As we reach 2023's halfway point, the underlying economic fundamentals are deteriorating.

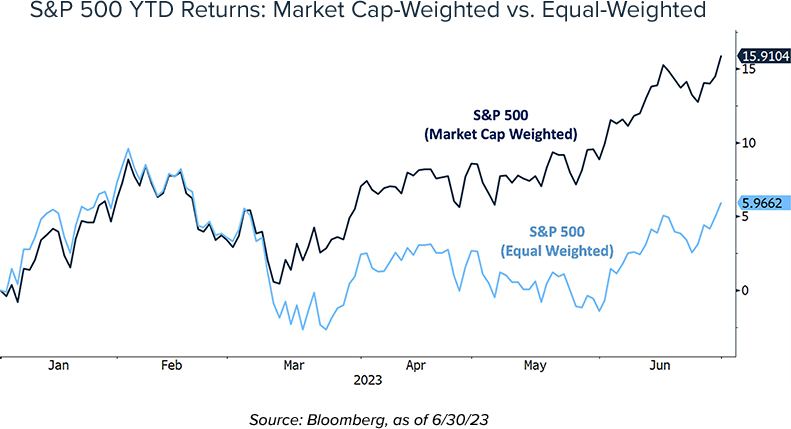

Equities seem unconcerned, trading at prices that reflect a suspiciously rosy outlook. The S&P 500's price return is up 16% YTD, clawing back to approximately 7% of the all-time peak. Moreover, its P/E ratio is already elevated, and on the back of what we view as inflated EPS expectations to boot. This high starting point provides little in the way of air cover for potential earnings declines as fundamental weakness sets in (more on this later).

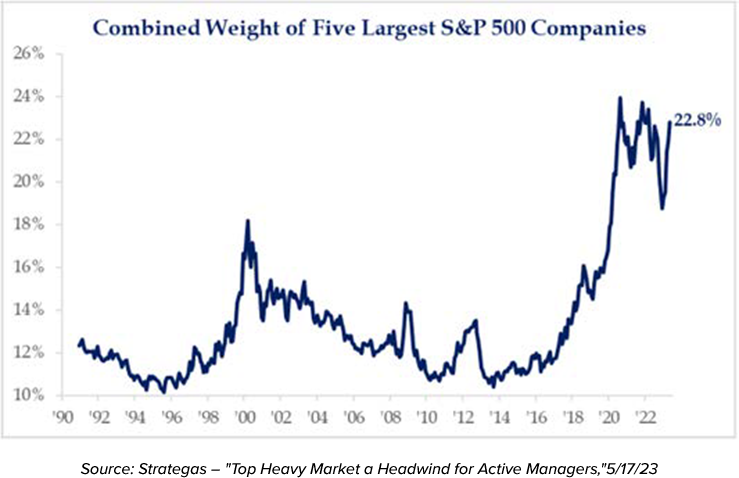

However, there's significant divergence in the components underlying these headline numbers. Note that the 5 largest companies in the S&P 500 (all tech-oriented growth firms) together make up nearly a quarter of the index's value.

While these large-cap tech companies have propped up the capitalization-weighted index, the equal-weighted S&P 500 has noticeably lagged its better-known market-cap weighted cousin. It's also the cause behind the relatively anemic performance of the industrials-dominated Dow Jones Industrial Average (up less than 4% YTD). Consistent with our longstanding thinking, the mega-cap tech names continue to shine because of their persistent fundamental strengths: proven business models, staggering cashflow-generating capabilities, and formidable competitive moats.

Meanwhile, fixed income markets have experienced continued volatility. Short-term rates recently retraced a Q1 2023 rally to end up near their 2022 highs. The 10 Year Treasury yield, however, saw more subdued changes before finishing almost unchanged from where it began the year (still clearly near the upper end of its post-2008 Great Financial Crisis trading range). Finally, the yield curve remains inverted, meaning near-term rates are higher than long-end rates. However, this unusual situation hasn’t stopped us from uncovering attractive long-dated bonds.

