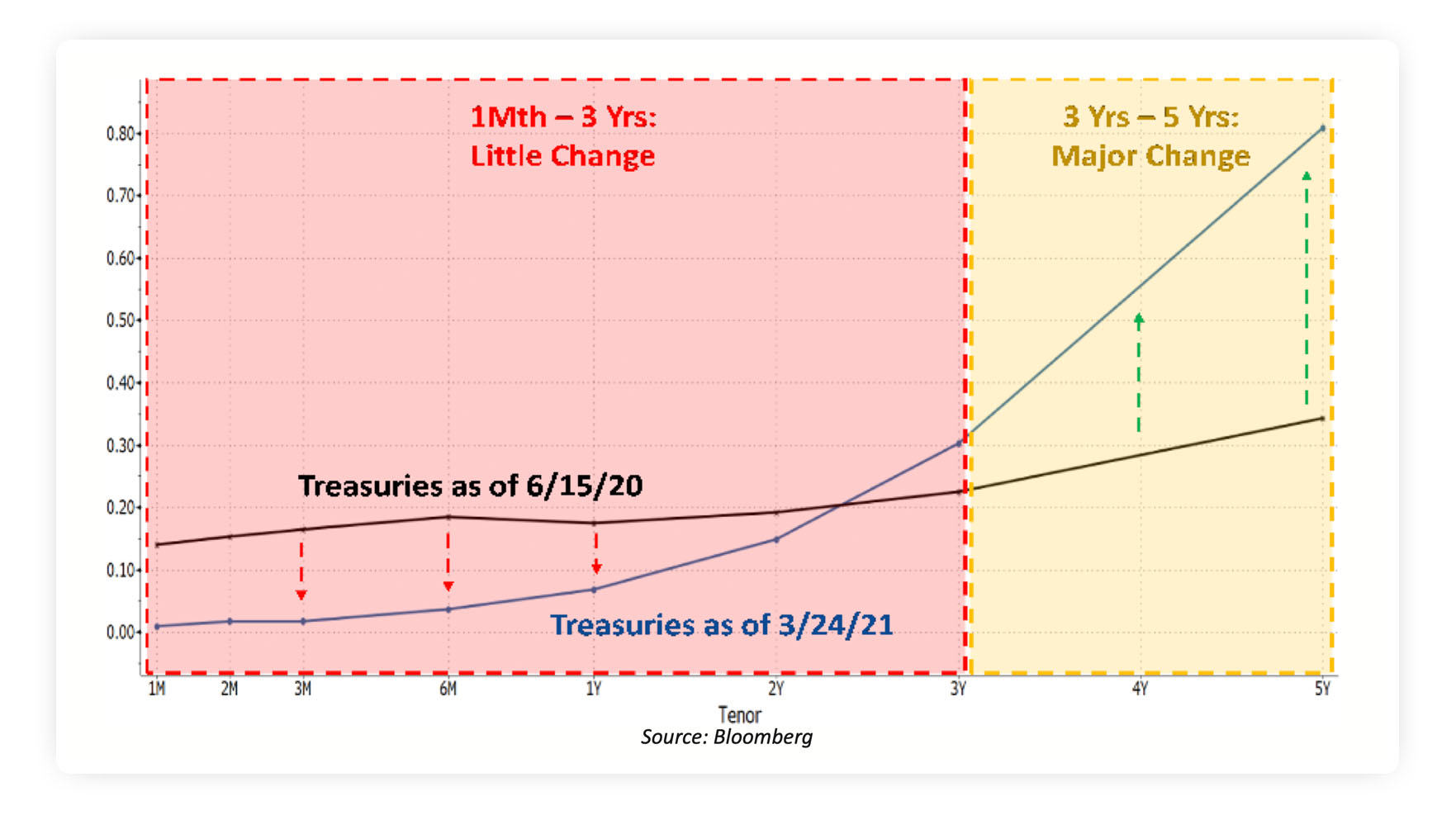

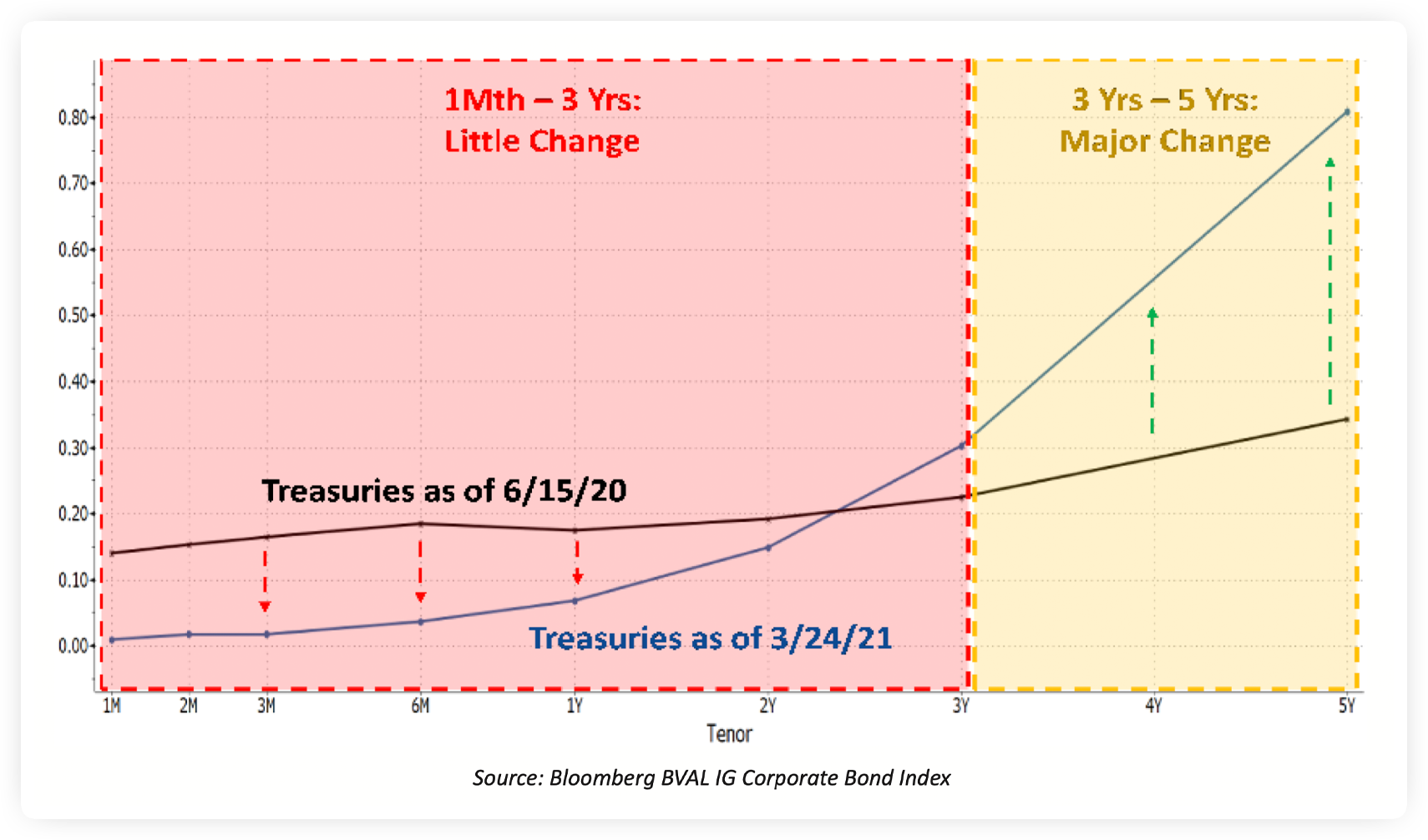

Throughout 2H 2020, an ultra-easy Federal Reserve and the ongoing pandemic resulted in very low and range-bound yields out to 5 years. This began changing as news of effective vaccines emerged in November and the prospect of victory against COVID-19 came into sight. With historically generous monetary and fiscal policy pumping torrents of liquidity, consensus rapidly pivoted towards assuming a booming expansion, causing the yield curve to pivot higher in maturities greater than 2.5 years.

As a result of this twisted curve, short-term rates remain lackluster while 3-5 year rates have dou- bled.

