Overall, 2021 proved to be a remarkably solid year for financial markets, as investors benefitted from one of the swiftest recoveries we’ve ever witnessed due to the great economic reopening. Thanks to the medical brilliance and superb execution of the pharmaceutical industry, the widespread rollout of successful vaccines and effective treatments against COVID-19 brought the end of the pandemic era within sight. Meanwhile, Corporate America skillfully navigated a challenging economic landscape, posting record profits while benefitting from the sustained tailwinds of booming consumer demand and still-easy monetary and fiscal policies.

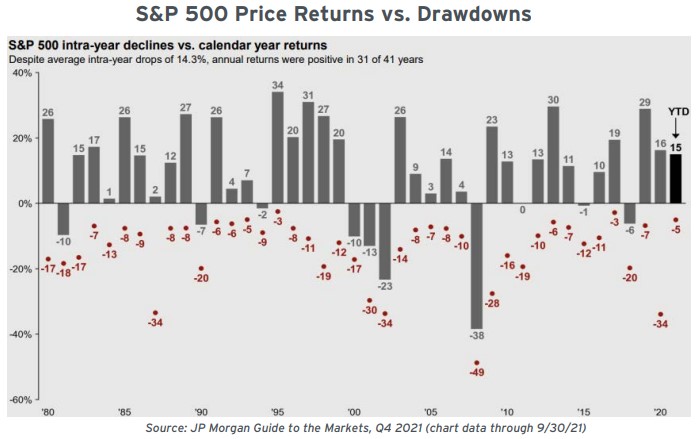

Given this impressive backdrop, it’s hardly surprising that the S&P 500 posted an excellent +26.9% return (through 12/15). US large-cap equities yet again outperformed their domestic and international peers, easily outpacing US small-caps (Russell 2000 +12.2%), developed international (MSCI World Ex-US +5.4%), and emerging markets (MSCI Emerging Markets -3.8%).

Moreover, the S&P 500’s strong gain was paired with unusually light volatility, as a modest 5% September decline represented the largest intra-year drawdown.

A look at sector-level developments reveals Growth (S&P 500 Growth +31.4%) outperformed Value (S&P 500 Value +21.8%), furthering a multi-year trend which began in 2018 but accelerated with the pandemic’s onset in early 2020.

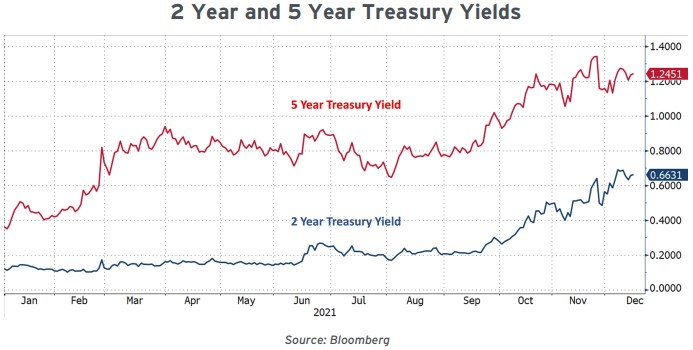

Fixed income was subdued, as the 10-year Treasury spent nearly all of 2021 trading within a tight 1.20-1.70% range. The (mild) exception was in short-term rates, where 2-year rates quintupled and 5- year rates more than tripled, albeit from ultra-low starting points.

Equities

As we usher in a new year, the outlook for our equity exposure remains positive, as economic growth appears poised to continue:

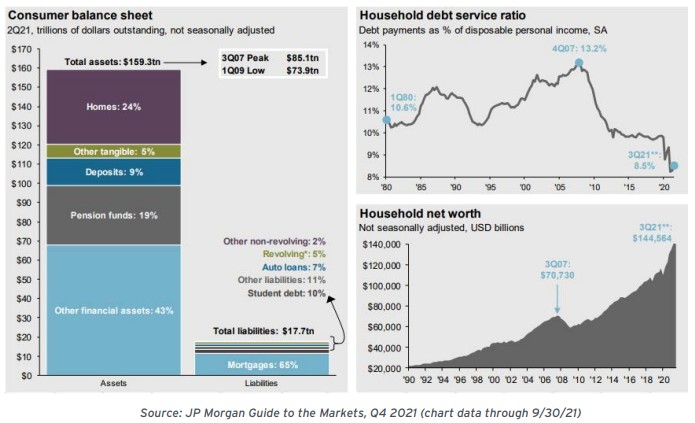

American consumers’ balance sheets remain very strong: savings rates are robust, net worth measures are at all-time highs, and household debt service burdens are plumbing new lows. Consumption spending remains the domestic economy’s primary engine, and consumers appear to have plenty of available spending power.

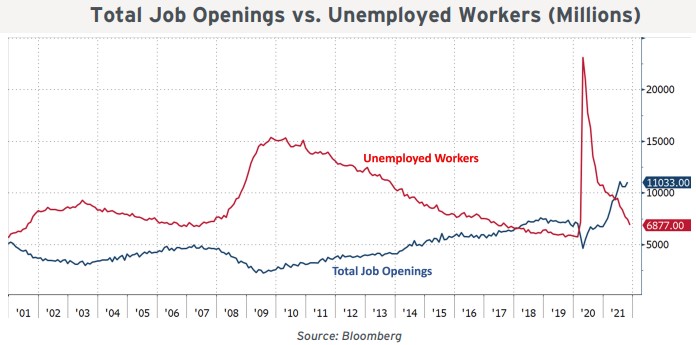

The labor market remains incredibly tight, with far more job openings than job searchers and employers across industries reporting difficulties in scaling up. Over time, we expect employment to keep steadily increasing, allowing output to improve and further bolstering consumer spending.

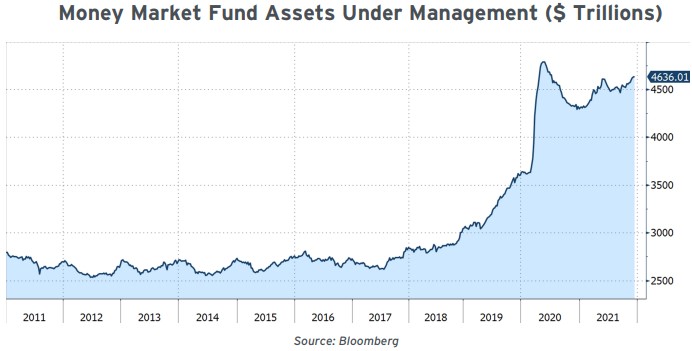

There’s still a tremendous amount of excess liquidity sloshing around the edges of financial markets. Money Market Fund assets remain at (far and away) historic all-time highs, representing uncommitted “dry powder” that’s available for reinvestment.

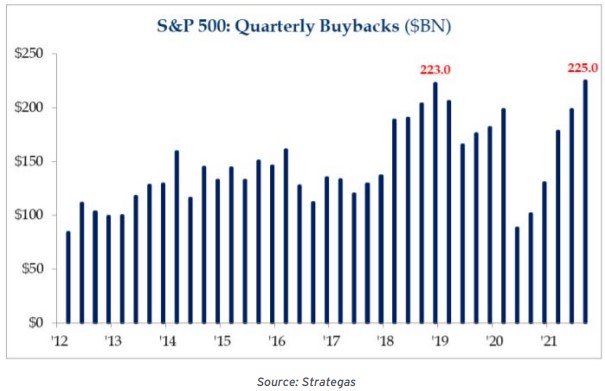

Stock buybacks have also rebounded to reach new heights. An important source of shareholder return, buybacks gradually reduce the supply of outstanding shares, amplifying the impact of ‘natural’ investor demand. We expect the level of buybacks to remain strong, as corporate cash balances as a percentage of total assets are elevated (currently at approximately 6.5% vs their historic average of 3.8% over the past 60 years).