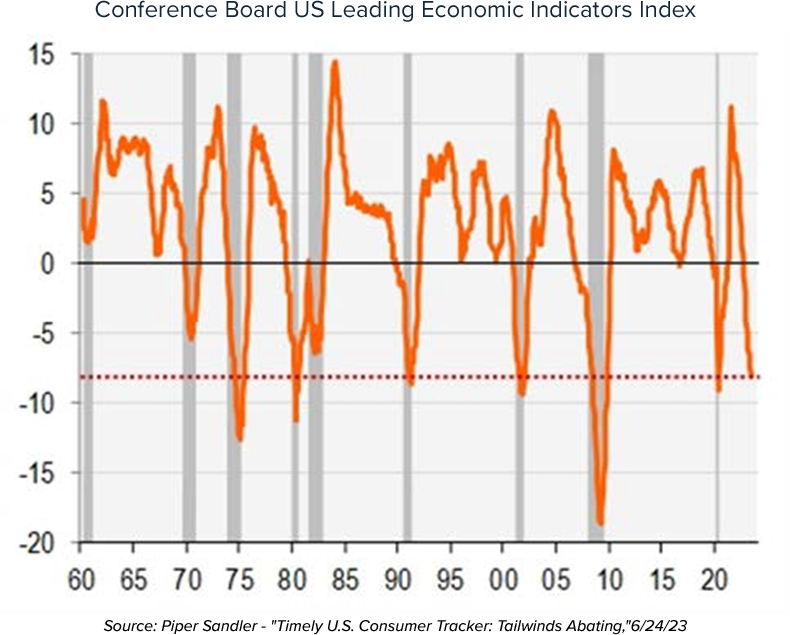

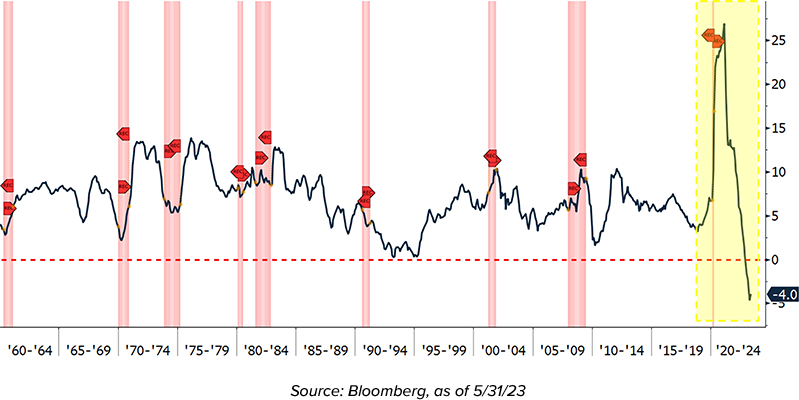

We believe the economy is showing unmistakable signs of slowing. Most leading economic indicators (LEIs) are already in negative territory, historically an excellent predictor of near-term recession risk (Note: in all charts, grey/red shading indicates a recession).

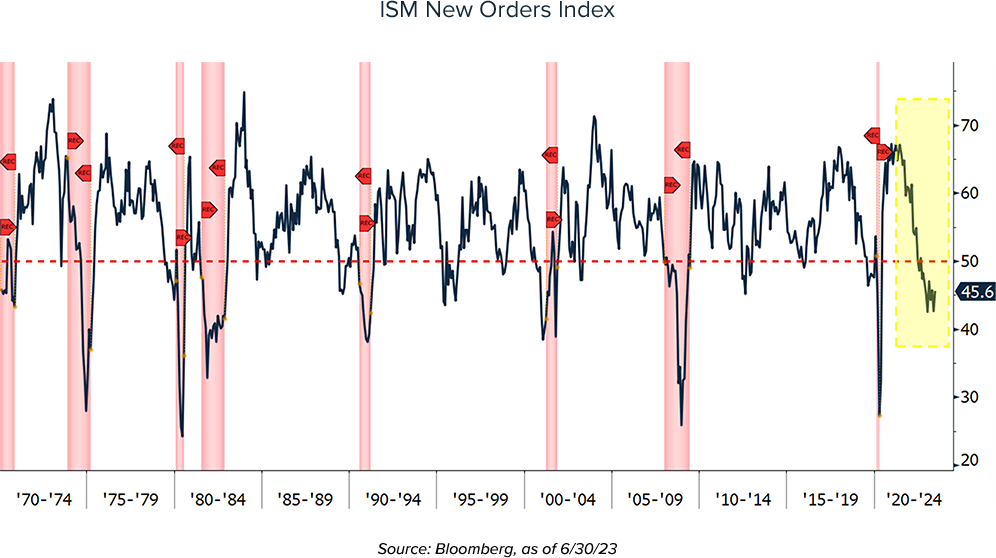

A granular look at the evidence reflects decelerating economic activity. For example, the ISM New Orders index measures the aggregate behavior of purchasing managers across industries. Figures above 50 signal expansion/increasing outlays; below 50, contraction/fewer purchases. The latest reads have been trending well below 50, indicating declining corporate spending.