The bulk of the uptick in intermediate yields happened relatively recently, and opens up the possibil- ity of extending maturities at much more attractive levels than those available last June, when we essentially limited new purchases to a maximum 2024 final maturity

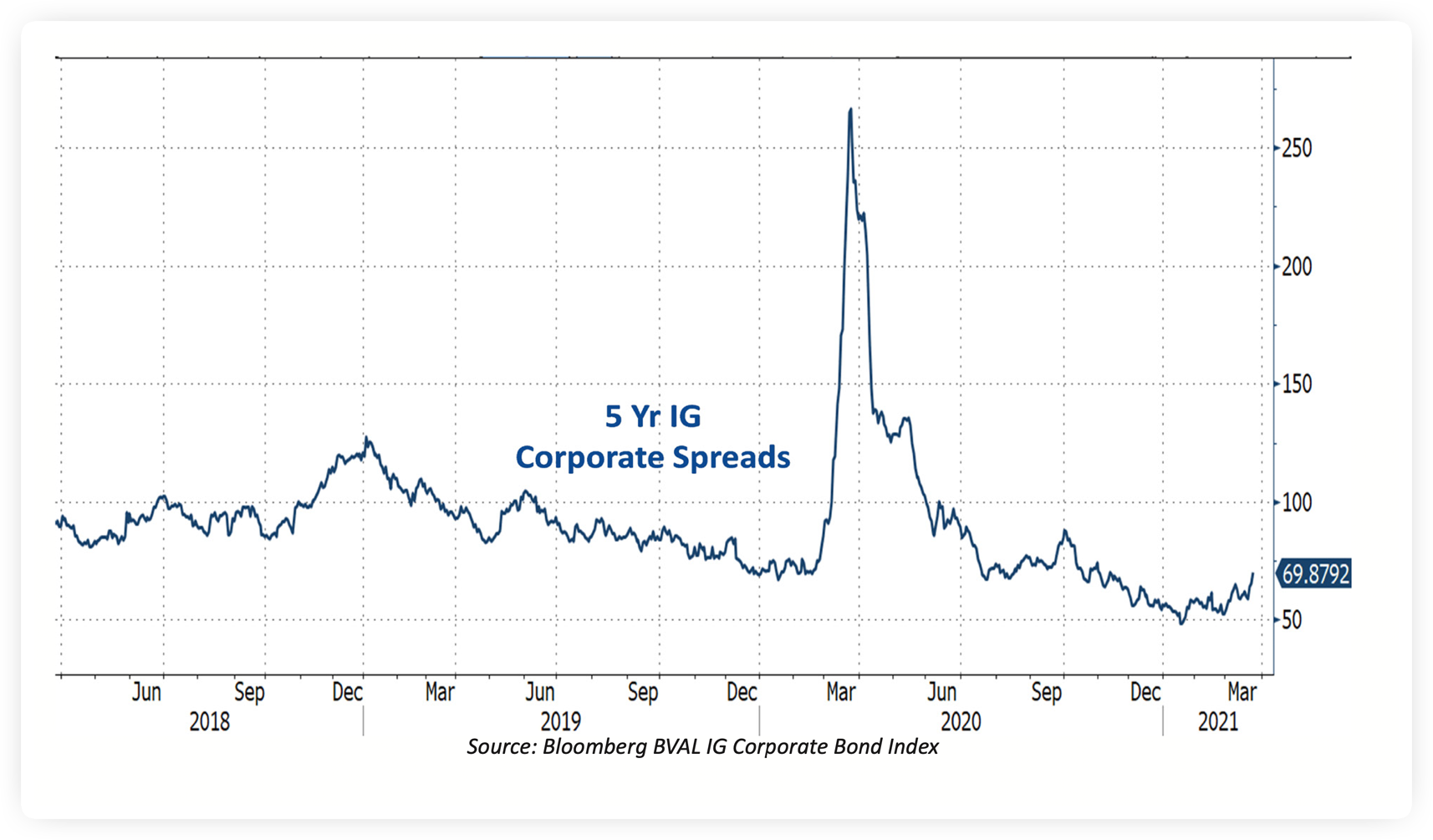

Unfortunately, credit spreads haven’t shown the same degree of increase as risk-free rates, a logical outcome given the improving economic climate. While spreads have bounced slightly off their mid- summer doldrums, they’re merely back to their immediate pre-pandemic levels.

The comparison is even less flattering when looking back further. Recall that pre-pandemic spreads were already trading tight to historical levels, as years of aggressive interventionism from global cen- tral banks had forced investors to compete for ever-scarcer positive yields. The incremental reward for bearing credit risk remains meager.