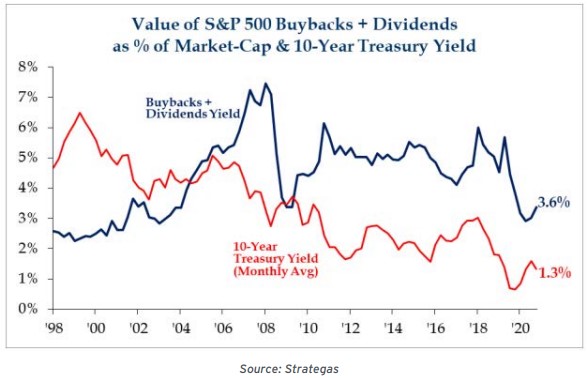

Of course, equity “shareholder yields” (dividend payouts + net impact of buybacks) are still attractive compared to bond yields. Corporate liquidity remains elevated, and we expect continued return of capital to shareholders.

But the counterpoint to this long list of positive factors is that much of this optimism already appears priced into equity markets. Investors have rewarded healthy corporate earnings with very high valuations –2022 S&P 500 EPS estimates (of appr. $228/share) pencil out to a lofty 22x P/E multiple at current prices, a level that could accurately be described as “priced to perfection.” Any disappointments could spur significant volatility. As Cornerstone Macro’s Michael Kantrowitz points out, if P/E’s decline 1 turn, that alone generates a 4% market decline. Should P/Es decline just 2 turns, it would fully neutralize the impact of next year’s anticipated earnings growth. The upshot is that for stocks to post a positive return in 2022, they must meet existing expectations for healthy earnings growth and the P/E multiple must stay high.

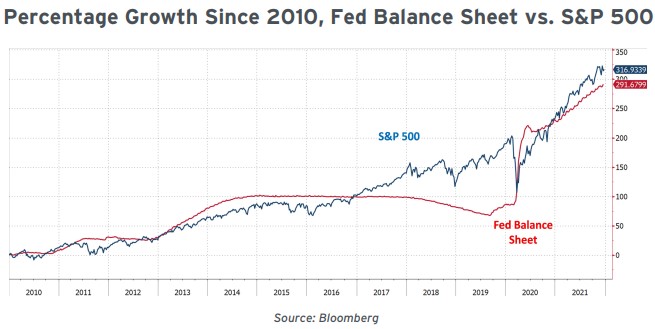

Complicating this picture is the observation that since the Great Financial Crisis (“GFC”), the S&P 500 has moved in near-lockstep with the growth of the Fed’s balance sheet. With this tide of money about to start receding, the liquidity that helped propel equities to current levels will fade.

Finally, the given lingering uncertainty over how much chaos COVID-19 can still cause (as recently demonstrated by the growing concerns over the Omicron variant), markets will remain subject to shocks from new mutations.

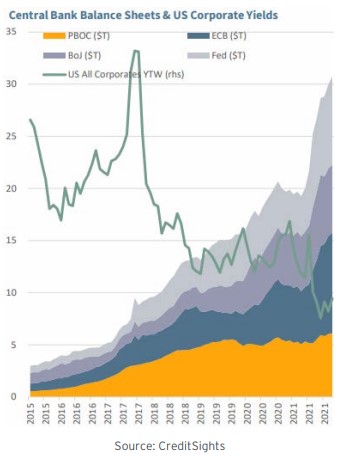

As we recently discussed (see Alert: Fed Tapering is Coming – Avoid Zero Cash-Flow Stocks and Bonds, 10/14/21), the Fed has bought and warehoused massive quantities of government and mortgage-backed securities. The explicit intent of Quantitative Easing (“QE”) has been to overpower the influence of traditional economic fundamentals to tamp down interest rates. Other global central banks followed suit with similar policies, proving wildly successful in driving down financing costs for both sovereign and corporate borrowers.

Over the next several months, these QE purchases will be tapered to zero. Framed differently, a gargantuan source of price-insensitive buying power is about to sunset. In addition, the impact of fiscal policy – which has been exceedingly supportive of consumer purchasing power and savings rates – will likely decline in 2022.