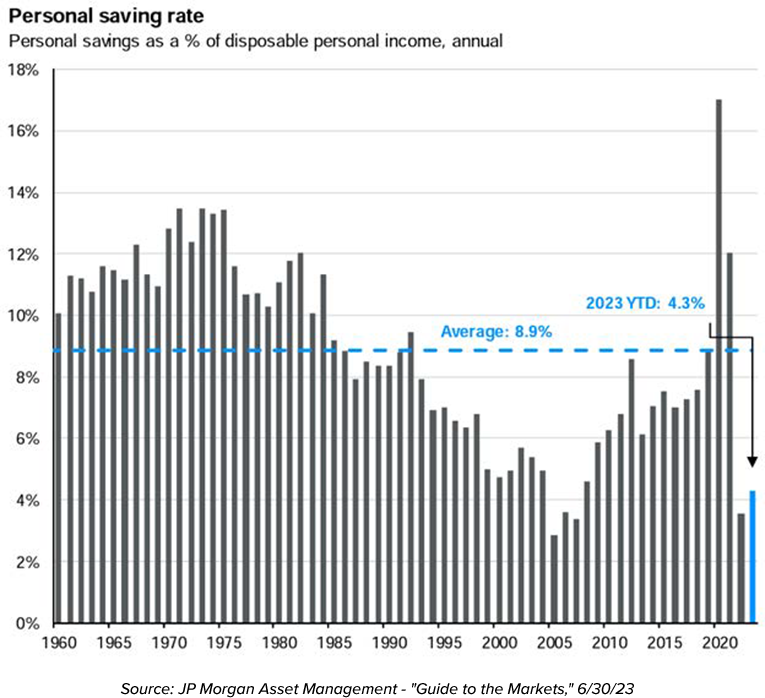

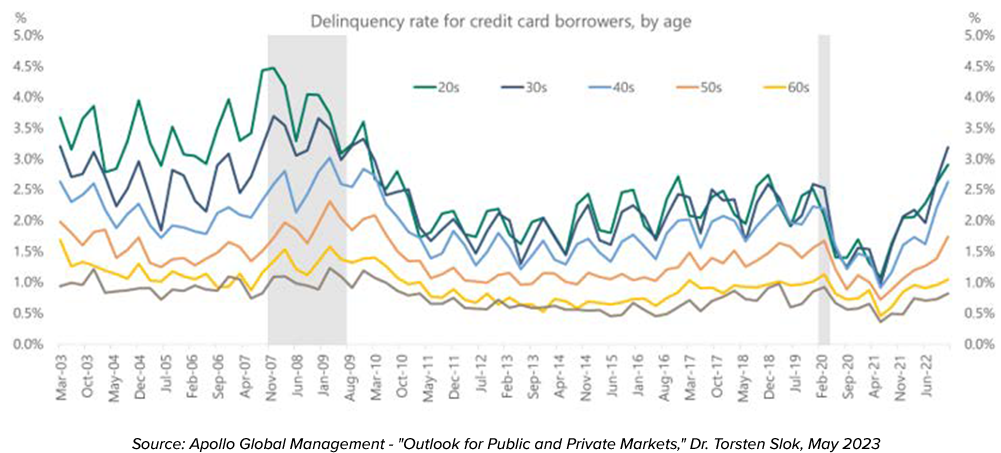

Other key datapoints indicate the health of the consumer, the engine that powers the American economy, has weakened – personal savings rates are down sharply while credit card delinquencies are spiking higher.

