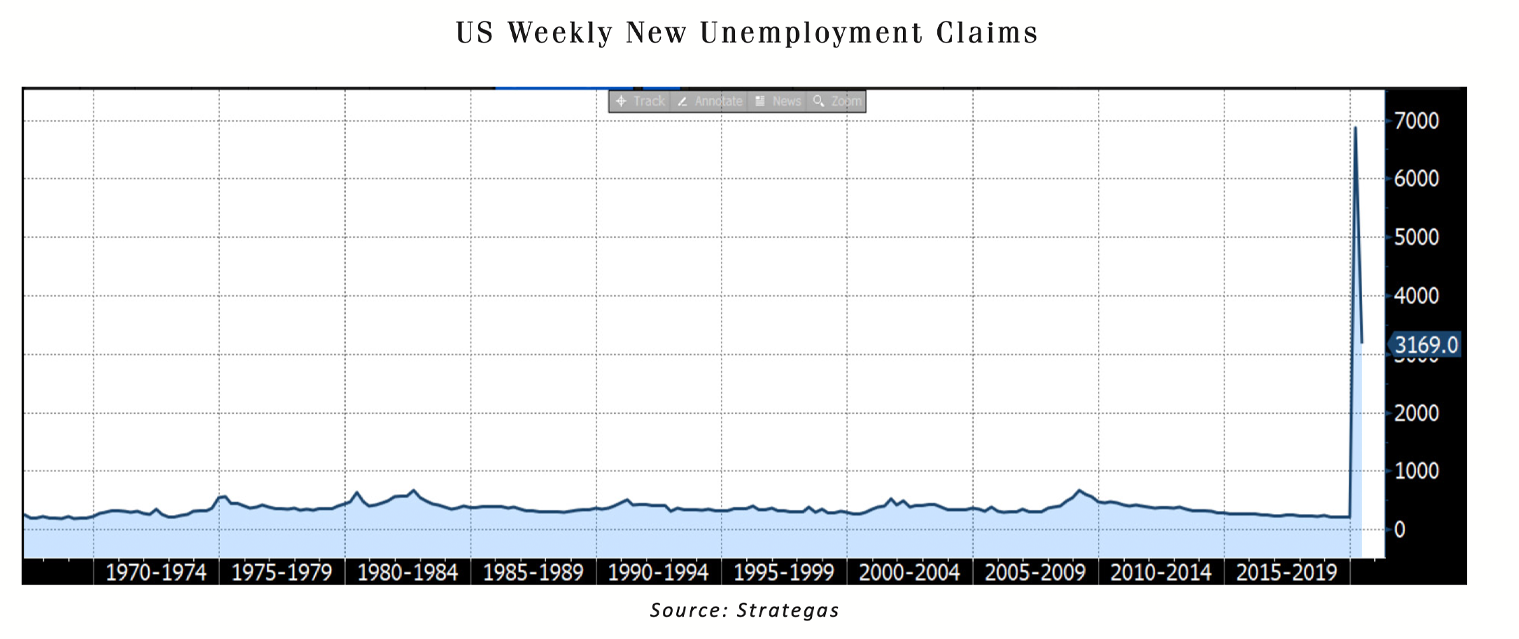

• Unemployment from 60-Year Low to 90-Year High. Previously record-low unemployment has surged to levels last seen during the ruinous 1930s Great Depression - all in just 7 weeks. At least 30 million Americans have lost their jobs, which translates to an approximately 20% “true” unem- ployment rate.

Implications: While a substantial number of employees will get rehired, we believe the uptake will be slow and unemployment will remain persistently above 7% though 2021. This means lower economic activity and less impressive earnings growth for stocks.

