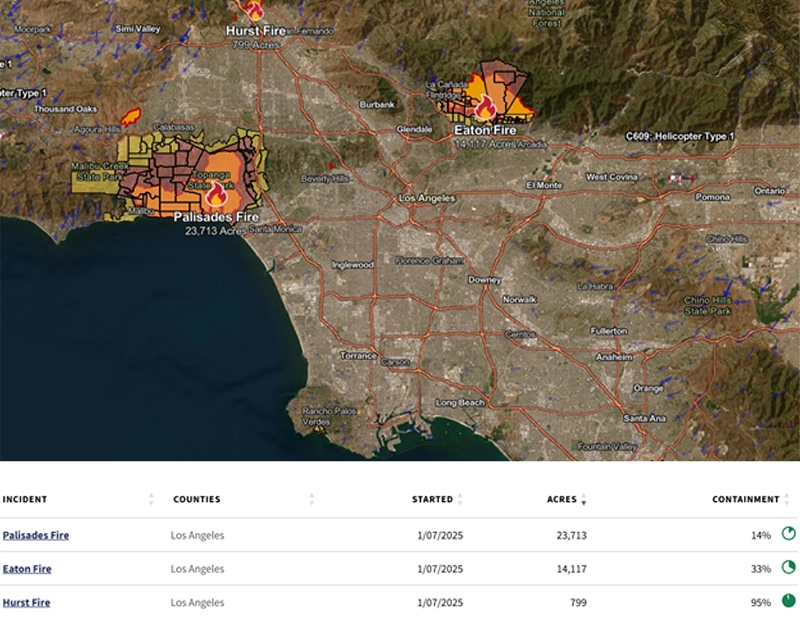

Last week, several major wildfires ignited and began sweeping through parts of the Greater Los Angeles metro area. Tens of thousands of residents have been forced to evacuate ahead of entire neighborhoods being totally destroyed by the rapidly spreading infernos. As we write this Alert, the disaster is still far from over: most wildfires are still ongoing, and dangerous wind conditions (which help fan the flames) are forecast to continue complicating firefighters' efforts to contain the spread.

Our thoughts and prayers are with those suffering from this tragedy. To support the disaster recovery efforts, Hightower Advisors will be making donations to the American Red Cross, World Central Kitchen, and Los Angeles Fire Department (LAFD) Foundation.

A number of bond portfolios managed by Treasury Partners hold municipal debt backed by various Los Angeles-area issuers, with the majority of these exposures clustered in the accounts of California-based clients. To the best of our knowledge, at this point we don't believe any of our holdings have suffered major wildfire damage, nor are any under imminent threat. As this remains an evolving situation, rest assured that we continue to carefully monitor our holdings to assess any adverse impacts.

In the medium to long term, we believe our holdings will maintain the strong credit characteristics they featured before these heartbreaking events. Our LA-area exposures are predominantly concentrated in the general obligation debt of local public school districts (which are secured by dedicated property tax revenues) and the revenues of various critical public service enterprises (e.g. Los Angeles International Airport and the Los Angeles Department of Water and Power).

We have high confidence that Los Angeles will largely rebuild and remain one the largest and most economically vibrant cities in the nation, which supports the continued essentiality and preservation of such indispensable public services.

Furthermore, while our fundamental analysis doesn't depend on it, we're mindful of the many longstanding historical precedents our federal government has set in previous major national disasters. History has shown that our country doesn't abandon its citizens in times of crisis, and in similar situations the magnitude of federal support and financial assistance for recovery and rebuilding efforts has typically been extensive. Although nothing is guaranteed, we also have no reason to believe this time will prove to be materially different.

These unfortunate events help illustrate a key tenet of our portfolio management philosophy. As investors, our primary duty is to assess and manage the tradeoff between risk vs. reward. One of our core principles for structuring tax-sensitive bond portfolios is to limit in-state municipal bond concentrations, even at the cost of potentially sacrificing a small degree of state tax advantage.

As a reminder: while most municipal bonds are exempt from federal taxes, munis issued in the same state in which the account beneficiary qualifies as a resident (and incurs a state tax liability) are generally also exempt from state and local taxes. Said differently - all else equal, the after-tax yields on municipal bonds from an investor's 'home state' are usually higher than those from another state. The value of the state tax exemption is positively correlated with the level of tax rates: there’s no benefit for a Florida or Texas resident to stick with in-state munis (as there’s no state tax at all), while investors in relatively high-tax New York, New Jersey, and California have a material incentive to prioritize in-state bonds. We're always mindful of the math, and acknowledge that sticking to in-state bonds and saving an extra 7-13%* in state and local taxes provides compelling additional income for affected clients.

But we also live in an imperfect and risky world: bad things can and will happen, with varying magnitudes and at unpredictable frequencies. The most important tool an investor can employ to mitigate exposure is to diversify holdings across a broad range of factors such as issuers, credit characteristics, maturities, and location. There's a world of difference between constructing portfolios that are mostly vs. exclusively (or almost exclusively) concentrated in a single state. To us, the latter doesn't exemplify prudent risk management – that’s allowing the tail to wag the dog.

*At the time of writing, the following top marginal state tax rates are in effect (according to Bloomberg): CT = 6.99%, NY = 10.9%, NJ = 10.75%, CA = 13.3%.

Consider this observation: although our fundamental outlook on the situation is cautiously optimistic (and we believe the broader municipal market shares this view), we're also currently seeing prices of bonds from several California issuers being (mildly) repriced lower. We're also seeing the rating agencies begin to take negative action. For example, on January 14th Standard & Poor's downgraded the ratings on the Los Angeles Department of Water and Power's electric revenue bonds 2 notches (from AA- to A), citing their "view of heightened potential for litigation, liabilities, and future costs" arising from wildfire-related impacts.

In the short-term these aren't necessarily illogical (or unprecedented) developments, and it exemplifies the reality that bonds are tradeable securities with dynamic prices that are subject to broader market forces. These market conditions will likely persist for some time, and an investor needing to unexpectedly tap liquidity from a fully California-based municipal bond portfolio now faces a headache that an investor with at least some national munis likely does not.

As always, please reach out to us if you have any questions.