When we generally suspended longer-dated purchases in June 2020, our rationale was straightfor- ward; with a nearly-flat curve hugging 0% and little relief available in spread markets, the risk-reward tradeoff was poor. This meant accepting painfully low returns but maintaining reinvestment flex- ibility versus reaching out longer for a tiny bump in yield and less flexibility. Given massive fiscal and monetary intervention creating a tsunami of easy money, we thought the curve would eventually steepen while the short-end would remain firmly anchored to a 0% Fed Funds rate.

That curve steepening has indeed come to pass, and the yield pickup from extending maturities is now far higher. However, since many clients don’t have the flexibility to consider longer-term maturi- ties, our strategy for portfolios with limits inside of 3 years is to continue extending maturities and guide portfolios closer to their max WAMs. While returns remain meager, our expectation is that the Fed maintains a 0% Fed Funds rate into 2023. This will continue to durably keep shorter-term yields near their current low levels, but also minimizes the risk of sudden increases. We continue to favor corporate over government bonds given their incrementally higher returns versus base risk-free rates.

For those clients with IPs that permit longer-term maturities, our prior restraint has preserved the ability to take advantage of a more favorable environment in 3-5 year investments (while minimizing unrealized losses). We’re not quite ready to lift those limits and add longer-dated exposures (al- though we’re getting closer). However, it’s an opportune moment for readers to ponder their overall portfolio duration targets and weigh the merits of extending maturities.

