• Russia’s invasion of Ukraine is driving financial markets.

• In addition to the tragic human cost, the war has ushered in momentous changes in the investment landscape.

• Markets are fundamentally riskier and more uncertain than before the invasion.

Read on for our latest thoughts.

Never in my 40-year career did I expect to witness a kinetic war in Europe. We’re deeply saddened, and our hearts go out to all citizens of Ukraine. While we’re inspired by their bravery, the conflict has created substantial risks for financial markets. Without minimizing the devastation and human toll, it is our role to antiseptically evaluate and report on the investment landscape.

As fundamental investors, our skill set is in evaluating economic factors, balance sheets, income statements, the Federal Reserve, etc. These factors hold less weight in our current environment. Today’s markets are instead being driven by the war and geopolitics, the epitome of unpredictable outcomes. The consequences of this conflict are far-reaching and pervasive: energy markets, agricultural and industrial commodity flows, manufacturing supply chains, trade shipping routes, and more have been disrupted. Some financial sanctions could potentially even rewire the very underpinnings of the global financial system (e.g., restricting access to SWIFT and central bank reserves). The situation is inherently unpredictable and constantly shifting.

“There are decades where nothing

happens, and there are weeks where decades happen.”

Vladimir Lenin

One of the few things that’s clear is that Russian President Vladimir Putin grossly: overestimated Russia’s conventional military capabilities; underestimated the resolve of the Ukrainian people; and misunderstood the strength of the coordinated global response from foreign governments, companies, and ordinary citizens. While the unprecedented sanctions have successfully banished Russia from the world’s major financial and trade ecosystems, they’ve also raised the odds that the conflict escalates into something worse. Compared to Western powers, Russia has long asserted that nuclear and chemical weapons constitute legitimate battlefield arms, which lowers the bar for deployment. The West can’t afford to let events unfold to the point where Putin feels he’s backed into a corner and must use non-conventional weapons.

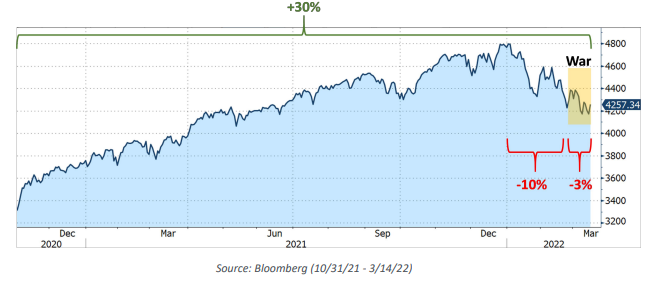

All things considered, most markets have held up well; the S&P 500 is down less than 3% since the first shots were fired on February 24th, which is far less than the index’s unrelated -10% year-to-date decline prior to the conflict. For perspective, the index is still up an impressive +30% since November 2020 (when the first effective COVID-19 vaccines were announced).

We see the potential for several outcomes, each with diverging results for asset prices:

“The fight is here; I need ammunition,

not a ride.”

Volodymyr Zelensky, President of Ukraine (responding to

a US offer of evacuation )

Zelensky and Putin reach a compromise that gives Russia an “off-ramp” from its stalled invasion. A tenuous peace takes hold as Russia ends the bloodshed in exchange for Ukraine recognizing several breakaway regions and agreeing to “neutrality.” Global economic sanctions, while eased somewhat, largely stay in place and prevent anything that looks like a return to normalcy.

• Economic Implications: Commodity prices stay elevated, with concerns centered on oil/gas and agricultural staples (Geopolitical Futures calculates that Ukraine + Russia combined account for 29% of global wheat exports, 19% of corn, 30% of barley and 78% of sunflower oil). Combined with still-snarled supply chains, elevated global inflation persists, leading to reduced consumer spending that slows economic growth in the US and possibly tips the Eurozone into recession. Of note, the financial sanctions could have long-lasting (and unintended) impacts for the global economy that are difficult to predict and unwind.

• Near-Term Market Reaction: Stocks stage a modest relief rally, energy prices peak and modestly decline, yields continue drifting higher. A beleaguered Eurozone, faced with integrating an unprecedented number of refugees, slows from the strain on its finances and infrastructure. Select companies benefit from the reconstruction in Ukraine.

• Relative Probability: Highest. This is currently our base case.

