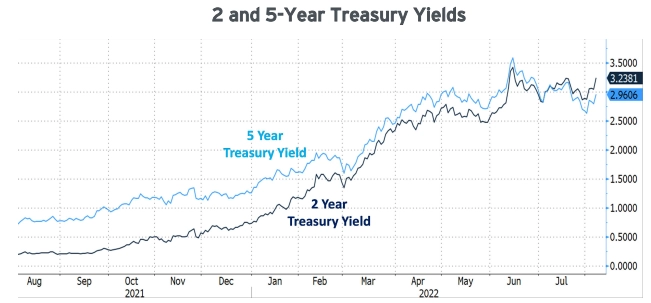

The extreme volatility in short-term markets has been nothing short of enormous. Two and five-year Treasuries have witnessed intraday moves of 20+ basis points as investors react to each signal and subtle hint from Fed officials. Read on for our latest thoughts on positioning corporate cash portfolios in these challenging times.

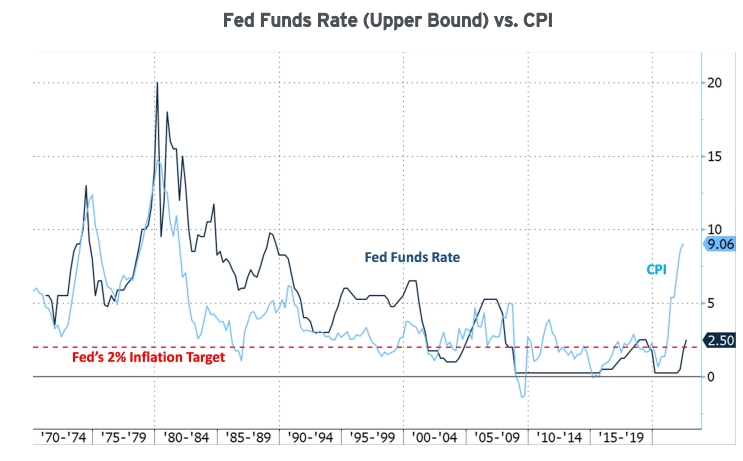

After decades as a dormant risk, inflation figures have now spent an entire year at levels not seen since the 1970s. An increasingly concerned Fed has been forced to pivot from dismissing it as ‘transitory’ to hurriedly implementing aggressive rate hikes.

The Fed Funds rate has now been raised to 2.50% (the peak of the last hiking cycle) while simultaneous Quantitative Tightening has further constricted liquidity (initially at a pace of $47 billion/month but soon accelerating to $95 billion/month). This has elevated market fears of a recession, generating much of the recent unprecedented volatility in front-end rates. Specifically, yields declined from their mid-June peaks as investors priced in growing recession fears and a potential Fed ‘dovish pivot’ before recently ticking back up.

We disagree with the predictions of an imminent dovish Fed pivot. Chair Powell and other Fed officials appreciate the gravity of the inflation problem, and as such and we expect continued tightening. History indicates that the Fed typically does not stop tightening until the Fed Funds rate matches or exceeds the rate of inflation. We are far from meeting that threshold at this juncture.

The believe that the market is still underestimating both the peak and length of this tightening cycle. The Fed continues to signal its determination to bring inflation down despite the risk that tighter monetary policy will damage real economic growth. Even if the next few months bring ‘cooling’ inflation data, CPI is highly unlikely to fall to 3-4% in such a short period of time – and we expect further rate increases, especially given the very low (3.5%) unemployment rate.

Although we anticipate more tightening, we cannot ignore the fact that front-end Treasury rates are near decade-plus highs, and are even comfortably above their longer 20-year average.

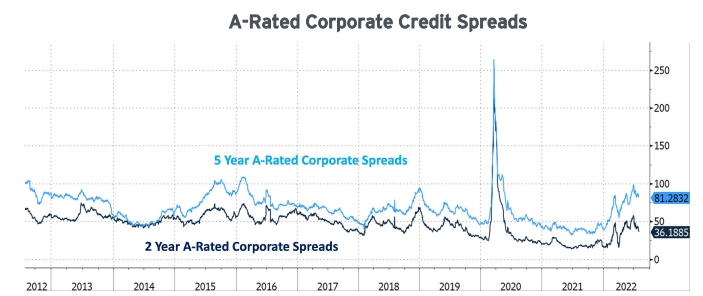

For clients who can purchase corporate bonds, credit spreads have widened to reflect a potential slowdown in economic activity.

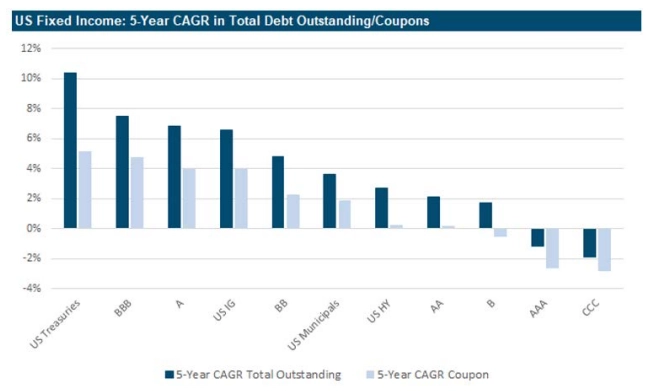

At the same time, the ability to capture such opportunities has improved. The absolute amount of Treasury and investment-grade corporate debt outstanding has increased considerably over the past several years, expanding the size of the investable universe.