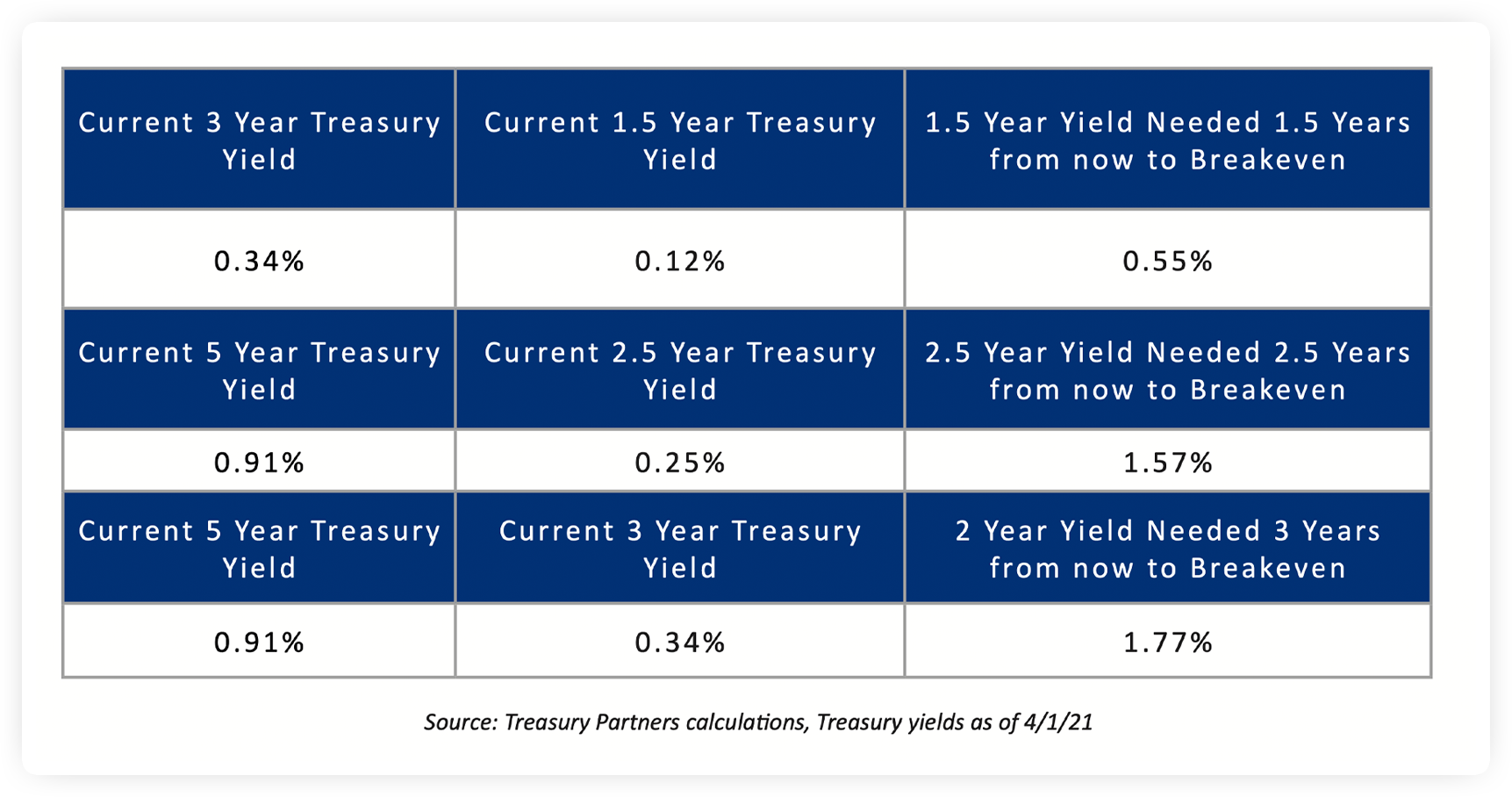

At the current 3 year Treasury yield of 0.34%, an investor who instead buys a 1.5 year Treasury at 0.12% will come out ahead if, when that original bond matures, they can reinvest into another 1.5 year Treasury yielding over 0.55%. Similarly, with the 5 year now at 0.91%, 2-2.5 year Treasuries would have to rise to more than 1.57%-1.77% in a couple of years from now to be better off than locking in the 0.91% today.

The current economic expansion has all the makings of a strong one, and booming real economies tend to create upward rate pressure. Moreover, the next several months are likely to bring unusually- high inflation readings (skewed by base effects from an easy comparison to pandemic-ravaged 2020). At these low nominal yields, the most significant threat to longer-dated bond returns is a sustained uptick in inflation, which is not our base case.

As a result, we're holding off on fully extending into3-5 year postions for now, waiting to see if the next few months bring an "inflationary scare" that creates an opportunity to add more aggressiverly at higher book yields. However, investors with low durations and ongoing free cash flow should con-sider the merits of extending maturities on any rate spikes over the next few months.

For over 37 years, corporations, high-net-worth individuals, family offices, trusts, foundations and endowments have sought our help to construct diversified portfolios positioned to perform throughout market cycles. Among other industr y recognitions, Barron’s has ranked us in the top tier on its annual listing of “America’s Top 100 Financial Advisors” every year since the sur vey was introduced in 2004.Speak with Our Barron’s Top-R anked Team Today

Treasury Partners is a group of investment professionals registered with Hightower Securities, LLC, member FINRA and SIPC, and with Hightower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through Hightower Securities, LLC; advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past perfor - mance is not indicative of current or future performance and is not a guarantee. The investment opportunities referenced herein may not be suitable for all investors. Yield and market values will fluctuate with changes in market conditions. Prices and availability are subject to market conditions. Projected cash flows will change as bonds mature. Some bonds may be called prior to maturity. The investment return and principal value of an investment security will fluctuate with market conditions so that, when redeemed, the value of the investment may be worth more or less than the original cost. The information herein has been obtained from sources considered to be reliable, but the accuracy of which cannot be guaranteed. Municipal bonds are subject to risks related to litigation, legislation, political changes, local business or economic conditions, conditions in underlying sectors, bankruptcy or other changes in the financial condition of the issuer, and/or the discontinuance of the taxation supporting the project or assets or the inability to collect revenues for the project or from the assets. They are also subject to credit risk, interest rate risk, call risk, lease obligations and tax risk. The market for municipal bonds may be less liquid than for taxable bonds. Income from some municipal bonds may be subject to the federal alternative minimum tax (AMT) for certain investors. Investing involves risk, including possible loss of principal. All data and information reference herein are from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other information contained in this research is provided as general market commentary, it does not constitute investment advice. Treasury Partners and Hightower shall not in any way be liable for claims, and make no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information, or for statements or errors contained in or omissions from the obtained data and information referenced herein. The data and information are provided as of the date referenced. Such data and information are subject to change without notice. This document was created for informational purposes only; the opinions expressed are solely those of Treasury Partners and do not represent those of Hightower Advisors, LLC, or any of its affiliates.