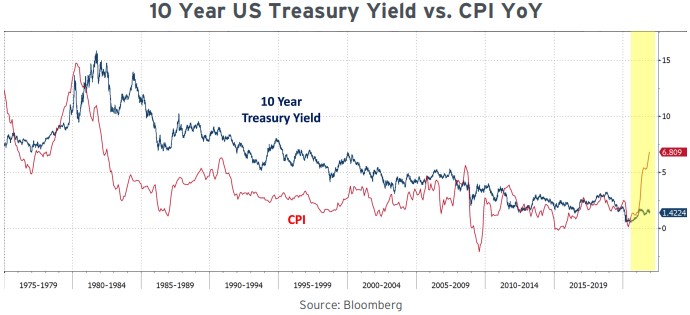

As a result, investors must face these sizable twin headwinds while 10 Year Treasuries now consistently yield well below the rate of inflation (something we haven’t seen since the early 1980s). Radical government intervention in financial markets has created a truly bizarre relationship between interest rates and inflation. Investors who seek the safety of bonds and maintain exposure to fixed income markets - savers, retirees, and risk-averse investors – are being steadily robbed of their purchasing power.

We all know that inflation is elevated. Short-term rate markets are betting that current red-hot inflation readings will stay elevated for longer than the Fed can tolerate, provoking quicker and more frequent hikes than anticipated. We disagree, as we think inflation will peak and slowly cool down as supply chains heal and consumers shift their spending from goods to services. While that doesn’t necessarily mean inflation quickly falls back to the pre-pandemic norm of less than 2% per year, we don’t foresee a 1970s-style inflationary environment that forces aggressive Fed Funds rate hikes. As a result, we do not expect meaningful Fed Funds increases in 2022.

To summarize, with the combination of a healthy economic outlook, tight labor markets, and a Fed that’s growing less accommodative, we expect rates to increase modestly. While short-term rates have already ratcheted materially higher, we prefer not to extend maturities into longer duration bonds at these levels. There’s still simply not enough protection to justify extending with what’s meant to be the “safe and stable” component of client asset allocations. To illustrate our concerns - at its current yield of approximately 1.50%, the price of a 10-year Treasury would decline in value by nearly 9% if rates rose just 1% from here.

Rather than accept the possibility of such eye-popping price volatility, we’re taking the safer approach for our client fixed income portfolios by restricting bond reinvestments to short-term maturities. Although the absolute level of rates is lower on the front-end of the curve, so are the threats to principal values. Within that strategy, where appropriate, short-term callable municipals continue offering some of the most attractive risk-adjusted returns.

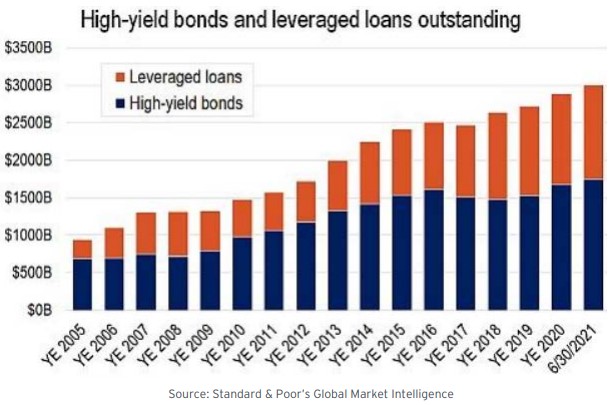

We’re keeping a close eye on speculative-grade credit markets, which have exploded in popularity. Years of copious liquidity and low rates have encouraged a boom in loans provided to smaller and often less-creditworthy borrowers. The outstanding value of below-Investment Grade debt, which includes both privately held Leveraged Loans and publicly traded High-Yield (“HY”) bonds, has more than doubled since the GFC.