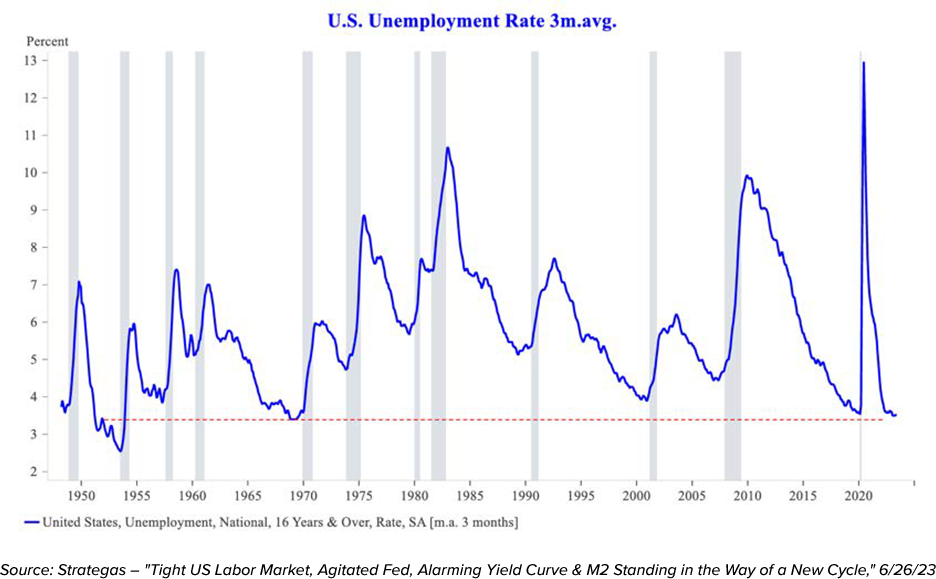

A still-robust labor market is essentially the 'last datapoint standing', but employment figures are typically lagging or coincident indicators (and thus don’t have much predictive value).

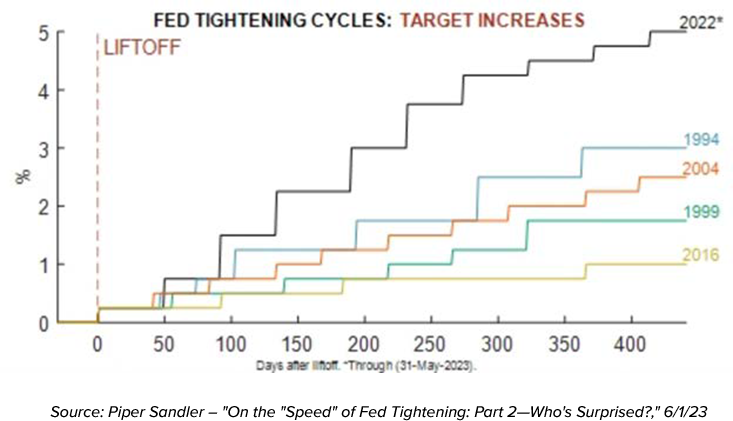

It all traces back to the fact that the Fed is in the midst of the most aggressive hiking cycle in a generation. We expect continued economic weakness going forward as the farreaching effects of monetary tightening works its way through the system.

We've gone from 15 years of supercharged easing to slamming on the brakes in what seems like the blink of an eye. After an historic COVID-related upward spike in M2 (a measure of the broad money supply), this year's decline is the most severe in the long history of that data series.

