Over the past several years, Corporate America has embraced higher debt loads. Given the low yields available on corporate bonds, it’s an opportune time to consider the implications for corporate credit. Read on for our detailed thoughts.

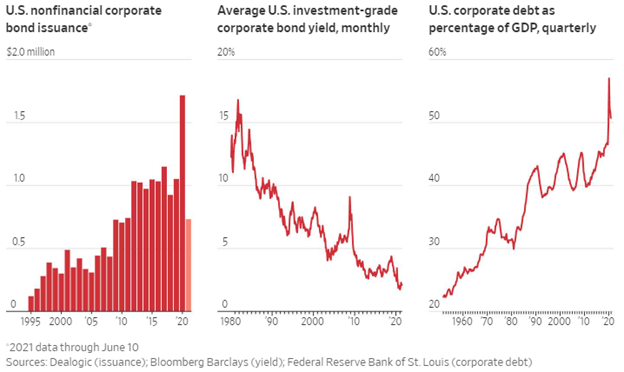

At first glance, the headline numbers are sobering. As borrowing costs plumb new depths, companies have taken full advantage of the opportunity to secure cheap financing. Last year (2020) saw an unprecedented explosion of new issuance, as nonfinancial corporations eager to add to their cash cushions sold over $1.7 trillion of new bonds. By the Fed’s count, total outstanding US corporate bonded debt now stands at over $11 trillion – approximately 50% of GDP, a significant spike over just a few years.

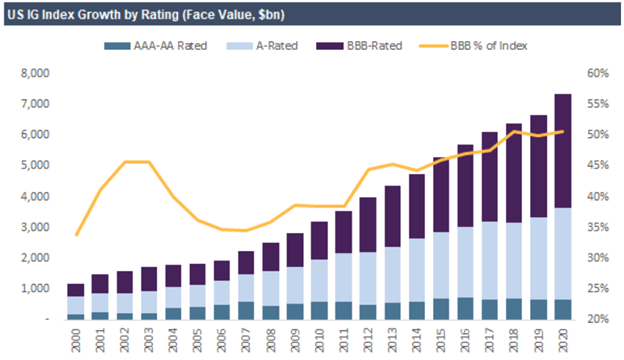

Thus far the consequences have been limited to a deterioration in overall corporate credit quality. Within the Investment Grade (“IG”) universe, over 50% of outstanding debt is rated in the BBB range. This isn’t totally unprecedented; in 2002-2003 the proportion of BBBs came close to 50% as businesses suffered through the aftermath of the dotcom-bubble’s bursting.