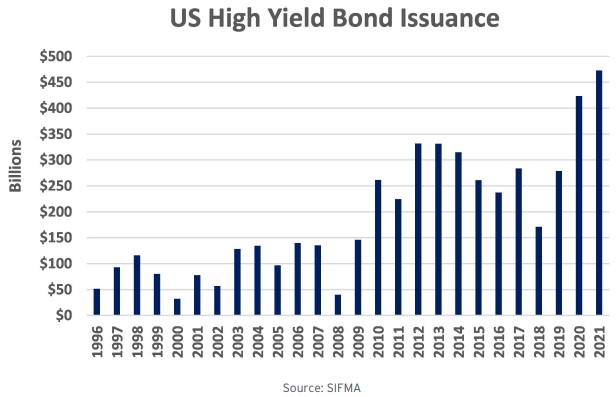

From a lower-rated issuer’s point of view, it’s rational to take advantage of the artificially permissive rate environment by locking in low yields that wouldn’t otherwise be available. Through November, year-to-date HY bond issuance has surged to a record $473 billion, topping the $424 billion raised in 2020 (which itself smashed the previous record). For context, new HY supply averaged just $270 billion from 2010-2019 and never exceeded $150b pre-GFC.

"We think inflation will peak and slowly cool down as supply chains heal and consumers shift their spending from goods to services."

Richard Saperstein, Chief Investment Officer, Treasury Partners

This is a prime example of an unintended consequence arising from the copious liquidity created by the Fed. It’s an uncomfortably familiar sign of the many potential “systemic risks” from growing borrower leverage, declining lending standards, and illiquid market structures.

Depending on economic activity, we’d expect to see large sudden swings in these markets. HY Index spreads (the difference between the yield on Treasuries and HY bonds), are currently approximately +370 basis points (+3.7%). Given that the index has averaged a roughly +550 bps spread since 1996, it’s not unreasonable to expect an uptick in volatility as Fed tightening commences. We’ll continue to largely avoid this asset class and keep our eyes wide open for broader implications from this canary in the coal mine.

A few weeks ago (see Reflections on 40 Years of Investing: Thoughts on Fixed Income’s Evolving Role, 12/6/21), we pondered whether the Fed (and other global central banks) has trapped itself in the horns of a dilemma. If rates quickly rise, do the resulting higher debt service costs and receding liquidity threaten to smother economic growth? Would the Fed accept this ‘free market’ risk (and the resulting selloffs) or would they instead pull back on tightening, bolstering markets at the price of damaging their credibility and deepening the economy’s addiction to monetary stimulus? Only time will ultimately tell, but with hindsight it’s clear that the GFC ushered in an era of increased moral hazard for financial markets.

The broad investment environment will likely become more complex in 2022. The greatest near-term threat is the potential for a Fed policy error as they ‘pull away the punch bowl’ of liquidity. The start of a Fed tightening cycle is a fundamental change, reverberating across asset classes with impacts whose direction and magnitude are surprisingly difficult to predict. Depending on a wide range of factors, markets could react to policy normalization either positively or negatively.

We’re maintaining full equity allocations, including our longstanding (and thus far very successful)overweight of US vs. international equities. The domestic outperformance has been so long and pronounced that it’s caused US stocks ‘to punch above their weight’. According to GaveKal Research, the US accounts for approximately 24% of the world’s annual economic output (global GDP is nearly $90 trillion). The world’s aggregated equity markets are valued at approximately $100 trillion, with US markets representing approximately half of the total, or $50 trillion. In short, American stocks are valued at half of global market capitalization but only generate a quarter of the world’s underlying fundamental economic activity.

Since we initiated this extreme US equity overweight immediately following the Great Financial Crisis, we’ve regularly heard the same arguments that US outperformance is ‘unsustainable,’ that the far-less expensive international equities are destined to surge. We agree that American stocks are more expensive but that’s no reason to expect relative underperformance. Fundamentals matter, and we believe the root causes for the ‘imbalance’ lie in several critical US advantages including: a single monetary/fiscal regime, the dollar remaining the global reserve currency, a disproportionately large Growth/Tech sector, and a more business-friendly environment. Of course, we continue to monitor the landscape for knowledge that would change our thinking.

As the post-pandemic recovery progresses, we also expect Goods-related sectors to hand the outperformance baton over to Services-related sectors. Americans will increasingly shift their consumption patterns away from the physical things we were limited to buying during Covid (e.g. the new storage shed next to my vegetable garden), and instead steer the spending towards long-foregone experiences. As this transition takes place, it should also help cool down inflation; voracious consumer demand for goods disproportionately contributes to the forces driving currently high inflation readings. To the extent that goods-related demand moderates, overburdened supply chains will begin to heal and many of the most eye-popping price increases (such as those for used autos) should also fade.