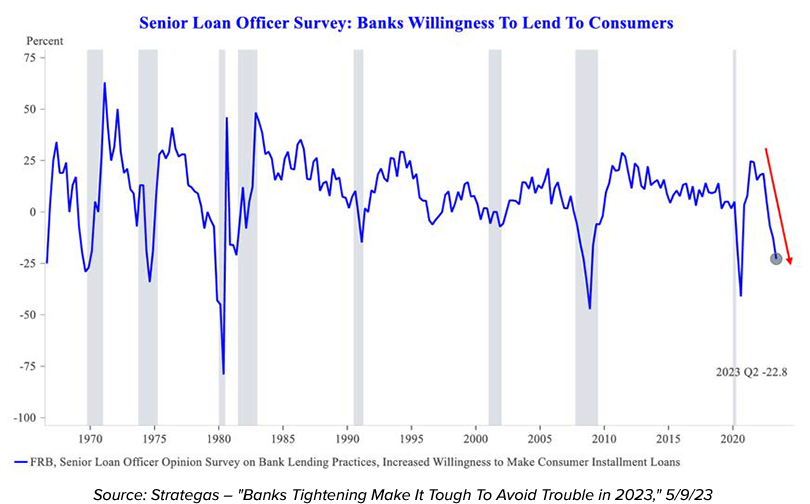

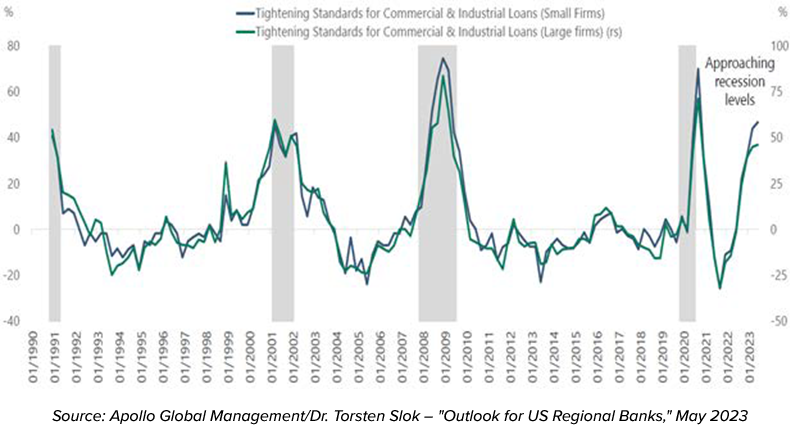

The ripple effects of tighter liquidity have already had significant impacts. The recent failures of 3 of the nation's 50 largest banks (First Republic, Silicon Valley, and Signature Bank) induced a mini-panic within the financial sector that's caused other banks to hike lending standards and restrict new loan originations. As a result, not only has the cost of borrowing increased (via higher Fed Funds), but both consumers and companies are having a harder time finding loans in the first place. It's effectively another form of tightening adding to the cumulative burden.

Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans

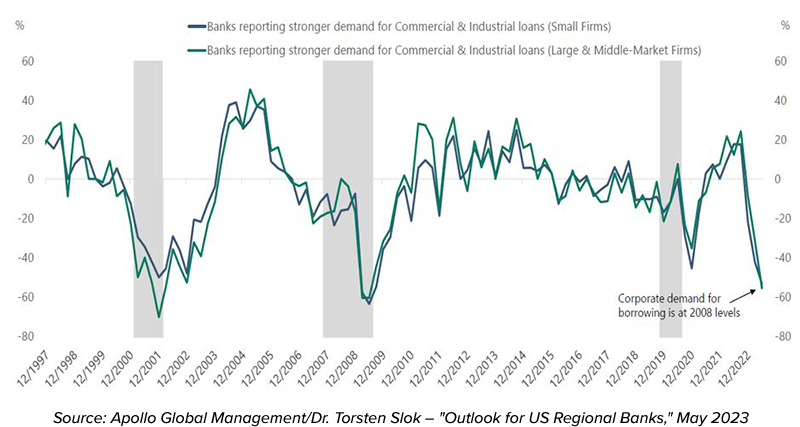

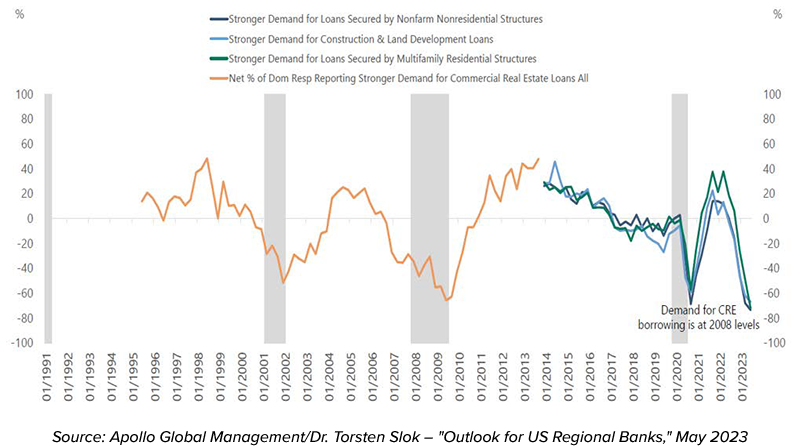

The philosophy behind how restrictive monetary policy helps cool inflation is bleak; tighter conditions are meant to restrain the circulation of money, which in turn reduces economic activity. There are mounting signs this chain of causation is slowly starting to take effect. For example, more expensive and onerous loan terms are driving down demand for new corporate borrowing (and, by extension, net new corporate spending).