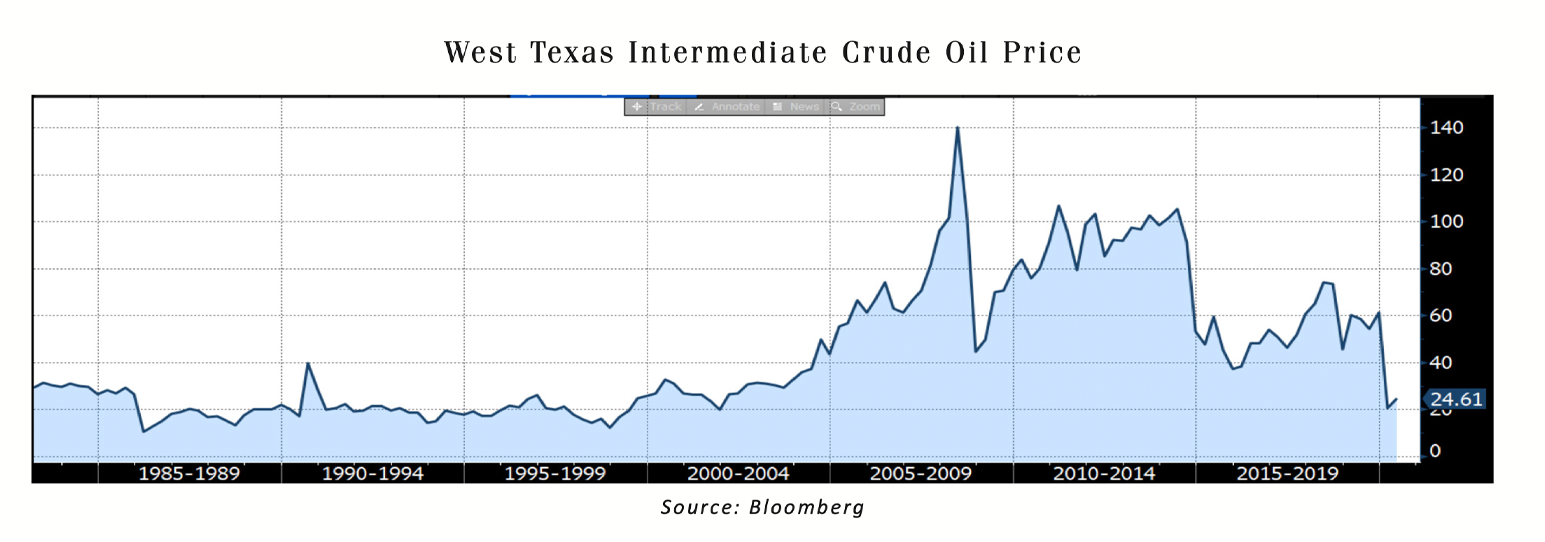

• Oil Cheaper Than Water. While it’s not strictly true to say that oil is now cheaper than water, it’s close. Pandemic-driven demand destruction combined with an oversupply of oil - due to an ill-timed global battle for market share - have driven the price of crude to rock-bottom levels. In fact, a futures contract for May delivery of crude oil recently traded below $0! Twenty years ago, our concern was that oil-producing nations had an unshakeable grip on US oil supplies. That’s clearly changed, along with our views.

Implications: Today, low oil prices will result in less pressure on inflation and increased cash flow for consumers. In 2021, we could see a countervailing imbalance (renewed demand exceeding reduced supply) and prices driven back to $40/barrel.

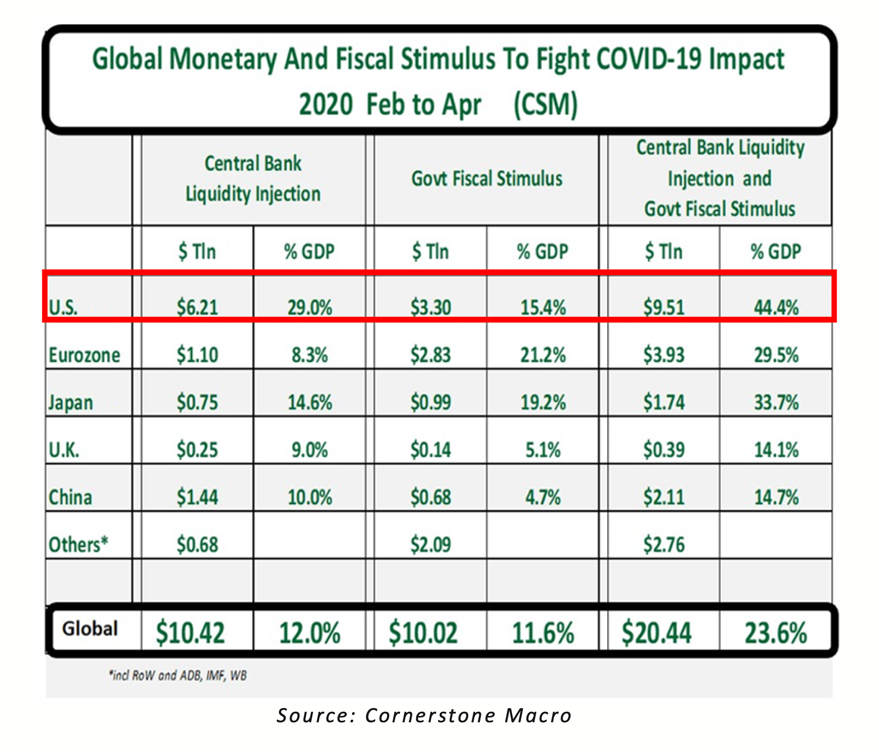

• Washington and the Federal Reserve to the Rescue. Our federal government and central bank have quickly launched rescue programs that are greater in size than anything we’ve ever ex- perienced. The combined size of all the fiscal and monetary policy actions are in excess of 40% of 2019 GDP - meaning the stimulus is worth over two-fifths the value of everything the entire American economy produced last year. This dwarfs the response to 2008’s Great Financial Crisis (the prior standard-bearer for “unprecedented” support), and doesn’t include the probability that there’s more still to come.