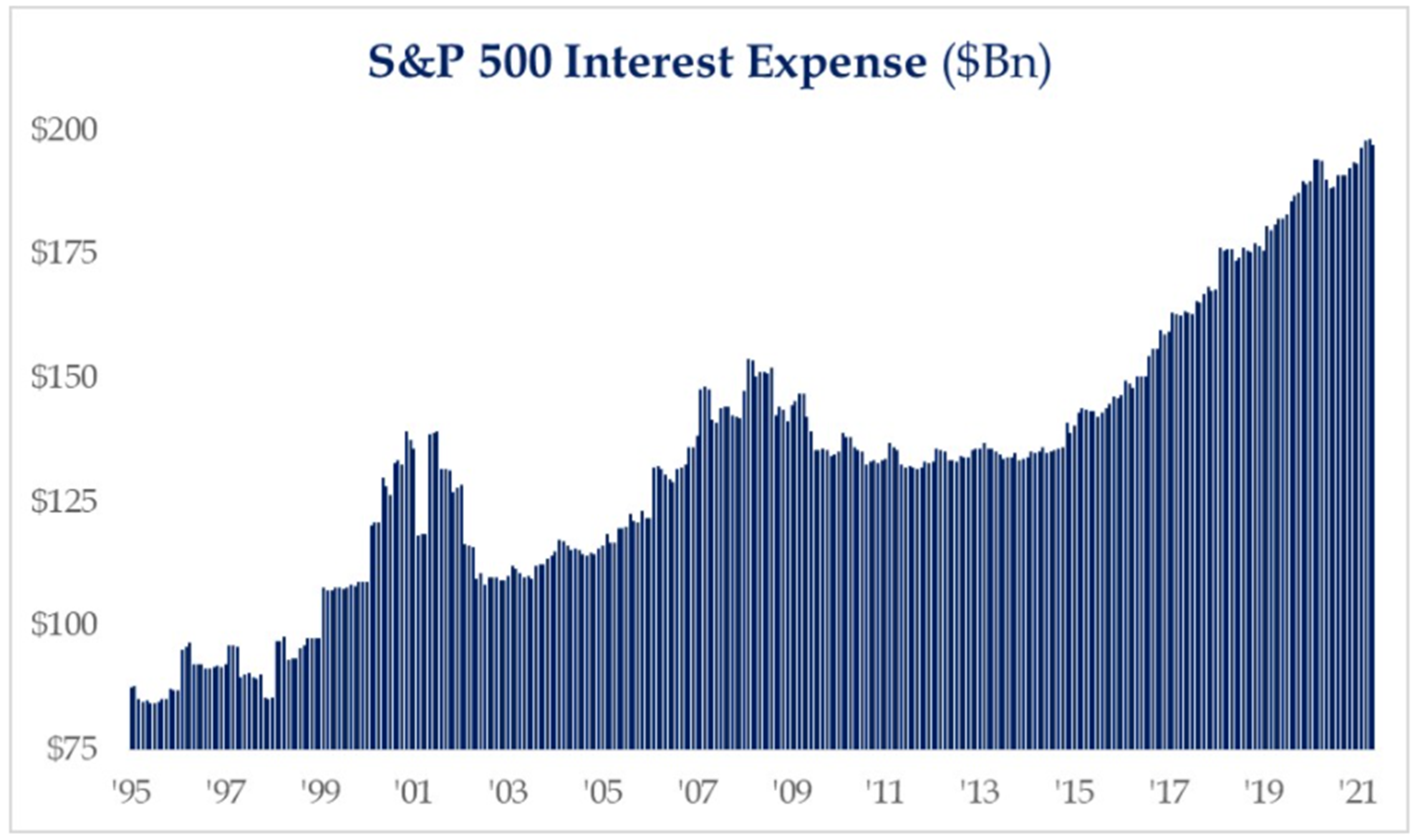

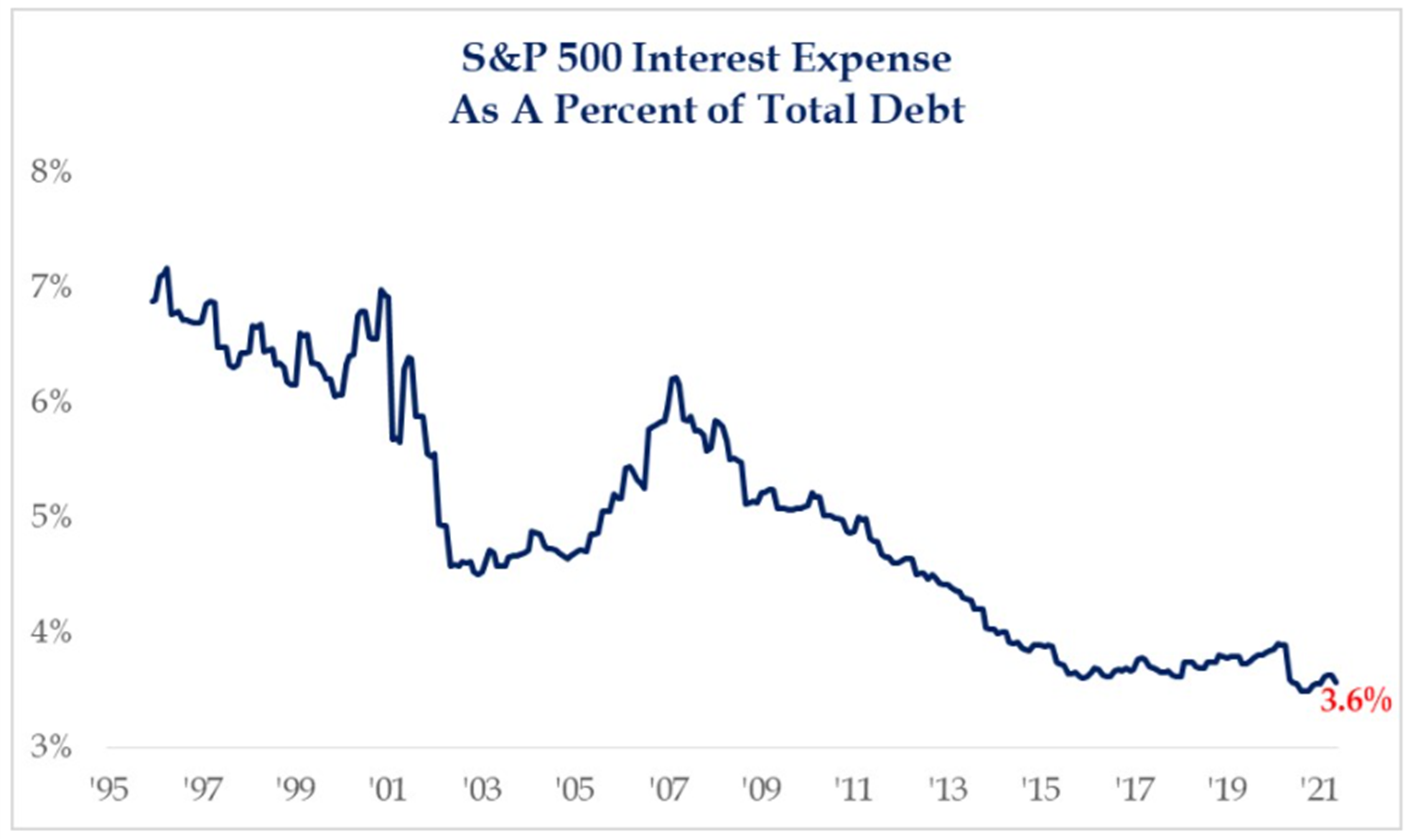

The decline in aggregate corporate credit is supported by fundamentals. Balance sheets have undoubtedly levered up, and interest payouts now