Net Percentage of Domestic Banks Reporting Stronger Demand for Commercial and Industrial Loans

Net Percentage of Domestic Banks Reporting Stronger Demand for Commercial Real Estate Loans

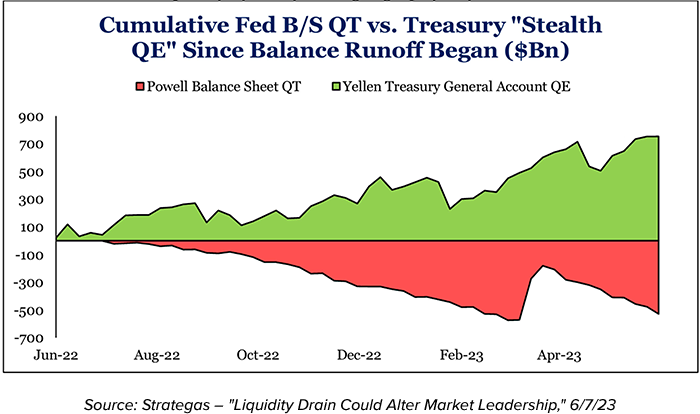

Importantly, the process of unwinding the prior 15 years of near-zero interest rates and Fed bond buying will take time, and we haven't yet felt the full impact of the tightening. In fact, the Fed's current Quantitative Tightening to date has been largely offset by the US Treasury's draining of the cash balance from its Treasury General Account (TGA). This acted as a counterbalancing form of Quantitative Easing, but with the debt ceiling now resolved, the TGA refill flipped to become yet another source of tightening (as Yellen's Treasury issues new debt to refill its depleted spending account).

Everything points in the same direction; economic activity is poised to weaken while liquidity and credit are becoming increasingly scarce. Historically, this combination of factors doesn't bode well for risk assets.

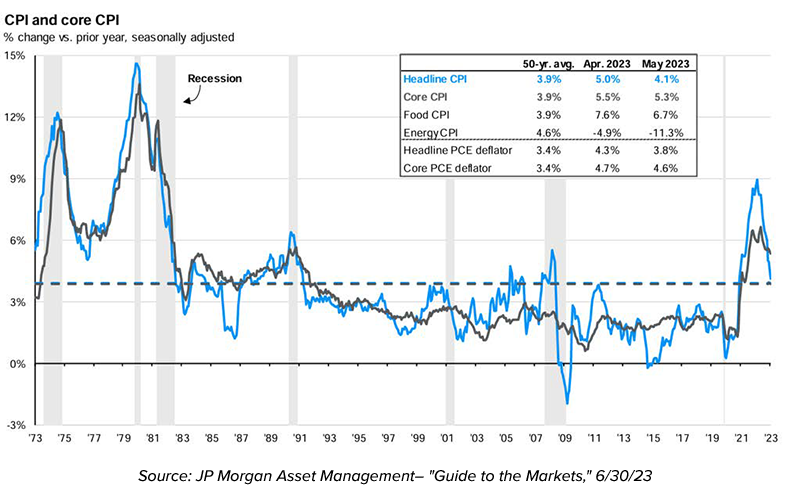

Inflation – the key driver for the Fed's tightening impulse - is trending lower, albeit at a sluggish pace. Although clearly far below its post-pandemic peak, it's nonetheless lingering at uncomfortably elevated levels well above their stated 2% target.

We anticipate the Fed will maintain an elevated funds rate until inflation drops below at least 3%. This will, in all likelihood, not be a quick process; accordingly, we don't anticipate any rate cuts in 2023.

One potentially unwelcome possibility we're monitoring is the simultaneous pairing of an economic slowdown with still high and sticky inflation. This 'stagflationary' scenario would force the Fed to explicitly choose between continuing the inflation fight or easing in an attempt to keep the economy afloat. Needless to say, slowing growth coupled with persistent inflation wouldn't be a constructive environment for equities.