Putin resists the “off-ramp” and keeps fighting for several more weeks. Either the war transitions into a long, frustrating slog, or the Russian military breaks through and conquers the bulk of Ukraine. Should Putin feel emboldened, he also rolls over Transnistria and Moldova and Russian tanks arrive at NATO borders in Romania. NATO scrambles to shore up its defenses while an outraged world further increases sanctions. Unintended escalation risks persist indefinitely.

• Economic Implications: Commodity prices stay expensive for longer, inflation continues to spiral higher, recession risk materially increases in the Eurozone.

• Near-Term Market Reaction: Equities decline (especially in the Eurozone), bond yields accelerate higher to incorporate rising inflation expectations.

• Relatively Probability: Low. Putin’s forces are already faltering and he’s likely to run out of money and munitions sooner rather than later.

Russia’s position deteriorates and the military situation grows desperate. With an economy devastated by sanctions and seemingly no face-saving exit to be had, Putin’s hold on power becomes tenuous. While I never thought this would occur in my lifetime, a cornered Putin tries to turn the tide by credibly threatening or authorizing non-conventional warfare, such as a tactical nuclear strike or major chemical/biological attack. The world reels in horror and debates whether World War 3 has arrived.

• Economic Implications: An amplified version of Scenario #2

• Near-Term Market Reaction: Significantly lower stocks, lower bond yields (as investors flee to quality and the closest thing to stability)

• Relatively Probability: Lowest, and let’s hope it stays that way.

Even the best scenario presents uncertainty and in our view, a less than satisfactory backdrop for risk assets.

“If the markets survive Putin, they’ll

still have to deal with Powell.”

Richard Saperstein

The outbreak of war isn’t the only threat to worry about. Even prior to Russia’s invasion of Ukraine, there were growing risks to the investment backdrop that had already precipitated increased market volatility.

In our 2022 Outlook (2021 Review and 2022 Outlook: Volatility Returns, 12/24/21), we noted that although underlying economic fundamentals were strong (impressive jobs growth, robust consumer demand supported by healthy balance sheets, etc.), the market was betting that naggingly high inflation would soon prod the Fed into an increasingly aggressive pace of tightening. Uncertainty about the contours and pace of Quantitative Tightening (“QT”), or the process of allowing bonds to roll off the Fed’s balance sheet, also loomed. These fundamental factors caused a rapid uptick in yields that also pressured equity Price/Earnings multiples, particularly within previously high-flying sectors (see Alert: Fed Tapering is Coming, Avoid Zero Cash-Flow Stocks and Bonds, 10/13/21 ).

Our pre-war thesis was that inflation, which was elevated primarily due to supply-chain backups, was peaking and would moderate enough to allow the Fed to tighten slower than predicted. The war and its consequences force us to rethink our base case and incorporate a wider range of outcomes. For example:

• Inflation. Although we still expect supply chain-induced inflationary pressures to moderate, the benefit will be more than offset by surging commodity and food prices. Inflation now likely remains higher for longer.

• Fed Policy. Persistently elevated inflation is a heavy drag on economic activity. We face the possibility of stagflation - slowing economic growth paired with rising inflation. The Fed will likely respond with rate hikes and QT, and how/when it approaches this process remains a wild card.

• Economic Activity. We’ve reduced our growth expectations in both the US and especially in the Eurozone, which is particularly hard-hit by the spike in all-important energy prices. The divergence in the relative prices of European natural gas vs. the rest of the world is due to their high dependence on Russian imports.

As long-term investors, our primary goal is to minimize the risk of deep downside losses while preserving opportunities for reasonable upside gains. On a macro level, we try to avoid unquantifiable risks or investments that don’t present a favorable risk/reward proposition. Longtime readers know that this approach underlies some of our longstanding out-of-consensus calls, such as avoiding direct exposure to Emerging Markets, severe underweighting of Eurozone/ International equities, aggressively extending maturities upon the pandemic’s outbreak in March 2020, etc.

Today, we must deal with a new unquantifiable risk. We’re unable to comfortably assess hard probabilities for the scenarios presented above. But the key takeaway is that even the most favorable scenario for markets, the “Off-Ramp”, still likely results in elevated and persistent global inflation which will drag on consumer spending. The implications of reduced globalization and the advent of weaponized sanctions could have far-reaching and unpredictable long-term effects. Moreover, this would occur while the Fed begins hiking rates and withdrawing andemic-era liquidity through Quantitative Tightening.