We’re also ‘status quo’ in our existing overweight of Growth vs Value. In Alert: Fed Tapering is Coming Avoid Zero Cash-Flow Stocks and Bonds (10/14/21), we pointed out that the assets primed to suffer the most in rising rate environments are those with the furthest-off and most uncertain cashflows – what we term zero cash flow bonds and equities:

Our view hasn’t changed in the past couple of months –these types of securities are still squarely in the firing line and have already been badly stung by mild upticks in rates.

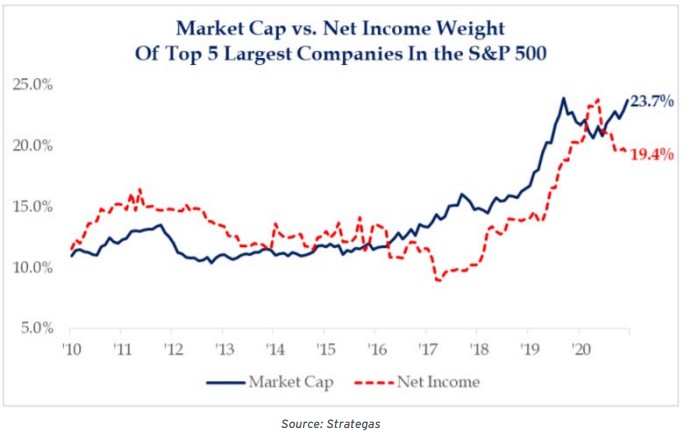

Instead, we remain focused on large-cap Growth companies that consistently generate high levels of free cash flow. While the small club of ‘mega-cap’ names have already enjoyed an astoundingly strong multi-year run of outperformance, their gigantic market caps aren’t wildly disproportionate to their share of the index’s overall earnings. Further, as net flows into passively managed index funds continue to surge, the largest companies continue to automatically capture the lion’s share of new money (in the capitalization-weighted S&P 500, the bigger your initial weighting, the bigger your allocation).

We’d like to thank you for the trust and confidence you’ve placed in us and look forward to continued dialogue in the new year. Our best wishes to you and your family for a wonderful holiday season and a happy, healthy and peaceful New Year.

Treasury Partners is a group of investment professionals registered with Hightower Securities, LLC, member FINRA and SIPC, and with Hightower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through Hightower Securities, LLC; advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past perfor - mance is not indicative of current or future performance and is not a guarantee. The investment opportunities referenced herein may not be suitable for all investors. Yield and market values will fluctuate with changes in market conditions. Prices and availability are subject to market conditions. Projected cash flows will change as bonds mature. Some bonds may be called prior to maturity. The investment return and principal value of an investment security will fluctuate with market conditions so that, when redeemed, the value of the investment may be worth more or less than the original cost. The information herein has been obtained from sources considered to be reliable, but the accuracy of which cannot be guaranteed. Municipal bonds are subject to risks related to litigation, legislation, political changes, local business or economic conditions, conditions in underlying sectors, bankruptcy or other changes in the financial condition of the issuer, and/or the discontinuance of the taxation supporting the project or assets or the inability to collect revenues for the project or from the assets. They are also subject to credit risk, interest rate risk, call risk, lease obligations and tax risk. The market for municipal bonds may be less liquid than for taxable bonds. Income from some municipal bonds may be subject to the federal alternative minimum tax (AMT) for certain investors. Investing involves risk, including possible loss of principal. All data and information reference herein are from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other information contained in this research is provided as general market commentary, it does not constitute investment advice. Treasury Partners and Hightower shall not in any way be liable for claims, and make no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information, or for statements or errors contained in or omissions from the obtained data and information referenced herein. The data and information are provided as of the date referenced. Such data and information are subject to change without notice. This document was created for informational purposes only; the opinions expressed are solely those of Treasury Partners and do not represent those of Hightower Advisors, LLC, or any of its affiliates.