The financial landscape has radically shifted in 2022. After more than a decade of ultra-low rates, the current environment presents an opportunity for corporate cash investors.

Before we discuss our views on portfolio positioning, we'll first recap the major credit developments within the corporate bond market. As you can see, there's a nuanced story behind the changes.

Any honest discussion of today's landscape must begin with the recent past. The preceding "ZIRP" (Zero Interest Rate Policy) era, despite being a historically unique anomaly, nevertheless persisted long enough to influence every corner of the financial markets. Corporate cash investors are all too aware of the results - artificially suppressed yields and credit spreads, forcing painful choices between (meager) rates of return and extension risk.

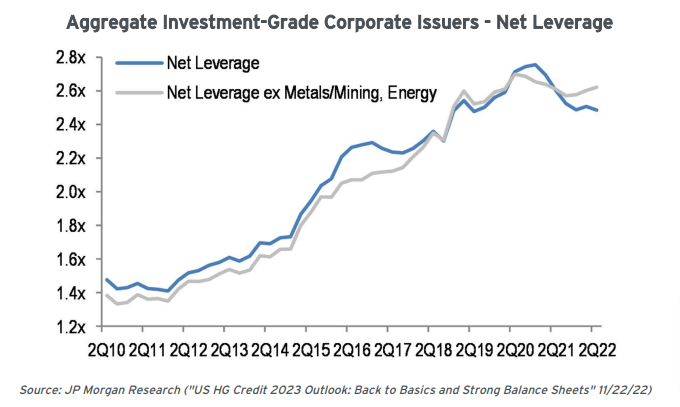

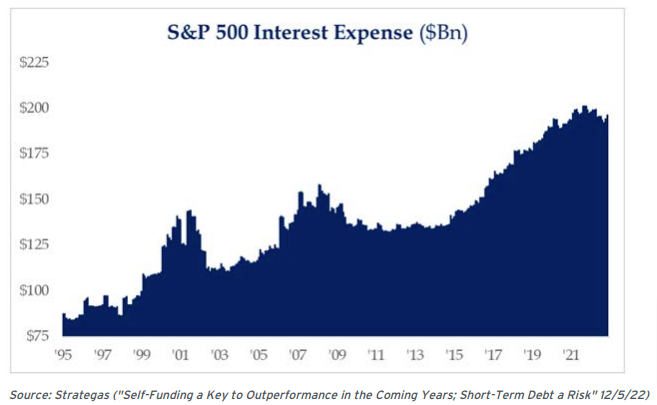

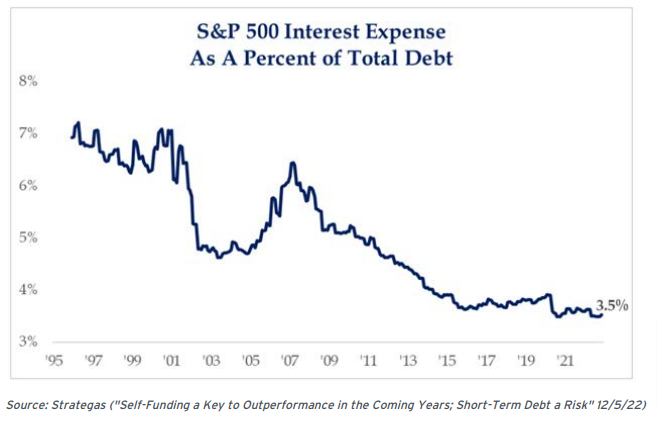

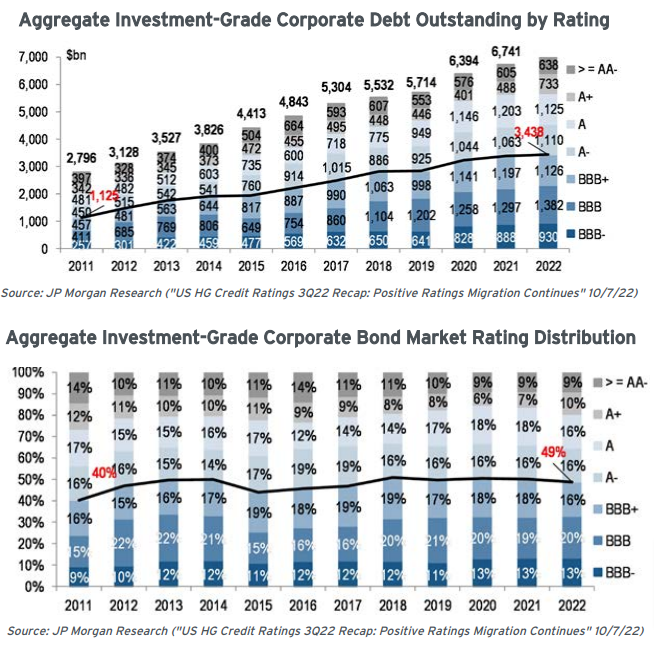

On the other side, corporate debt issuers contended with a market that began incentivizing actions that it had typically discouraged: increased debt loads, higher leverage, and lower credit ratings suddenly made little difference in the absolute cost of borrowing. Rational actors made prudent choices, and when presented with a low-consequence opportunity to increase leverage and loosen credit metrics, companies acted on it:

• Net leverage steadily increased throughout the last decade.