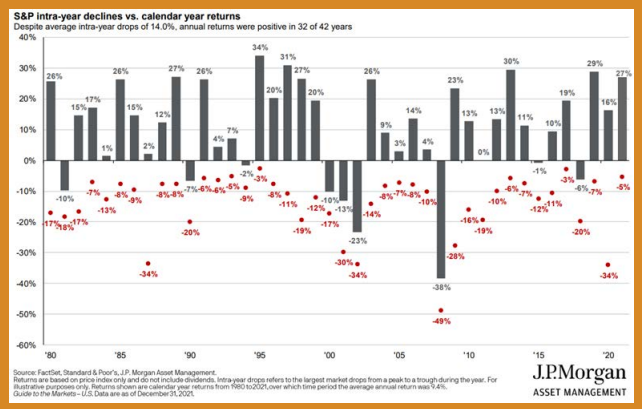

At current market levels, the downside of our “Off-Ramp” scenario is largely reflected in equity prices. A resolution of tensions would likely cause an immediate spike in equity prices. However, our other two scenarios aren’t priced in and could thus precipitate further drops in stock prices. We’ve often highlighted the chart below comparing the S&P 500’s annual returns with their worst intra-year drawdown. While full-year returns have been positive >75% of the time, the ride is frequently quite bumpy. The only aspect that can be controlled is our overall exposure to risk assets.

Times like this remind us that volatility is a very common, albeit uncomfortable, component of investing. We must remember; although the immediate future is murkier than usual, we’ve faced turmoil before. In my 40-year career, I recall:

• The 1987 “Black Monday” crash (a -30% day for the S&P 500)

• The early 2000s “Dot-Com” Bubble (followed by a multi-year bear market)

• The September 11th, 2001 terrorist attacks (stock markets closed for several days)

• 2008’s Great Financial Crisis (when the world’s financial infrastructure was genuinely collapsing)

• More recently – the COVID-19 pandemic (S&P 500 down -33% in 1 month)

The US economy and equity markets made it through each of these crises, just like we’ll make it through whatever might come next. The US remains the most dynamic and prosperous economy in the world, reaping massive benefits from the dollar’s undisputed status as the world’s reserve and preferred transactional currency. It’s rarely a straight line, but sooner or later we’ll surely keep prospering and growing, and this will ultimately be reflected in stock prices.

We recommend taking this opportunity to reflect on your ability and willingness to hold risk assets while enduring current levels of volatility (and possibly more given the two potential scenarios, not in our base case). Reducing risk assets and locking in losses in the middle of a downturn is a difficult and likely costly decision. However, these are unprecedented times. We appreciate the confidence and trust you place in us in this challenging environment.

Treasury Partners is a group of investment professionals registered with Hightower Securities, LLC, member FINRA and SIPC, and with Hightower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through Hightower Securities, LLC; advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past perfor - mance is not indicative of current or future performance and is not a guarantee. The investment opportunities referenced herein may not be suitable for all investors. Yield and market values will fluctuate with changes in market conditions. Prices and availability are subject to market conditions. Projected cash flows will change as bonds mature. Some bonds may be called prior to maturity. The investment return and principal value of an investment security will fluctuate with market conditions so that, when redeemed, the value of the investment may be worth more or less than the original cost. The information herein has been obtained from sources considered to be reliable, but the accuracy of which cannot be guaranteed. Municipal bonds are subject to risks related to litigation, legislation, political changes, local business or economic conditions, conditions in underlying sectors, bankruptcy or other changes in the financial condition of the issuer, and/or the discontinuance of the taxation supporting the project or assets or the inability to collect revenues for the project or from the assets. They are also subject to credit risk, interest rate risk, call risk, lease obligations and tax risk. The market for municipal bonds may be less liquid than for taxable bonds. Income from some municipal bonds may be subject to the federal alternative minimum tax (AMT) for certain investors. Investing involves risk, including possible loss of principal. All data and information reference herein are from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other information contained in this research is provided as general market commentary, it does not constitute investment advice. Treasury Partners and Hightower shall not in any way be liable for claims, and make no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information, or for statements or errors contained in or omissions from the obtained data and information referenced herein. The data and information are provided as of the date referenced. Such data and information are subject to change without notice. This document was created for informational purposes only; the opinions expressed are solely those of Treasury Partners and do not represent those of Hightower Advisors, LLC, or any of its affiliates.