consume more absolute dollars than ever.

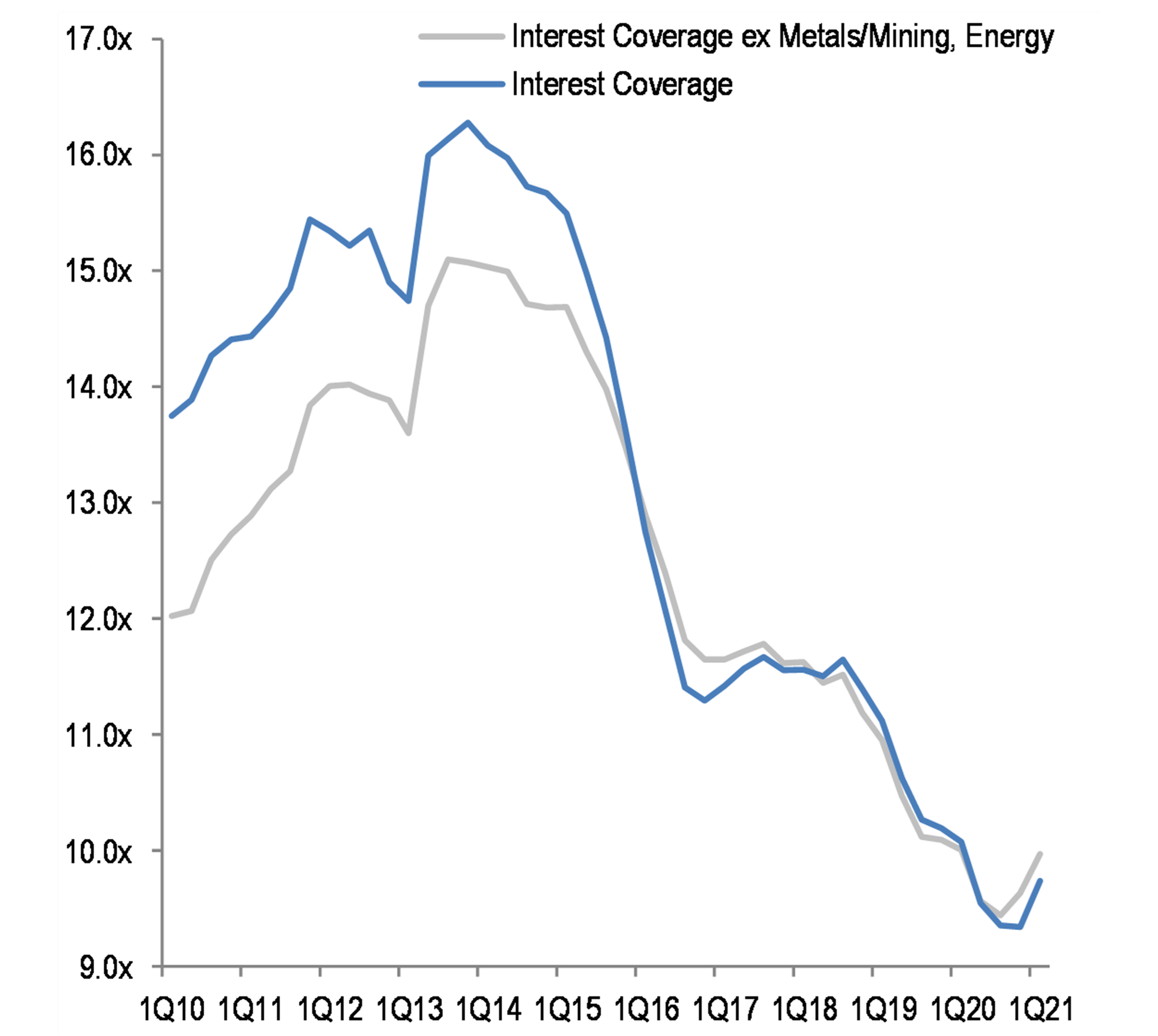

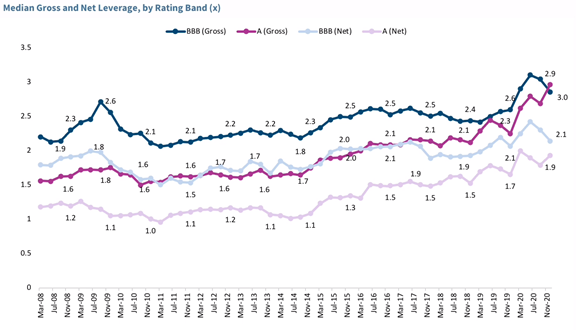

Naturally, interest coverage ratios have also declined (albeit stabilized at still-strong levels).

