The past several months have been marked by a sudden return of market volatility. From rising shortterm rates and shifting Fed policy expectations to heightened concerns about international credit exposures, there have been plenty of new developments. Read on for how Treasury Partners is positioning portfolios in today’s market.

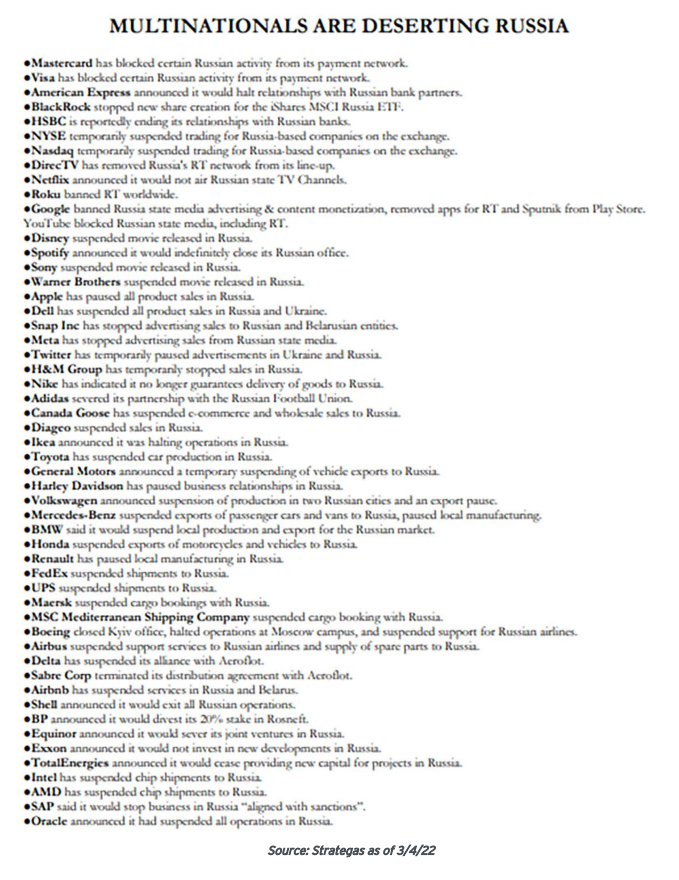

Headlines across the globe are rightfully dominated by news of the ongoing Russian invasion of Ukraine. This war has created new uncertainties for companies with material linkages to either countries’ economies, particularly those with joint ventures or investments impacted by harsh international sanctions against Russia.

We’ve always prioritized the safety of client assets, which includes actively seeking to minimize exposure to potential geopolitical and accounting transparency risks. As a result, we have no direct holdings backed by Russian or Ukrainian issuers. Some of the issuers currently held in client portfolios have indirect exposure; for example, large international-facing banks hold loans linked to or backed by Russian/Ukrainian companies or assets, and some companies in the energy industry have joint ventures or operating agreements with Russian energy firms. For example, Apple recently suspended product sales in Russia and Toyota has suspended auto production in St. Petersburg. For a more complete rundown of such multinational corporate actions, please see Strategas Research Partners’ running list included as an appendix to this Alert.

Although the situation is still evolving and we expect further knock-on effects to unfold, at this time we remain comfortable that the magnitude of any related exposure and losses will be manageable and would not lead to material credit degradation. Clearly the situation is tragic and changing daily. Given the material devastation within Ukraine and global impacts of the Russian sanctions, a deteriorating global macroeconomic backdrop may be the most important consequence affecting our investment landscape. We will of course continue to diligently monitor the situation.