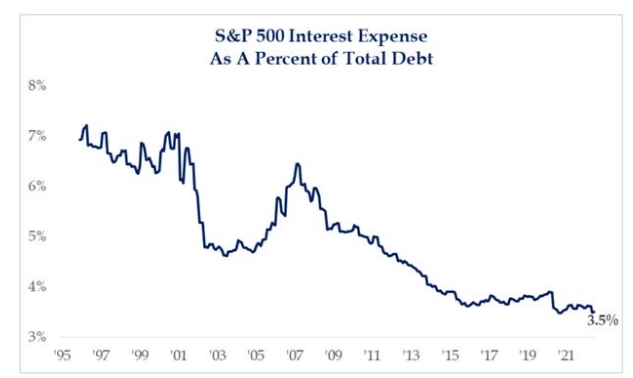

The increase in absolute debt loads has not come at the expense of a lockstep increase in debt service costs – note from the preceding chart that coupon payouts actually grew at a far slower rate. The core finding that these higher debt loads haven’t translated into proportionately higher financing costs is corroborated by other datasets – for example, the S&P 500’s interest expense ratio remains near multidecade lows.

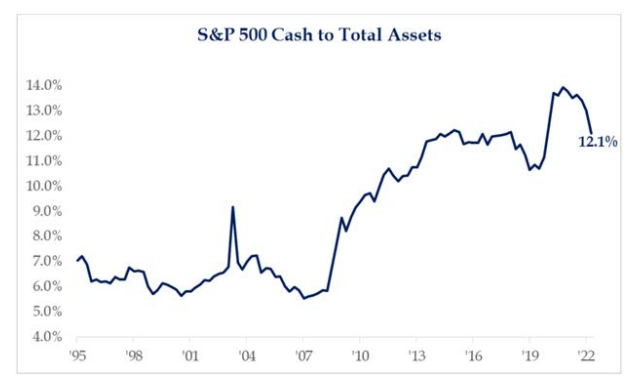

Moreover, the rest of Corporate America’s balance sheets remain relatively well-positioned to weather a potential recession – cash reserves are barely off their multi-decade high points.

Market Explanation

Corporate cash investors should recognize that although the Fed is expected to continue raising the Fed Funds rate, short term yields may not rise in lockstep. Markets are forward-looking, and history shows that rising rate cycles typically reach a point where the curve starts looking past the near-term tightening outlook to reflect the future consequences of a slowing economic climate.

This dynamic is shaping today’s 2s5s curve. Despite the consensus of more hikes in the coming months, cuts are already being priced in over the next couple of years. As a result, investors should carefully consider how to optimize strategies to take advantage of the current environment.

Strategy

For existing laddered portfolios, now is the time to extend maturities (subject to liquidity needs). The very steep upward slope of the short end of the curve, when combined with noticeably widened credit spreads, allows us to lock in attractive 3.5-4% yields in 2-5 year maturities. If rates continue to rise, upcoming maturities will be used to reinvest in the higher rate environment.

While unrealized mark-to-market losses are certainly possible as the Fed continues to tighten, these could also flip to unrealized gains if/when the market prices in the prospects of a slowing economy. For the first time in years, yields are high enough to justify the risk.

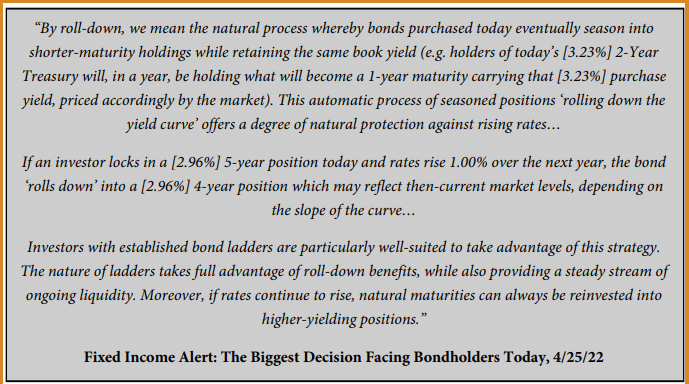

Another important consideration is one we discussed in our previous communication – the protective benefit of “roll-downs.”

For investors without existing positions, we suggest implementing a modified barbell portfolio. As an example, an investor with a 2-year maximum maturity and 1-year maximum average life, we would position the portfolio to emphasize 3-6 month maturities (e.g. ladder Treasuries) along with longer term holdings in the 12-24 month range (accordingly de-emphasizing holdings that fall between these timeframes). This strategy locks in today’s elevated longer-term levels while providing flexibility to keep reinvesting a proportion of the portfolio into a rising rate environment as the 3-6 month positions naturally roll off.

To summarize, short-term rates will continue to be extremely volatile and potentially trend higher. Current yields and spreads are at absolute levels that are too attractive to ignore, and portfolios can be structured to both lock in today’s opportunities while preserving flexibility for future tactical shifts. Don’t miss your flight just because there might be turbulence - prioritize getting to your destination!

Treasury Partners is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is neither indicative nor a guarantee of future results. The investment opportunities referenced herein may not be suitable for all investors. All data or other information referenced herein is from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other data or information contained in this presentation is provided as general market commentary and does not constitute investment advice. Treasury Partners and Hightower Advisors, LLC or any of its affiliates make no representations or warranties express or implied as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Treasury Partners and Hightower Advisors, LLC assume no liability for any action made or taken in reliance on or relating in any way to this information. The information is provided as of the date referenced in the document. Such data and other information are subject to change without notice. This document was created for informational purposes only; the opinions expressed herein are solely those of the author(s) and do not represent those of Hightower Advisors, LLC, or any of its affiliates.