One often overlooked task in each investor's investment journey is continuously monitoring overall asset allocation. Not only does this inform investment sizing, but it also enables portfolios to keep up with a constantly changing investment climate. One specific asset allocation theme investors should consider is the elimination of small and mid-cap equity exposure. We outline our rationale below.

In the period from 2010 to 2019, small and mid-cap ("SMID") equities largely performed in-line with large caps and acted as a positive diversifying influence on portfolios. However, since 2020, that positive contribution has eroded as SMID continuously underperformed. Since the start of the current bull market in 2023, that underperformance gap has only widened further.

We have identified several possible reasons including:

While some of these observations are circumstantial, we believe their cumulative impact is crystallizing into the very clear performance divergence we're seeing between SMID and large-cap stocks. And having observed markets for many decades, we aren't seeing the formation of any of the usual catalysts (other than valuation) which might reverse these trends.

Although SMID has performed relatively well recently (e.g. Russell 2000 is up +12.0% in the last three months through last Friday versus the S&P 500 up +9.7%, figures rounded), this is likely due to the valuation gap and expectation for Fed Funds rate cuts. Cuts would marginally benefit smaller companies more than large (via somewhat lower near-term borrowing costs, due to their floating rate leverage).

Concern around potential tax consequences is a very common refrain we hear when we propose asset allocation shifts, especially when selling a portfolio with large, embedded capital gains.

Here's a relevant example, while making some simplifying assumptions: Betty, a long-term investor, is contemplating the sale of a $1mm portfolio of SMID stocks with a $500k cost basis. That sale would generate a $500k capital gain, in turn requiring a $100k Federal tax payment (all figures approximate). No one likes seeing that large a tax bill - but the key here is that Betty receives ~$900k of net proceeds to reinvest into other (potentially more attractive) opportunities.

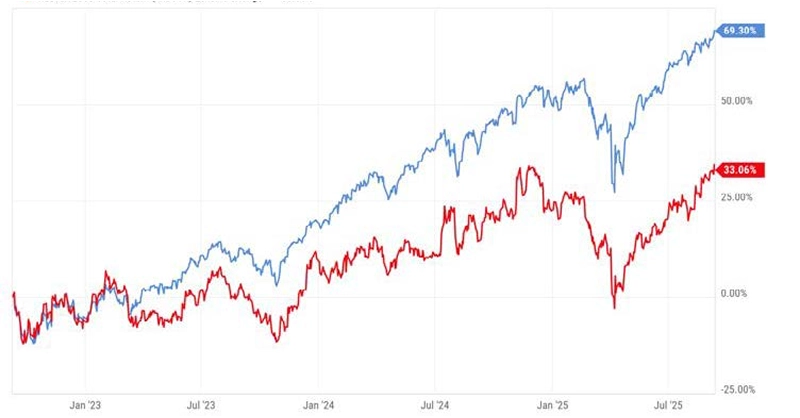

Measuring over the last three years from Friday's close, the S&P 500 produced a cumulative 69.3% total return; the Russell 2000 produced a cumulative 33.1%.

Had Betty's hypothetical $900k sale proceeds been invested in the S&P 500 over that same three year period, she'd have a cumulative portfolio value of $1.52mm; if instead she left the original $1mm in the Russell 2000, the result would have been $1.33mm. That difference of ~$190k is a significant 'missed opportunity' cost for having not made the asset allocation shift.

We believe that the performance differential between SMID and large-cap stocks will continue, and as a result, investors should strongly consider eliminating SMID exposure. Naturally as conditions change, we'll revisit our SMID allocations.