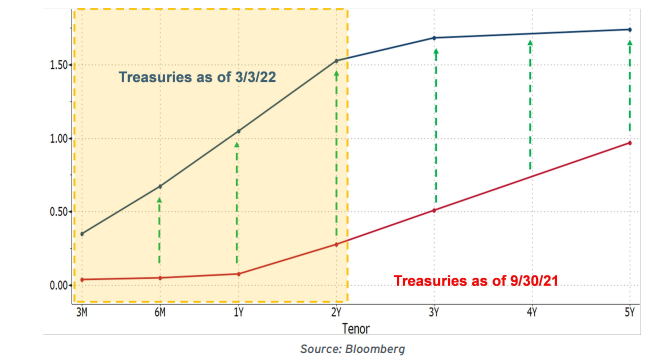

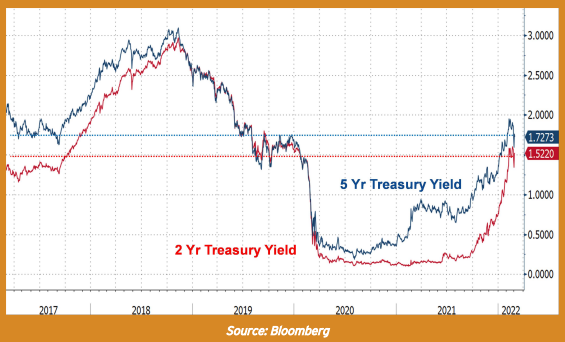

The change in market rates since the beginning of Q4 2021 has been nothing short of astounding. The front-end of the Treasury curve has ratcheted higher from near-zero levels, with 1 and 2-year yields in particular rising in a parabolic fashion.

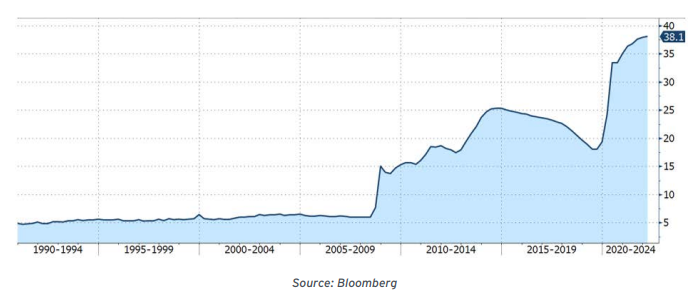

As always, it all traces back to the Fed. Elevated inflation has compelled the Fed to rapidly pivot to a more hawkish stance that dramatically shifted market perceptions of future policy decisions. In the span of five months, the consensus has gone from debating whether liftoff would commence in 2022 to now penciling in upwards of 5-7 hikes this year alone. Investors are also grappling with how to assess the potential contours and impact of “Quantitative Tightening” or allowing bonds to roll off from the Fed’s balance sheet. The Fed’s balance sheet has ballooned to a staggering $8.9 trillion, the equivalent of nearly 40% of US annual GDP. With little historical record on the collateral impact of balance sheet runoff (and no prior instances of active selling), what happens with QT represents the greatest “known unknown” overhanging markets.

This confluence of changes has significantly altered the front-end of the curve, which now features a much steeper slope up to two years and a much flatter tone from two to five years

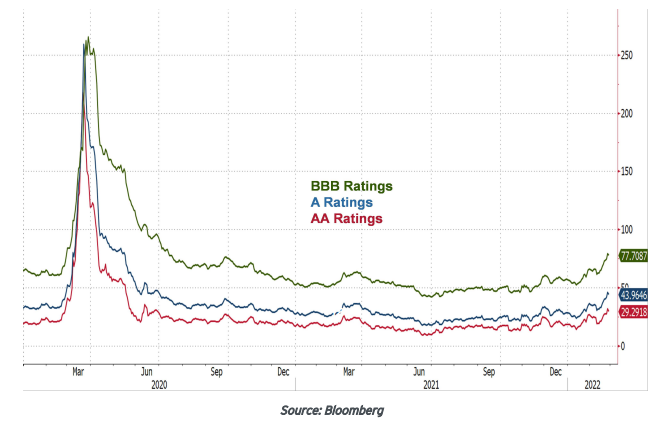

These massive adjustments have nevertheless been orderly, with no signs of undue credit stress. Although they have lately ticked higher, credit spreads are still trading consistent with established multi-year ranges. This benign credit environment makes sense given: (a) the underlying strength of the American economy; (b) the post-Covid expansion continues apace with strong jobs growth; (c) stillhealthy consumer spending; and (d) resilient corporate cashflows and earnings growth.

We’ll be blunt: we consider it highly unlikely that the Fed implements 6-7 hikes this year. Such a pace would be more reminiscent of the tightening cycles of yesteryear (and the decision-making of a longgone generation of Fed officials). Everything we’ve observed about the temperament of current central bankers since 2008’s Great Financial Crisis argues against their willingness to take such Volcker-like actions.