• Although interest expense grew to a new high in absolute dollar terms, it hit new all-time lows when measured relative to the amount of outstanding debt.

• Similarly, although the absolute amount of BBB-rated corporate debt reached new heights, the relative proportion of BBBs vs. the remainder of the IG universe has remained roughly constant for years.

Needless to say, times are different now. With Fed Funds over 4% and credit spreads noticeably wider, we are now undoubtably past the ZIRP era. Borrowing rates again resemble levels that would seem familiar in pre-2008 market environments, when "normal" conditions and economic relationships held.

Now that the ZIRP party is over, does that mean the hangover is coming? Not necessarily. With the obvious caveat that exceptions abound, the overall state of high-grade corporate credit remains robust:

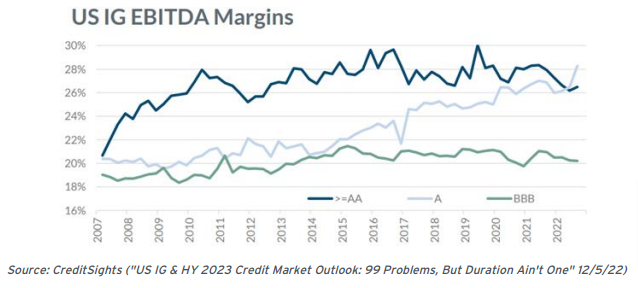

• Profit margins, although declining, remain very strong.

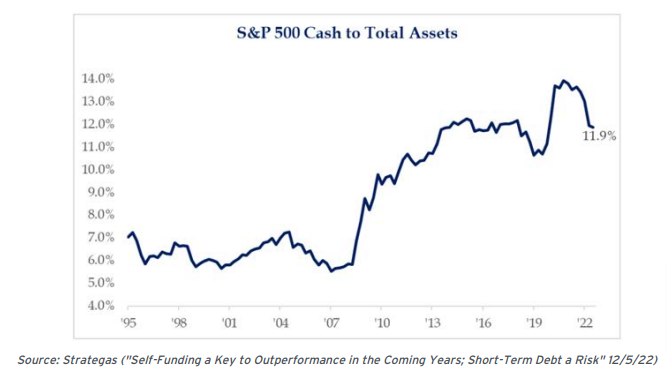

• Given those excellent profit margins, it's no surprise that balance sheet cash levels are healthy.

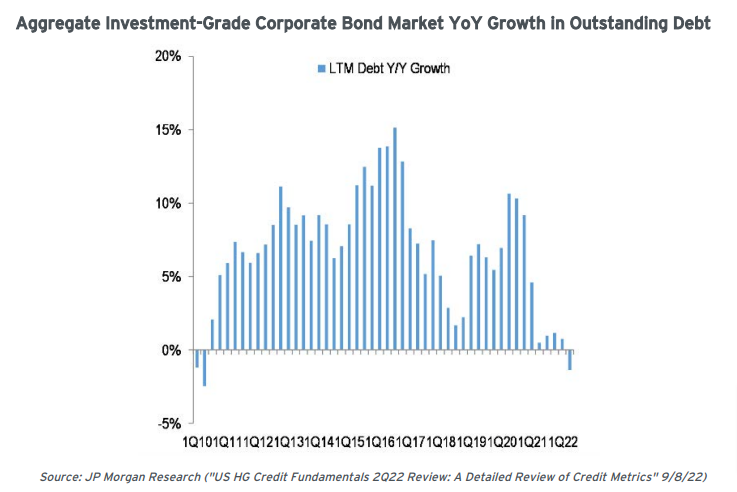

• Just as issuers acted logically in responding to the incentives of the ZIRP era, they are doing the same now that conditions have flipped. For example, now that leverage is no longer as cheap as it was previously, debt growth is turning negative.

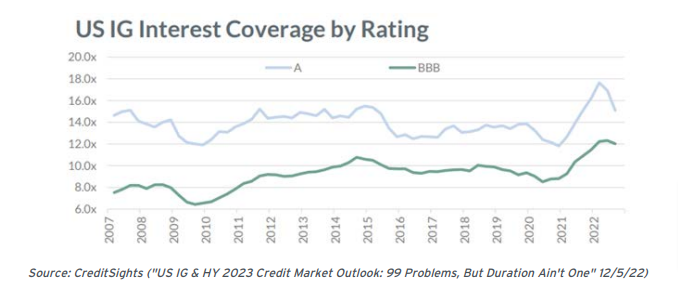

• Interest coverage on the remaining debt is still very high.