But context is key – companies have taken on more debt because the cost of capital is astoundingly cheap, near generational lows. Although some of the borrowing has benefitted equity investors, (e.g. funding stock buybacks), much of the proceeds have simply refinanced higher-cost debt or funded traditional productive uses such as capex and acquisitions.

It’s not just a function of ultra-low borrowing rates. Profit margins for IG corporates have steadily risen over the past several years, benefitting from the combined tailwinds of the pre-pandemic economic expansion, 2017’s tax cuts, and remarkable resilience in navigating the COVID shock. Robust profits help offset higher debt burdens by keeping interest coverage metrics healthy.

With rates and spreads at historic lows, issuing debt as a means to raise cash reserves also made sense (especially given the pandemic uncertainties). This widespread practice is visible in net leverage metrics remaining well below gross leverage. With COVID now giving way to a roaring new economic expansion, companies can instead look to productively deploy idle cash.

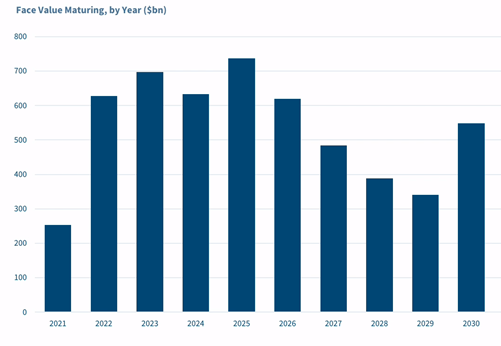

Looking at the principal amounts scheduled to come due in each year, there’s no wall of maturities looming on the horizon. Most of the newly issued debt was structured as 3-5+ year maturities, giving companies a long runway to plan for eventual refinancing or paydown.

Companies are indeed more indebted, lower rated, and paying out more absolute dollars for interest payments. But interest coverage remains comfortable, profits margins are plump, and Corporate America is flush with cash as a booming recovery unfolds. Moreover, borrowing costs are very likely to remain low for an extended period.

Thus far, the benefits of this debt binge have been one-sided. More debt at lower rates is a great benefit for issuers but not necessarily for investors. From an investor’s perspective, credit risks are somewhat higher than in prior periods, and accepting those risks carries lower rewards in today’s yield-suppressed market.

However, corporate debt still offers enhanced relative value vs. government-only paper. Every basis point makes a difference, and the spreads offered on front-end corporate bonds (however tight compared to historical norms) are a welcome pickup that could enhance corporate cash returns.

As a result, we’ll continue buying corporate bonds in a diversified portfolio of issuers that are wellpositioned to weather economic downturns. Our eyes remain wide open as to the merits of corporate bond investing in this ultra-low rate environment. Now more than ever, careful vigilance and constant credit monitoring are essential to distinguish between today’s cheap “opportunity” from tomorrow’s expensive “headache.” We’ve spent decades and many market cycles honing our conservative stance in evaluating issuers and spreads, and we’ll keep leaning on those insights to navigate these challenging times.

For over 37 years, corporations, high-net-worth individuals, family offices, trusts, foundations and endowments have sought our help to construct diversified portfolios positioned to perform throughout market cycles. Among other industr y recognitions, Barron’s has ranked us in the top tier on its annual listing of “America’s Top 100 Financial Advisors” ever y year since the sur vey was introduced in 2004.

Speak with Our Barron’s Top-R anked Team Today.

Treasury Partners is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is neither indicative nor a guarantee of future results. The investment opportunities referenced herein may not be suitable for all investors. All data or other information referenced herein is from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other data or information contained in this presentation is provided as general market commentary and does not constitute investment advice. Treasury Partners and Hightower Advisors, LLC or any of its affiliates make no representations or warranties express or implied as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Treasury Partners and Hightower Advisors, LLC assume no liability for any action made or taken in reliance on or relating in any way to this information. The information is provided as of the date referenced in the document. Such data and other information are subject to change without notice. This document was created for informational purposes only; the opinions expressed herein are solely those of the author(s) and do not represent those of Hightower Advisors, LLC, or any of its affiliates.