The effects have been significant and measurable. Previously-illiquid markets are now functioning smoothly, bond credit spreads have narrowed, and new issuance of corporate debt has surged. The greatest impact is reflected in the snapback we’ve seen in stock markets.

Implications: The message is clear - don’t fight the Fed. It’s an old lesson, and the primary reason why we didn’t reduce equity exposures as the pandemic began to unfold. However, going forward caution is warranted, as equity prices are high and credit spreads are low. Further, while all the money-printing is certainly supportive in the near-term, it’s impossible to forecast the medium and long-term effects of these interventions.

• States Declaring Bankruptcy? Municipal bond investors don’t like scary headlines but they’ve been forced to digest plenty of them lately, which has spawned opportunity. Political jousting and scaremongering over the prospect of additional federal aid to state and local governments, which face the brunt of the pandemic’s costs, has generated a favorable opportunity to buy municipal bonds at attractive levels.

Implications: The pandemic’s impact on municipal finances is real and significant, but no state is close to “broke;” they can’t and won’t declare bankruptcy. Moreover, state and local governments directly employ well over 10 million Americans, and any concerted nationwide effort at recovery must include this vital part of the economy. As indicated in our recent client alert Politics Is a Con- tact Sport: The Empty Threat of State Bankruptcies (4/24/20), we expect continued negotiations and sensational headlines. While that’s happening, we’ll remain buyers of high-grade municipals.

• Stock Market Getting Increasingly Concentrated? The pre-existing trend of “winner takes all” hasn’t skipped a beat, and if anything has accelerated. The combined weight of the S&P 500’s 5 largest stocks (currently Microsoft, Apple, Amazon, Facebook, and Alphabet) is now 20% of the entire index, a level that hasn’t been reached in decades. While this is consistent with our long- standing ‘Bricks to Clicks’ outlook, unfortunately, Google and Facebook rely on advertising spend- ing, while Apple and Amazon rely on consumer discretionary spending. Last we checked, un- employment was surging and the largest advertisers - hotels, restaurants, airlines, etc.- are shut down and struggling to survive. Is all truly as well as it seems?

Implications: We’ll continue to maintain current equity positions due to the massive liquidity injection by the Fed. Simultaneously, we’re trimming our passive (ETF) exposures and adding to our active managers. Think about it – for example, as Amazon grows, several retailers (in the S&P 500) will likely continue shrink. It’s time to be more selective.