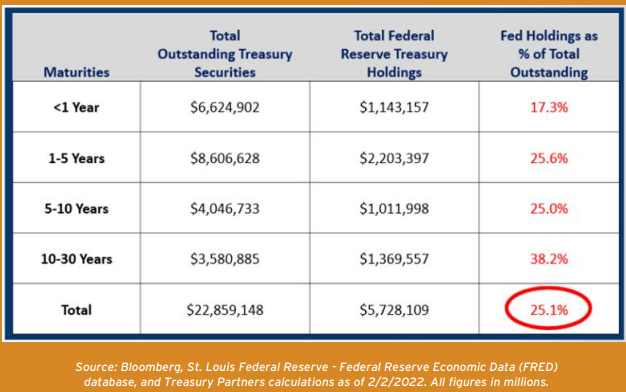

Remember: despite inflation measures running well >5% YoY since early summer 2021, the Fed was still engaging in Quantitative Easing until a few days ago. Importantly, at this point they own 25% of all tradeable Treasury debt and haven’t so much as outlined a plan to reduce the size of their balance sheet.

Pivoting to a more modest 3-4 hikes in 2022 with some balance sheet runoff commencing in H2 is our base case. Our view is informed by the seemingly little-acknowledged reality that traditional rate hikes aren’t the only way to tighten financial conditions. Other direct Fed actions, such as adjusting the timing and pace of balance sheet runoff, can act as ‘substitutes.’ Additionally, indirect actions outside the Fed’s control can also help do some of the heavy lifting – skyrocketing energy prices serve as a “tax” on consumer spending and cool down economic activity.

Given the disconnect between our base case and the market’s expectations for Fed tightening, we think current short-term rates present corporate cash investors with an excellent opportunity to extend maturities. In fact, today’s Treasury yields have basically round-tripped over the past 5 years, the last time we were in the early stages of a tightening cycle.

As our clients know, we suspended extending maturities starting in July 2020. Since rates spiked, we’ve shifted our strategy and are aggressively extending maturities to increase portfolio yields. In addition, surging 3- to 12-month rates have resulted in a wide gap between the yields on money market funds (MMFs) vs. short-term Treasuries. We’ve been taking advantage of this gap by reducing MMF balances and building liquidity ladders using 3-month Treasury bills. With MMFs currently returning approximately 3 basis points, utilizing such near-term Treasury ladders generates a substantial 40 basis point pickup.

As always, we thank our valued clients for your continued trust and confidence in our stewardship of your cash management needs.

Treasury Partners is a group of investment professionals registered with Hightower Securities, LLC, member FINRA and SIPC, and with Hightower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through Hightower Securities, LLC; advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past perfor - mance is not indicative of current or future performance and is not a guarantee. The investment opportunities referenced herein may not be suitable for all investors. Yield and market values will fluctuate with changes in market conditions. Prices and availability are subject to market conditions. Projected cash flows will change as bonds mature. Some bonds may be called prior to maturity. The investment return and principal value of an investment security will fluctuate with market conditions so that, when redeemed, the value of the investment may be worth more or less than the original cost. The information herein has been obtained from sources considered to be reliable, but the accuracy of which cannot be guaranteed. Municipal bonds are subject to risks related to litigation, legislation, political changes, local business or economic conditions, conditions in underlying sectors, bankruptcy or other changes in the financial condition of the issuer, and/or the discontinuance of the taxation supporting the project or assets or the inability to collect revenues for the project or from the assets. They are also subject to credit risk, interest rate risk, call risk, lease obligations and tax risk. The market for municipal bonds may be less liquid than for taxable bonds. Income from some municipal bonds may be subject to the federal alternative minimum tax (AMT) for certain investors. Investing involves risk, including possible loss of principal. All data and information reference herein are from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other information contained in this research is provided as general market commentary, it does not constitute investment advice. Treasury Partners and Hightower shall not in any way be liable for claims, and make no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information, or for statements or errors contained in or omissions from the obtained data and information referenced herein. The data and information are provided as of the date referenced. Such data and information are subject to change without notice. This document was created for informational purposes only; the opinions expressed are solely those of Treasury Partners and do not represent those of Hightower Advisors, LLC, or any of its affiliates.