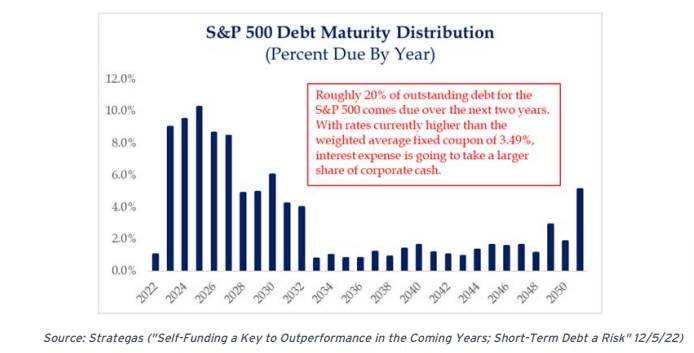

• Unlike the US federal government, during the ZIRP years corporate borrowers seized the opportunity to term out their debt maturities. While today's higher rates will slowly but surely filter into issuers' debt stacks, it will be a delayed process that provides plenty of time to adjust to the new reality.

Our investment strategy is clear; now that investors can achieve meaningfully higher returns than at any time over the last 15 years, we've been aggressively extending maturities. Specifically, we've been reinvesting maturities within client portfolios out to their maximum investment policy limits, subject to liquidity requirements, and will continue doing so as long as the Fed appears set to keep hiking. Let's unpack the rationale.

The Fed Funds rate is currently set in the 4.25-4.50% range and we believe further tightening is yet to come. Specifically, our expectation is that the Fed will tighten to at least 5.00% and maintain these levels at least through early 2024. However, rates typically move in advance of the Fed, both up and down, reacting to the implication of the data that will ultimately drive the Fed's future actions. At this advanced point in the hiking cycle (where many investors think we're close to reaching the apex), each additional tightening in the Fed Funds rate is no longer automatically accompanied by a lockstep increase in market interest rates.

For an illustrative example, look no further than the 2-Year Treasury's intraday trading moves around the week of the latest Fed tightening (a +50-bps hike on Weds, 12/14/22):

• Mon 12/12 began with the 2-Year Treasury yield trading close to 4.35%.

• On the morning of Tues 12/13, a below-consensus November CPI print reset investors' expectations about the pace of future Fed action, sending 2-Year yields 15 bps lower on the day.

• On Weds 12/14, a hawkish Fed hiked 50-bps and the 2-Year ended basically flat on the day, at a level slightly below the new 4.25% Fed Funds floor.

• Ultimately, the 2-Year ended the week even lower at 4.18% - nearly 20-bps lower than where it started.

Given our outlook, investors who extend maturities at current levels likely run the risk of the 2-Year Treasury moving another 50-bps higher. But while that would be painful, not all is lost - at today's absolute level of approximately 4.25%, the 2-Year Treasury (to continue the example) offers sufficient income protection to potentially offset potential unrealized price losses. As we've written before, don't discount the benefits of 'roll-down' protection: this time next year, investors who buy today's 4.25% 2- Year Treasury will instead be left holding a 1-year maturity with a 4.25% purchase yield. Although there's no guarantee that this seasoned position won't still price with an unrealized loss, this automatic 'rolling down the yield curve' offers some natural protection against such a possibility.

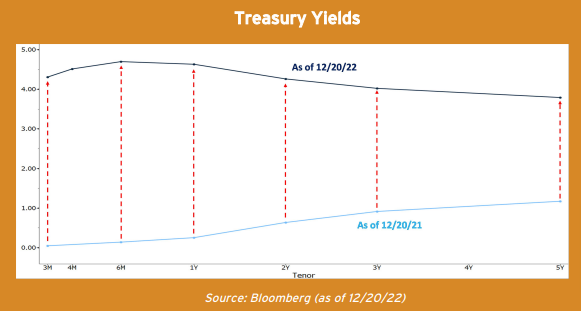

Finally, as readers know, we have experienced a parabolic move higher in short term rates.

In our experience of investing through forty years of market cycles, one of the most consistent patterns is that all parabolic moves (in this case, higher) eventually tend to get walked back (in this case, move lower). Stated differently, rates might tick higher - but once the bond market gets a whiff of imminent recession, rates will likely decline significantly, irrespective of Fed policy. It pays to take advantage of these absolute levels while they're still available.

As always, whether markets are calm or volatile, know that we're working hard to help you optimize your corporate cash portfolios. We're grateful for the trust and confidence you continue to place in us and thank you for your continued support.

Our best wishes for a wonderful holiday season and, and we look forward to partnering with you once more in 2023 and beyond.

Treasury Partners is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is neither indicative nor a guarantee of future results. The investment opportunities referenced herein may not be suitable for all investors. All data or other information referenced herein is from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other data or information contained in this presentation is provided as general market commentary and does not constitute investment advice. Treasury Partners and Hightower Advisors, LLC or any of its affiliates make no representations or warranties express or implied as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. Treasury Partners and Hightower Advisors, LLC assume no liability for any action made or taken in reliance on or relating in any way to this information. The information is provided as of the date referenced in the document. Such data and other information are subject to change without notice. This document was created for informational purposes only; the opinions expressed herein are solely those of the author(s) and do not represent those of Hightower Advisors, LLC, or any of its affiliates.