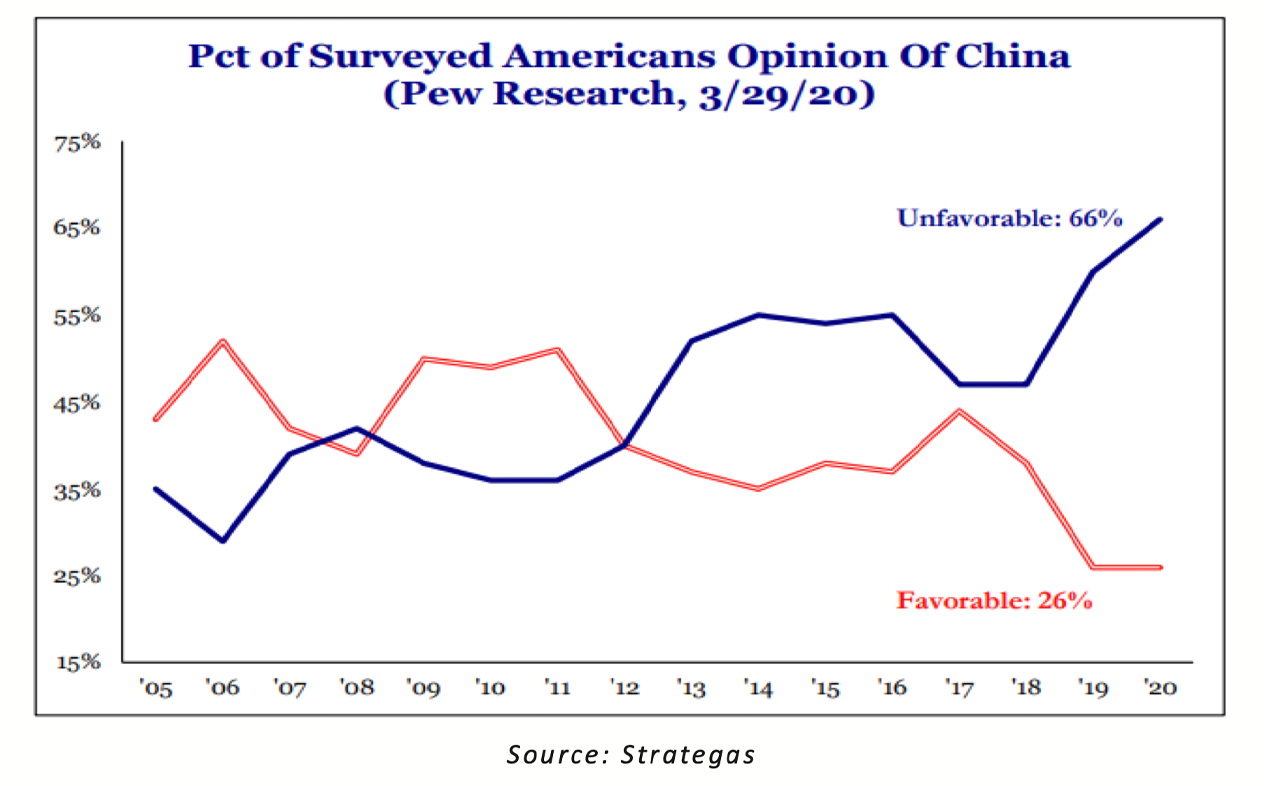

• China Tensions Will Grow. American public opinion has decisively shifted against China, with a bipartisan 66% 2 supermajority now holding an unfavorable opinion of our largest trading partner and a critical cog in many supply chains.

Implications: Don’t forget there’s an election in 6 months. Expect political candidates on both sides to take this to the bank and generate uncomfortable rhetoric. Markets won’t like the turmoil and further uncertainty.

Nearly 40 years of market watching have taught us that when faced with extreme uncertainty, we must conduct a scenario analysis to set the “playbook” for what’s likely to happen.

Our overall economic and market outlook is little changed from a month ago, when we published our Pandemic Road Map: Planning for the Next Phase (4/7/20). Our overarching point is that “it’s unlikely financial markets begin a durable recovery until the main (scientific) problem is resolved.” To be blunt, the prior level of economic activity isn’t likely to return until people no longer believe they might perish from COVID-19. Most will tolerate the risk of sitting on an airplane or in a crowded restaurant if they figure their maximum downside is a bad flu; but if the downside remains death, they’ll continue shunning these other social activities.

Meanwhile, the current reality is stark: the economic carnage is massive. In past recessions, the pace of rehiring is always slower than the preceding layoffs. While we expect conditions to improve, we’re sanguine about the prospects for a strong recovery and believe we’re primed for a cycle of persis- tently high unemployment through 2021. In our economy, where personal consumption drives the bulk of activity, this has huge negative implications for growth.

In summary, don’t expect reopening to mean a quick return to business as usual.

Remember; earnings are getting crushed, unemployment is at levels rivalling the Great Depression, and large swaths of the country are still effectively locked down. But if you didn’t know better, noth- ing about this equity price chart indicates we’re still dealing with the most serious economic crisis of our lifetimes.

Why the disconnect? It’s a consequence of “shock and awe” Fed intervention that could continue indefinitely, as they’ve promised to print massive amounts of money to support financial assets.

We still expect rates to remain “lower for longer” for a number of reasons:

• A slow economic recovery means the Fed will be forced to keep rates pinned to zero.

• The tsunami of global negative yielding debt (currently worth over $11 trillion) which we’ve repeatedly discussed in previous alerts still lurks in the background (see When the World Turns Upside Down: Positioning Portfolios During a Bond Bubble, 8/20/19). The “hunt for yield” is driv- ing foreign investors to continue flocking to the positive rates in the US.

• (As I can attest to), the continually-aging global population is likely to stay drawn to the relative safety of high-grade bonds. Further, we think post-pandemic saving rates are set to skyrocket. Both of these factors will increase demand for bonds.

What have we been doing? Overall, we aren’t increasing portfolio risk profiles and are maintaining existing long-term asset allocations. Given the disconnect between optimistic stock market multiples vs. pessimistic economic reality, we can’t justify either opportunistically increasing risk exposures or materially dialing them back. The fundamental outlook suggests caution and downside, but the hard and undeniable reality of monetary manipulation offsets these concerns.

Another decision we aren’t changing is our longstanding underweight in international markets. The pandemic’s impacts have further highlighted crippling weaknesses we’ve long highlighted as key risks. The Eurozone’s pre-existing mountain of negative-yielding debt, along with its fragmented fiscal policies and competing political interests, have slowed their response and limited its firepower. Our emerging markets equity exposure shall remain at zero. We’ve taken decisive action in fixed income portfolios by extending maturities where possible. Consistent with our “lower for longer” forecast, we’re locking in current rates and pre-deploying liquidity from upcoming maturities.

As always, thank you for your trust, and we wish you and your families continued health and happi- ness.