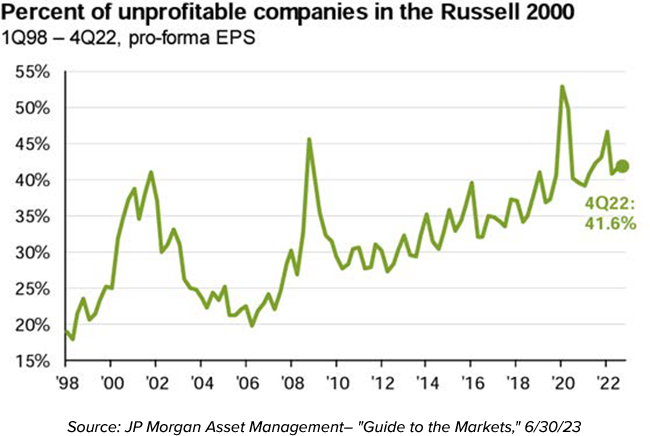

Tightening liquidity tends to disproportionately affect those areas of the market that benefitted most from the excesses of the preceding cheap-money environment. After a long era of extraordinarily easy money, one whose scope and scale was arguably unprecedented in modern history, odds are high that there are many such accumulated excesses prime to wash away with the receding tide of liquidity. For example, the fact that over 40% of companies within the Russell 2000 aren't profitable isn't 'normal'- is it reasonable to expect that to persist now that rates are 500 bps higher?

Color us doubtful. From our vantage point, it's seemingly impossible to go from near-zero rates, $4.5 trillion worth of QE, and $4.7 trillion worth of fiscal stimulus, to full reverse-liquidity thrusters without causing so much as a hiccup.

This has stark implications. History tells us the tightening process can lead to sudden and unexpected breakages and heightened volatility - for a great and timely illustration, look no further than the bank failures we recently experienced. Given that it’s likely there are other vulnerabilities looming in the fabric of today's markets, we're adjusting asset allocations and individual security holdings with an eye towards greater caution.

Our experience managing through past cycles, beginning with the Crash of 1987 (which was a doozy), it's time to exercise caution and have patience.

Far too much optimism is baked into current equity market expectations. Current S&P 500 2023 EPS estimates are approximately $218/share, just below 2022's full calendar-year level of $223/share. With slowing fundamentals after a whopping 500 basis points worth of Fed hikes, EPS expectations being barely off their highs is optimistic; we're skeptical. Slowdowns usually result in declining earnings and lower stock prices, because of both falling earnings and declining multiples. The S&P 500's average multiple at prior bear-market bottoms is just below 12x; we’re currently at 20.5x, a lofty level.

Accordingly, given our fundamental outlook we've reduced equity allocations under the belief that the current risk-reward offers below-average value. But underweight doesn't mean we're making wholesale reductions – we're trimming, not axing, the equity sleeves. Our focus remains on maintaining our clients' existing long-term exposures to high-quality, mostly domestic-focused growth companies with strong cash-generating capabilities.

One benefit of all the Fed tightening has been the very-welcome return of an investable bond market. To quote what we said 6 months ago: "A key reason we feel comfortable with reduced equity allocations is because the opportunity in fixed income remains compelling. Within bond portfolios, we're still focused on extending maturities and capturing today's elevated long-term rates." ("2022 Review and 2023 Outlook," 12/27/22). We continue to unearth attractive opportunities to lock-in bond yields for years to come.

For example, 10-year high-grade corporate bonds currently offer yields in the 5% range, while highly rated long-term municipal bonds are changing hands at tax-exempt yields of 3.75-4%+ (equivalent to a 7+% taxable return for full taxpayers). These are substantial income returns, and if the economy slows and rates decline - as we eventually expect - the prices of these bonds would increase (bond prices rise as rates fall, especially for longer-dated positions). This dynamic can also potentially provide protection to offset declining equity prices.

Despite our view that Fed cuts are unlikely this year (and, if anything, we see some additional tightening still to come), we expect the next significant move in longer term yields will be lower. A Fed that errs towards keeping rates elevated until inflation breaks could also impair the real economy, resulting in lower long-term rates. Again, this would benefit existing longdated bondholders via rising prices.

As always, we're grateful and honored by our clients' continued trust and confidence in our work. We wish everyone a relaxing and healthy summer. Feel free to reach out to us with any questions or comments.