Over the last three decades, one of our most consequential investment decisions has been to extend portfolio maturities vs. staying in shorter-dated positions. We most recently implemented and wrote about this strategy over the last six months (Corporate Cash Alert: Follow the Market, Not the Fed, 2/28/23, and What to Do Now?: Action Plan for the Worst Bond Market in 40+ Years, 10/20/22). At first glance, it seems an odd strategy given the inverted yield curve – what sense is there in tying up your money for a longer period for a lower yield?

It’s because time horizons matter. For those with well-defined short-term capital requirements– say, a corporate cash investor with a burn rate – very short-term bond ladders often make the most sense, as the priority is safety of principal and liquidity. But longer-term investors must consider reinvestment risk, or the uncertainty about what rates will be available when it’s time to roll over maturing principal payments. Putting it differently, today’s higher short-term yields might not seem like such a bargain compared to long-term yields if rates drop significantly.

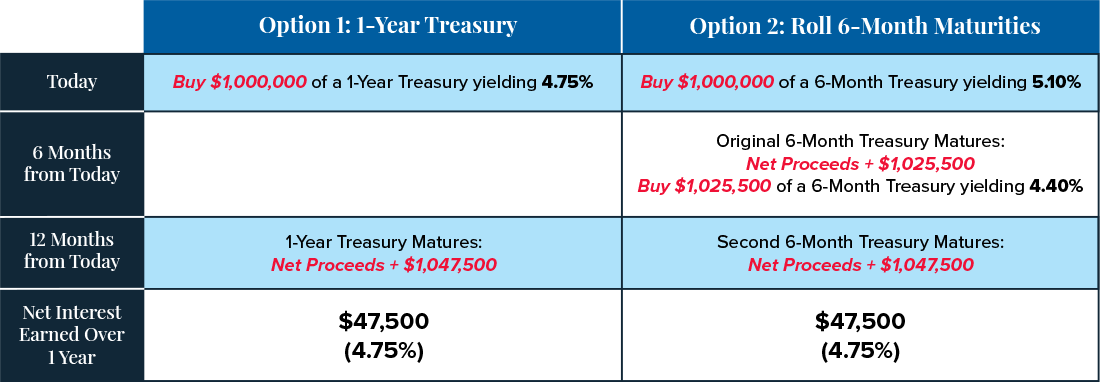

Let’s illustrate this dynamic with a concrete example. Imagine an investor has $1 million that’s needed a year from now. They have 2 options: keep it simple with a 1-year Treasury currently yielding 4.75%, or roll 6-month Treasuries where the first leg currently trades at 5.10%?

Which option nets the highest return? The answer depends on where rates will be trading in the future! But with some simple math, we can get a feel for where the range of answers may land and where the pivot point exists.

What if, 6 months from today, the 6-month Treasury yield has fallen from 5.10% down to 4.40%? The numbers are clear – 4.40% is the breakeven rate, or the yield at which an investor would be no better off between having chosen the 1-year or the 6-month initial investments. That’s because a year from now, both scenarios will have generated the exact same return.

Source: Treasury

Partners calculations

For illustrative purposes only

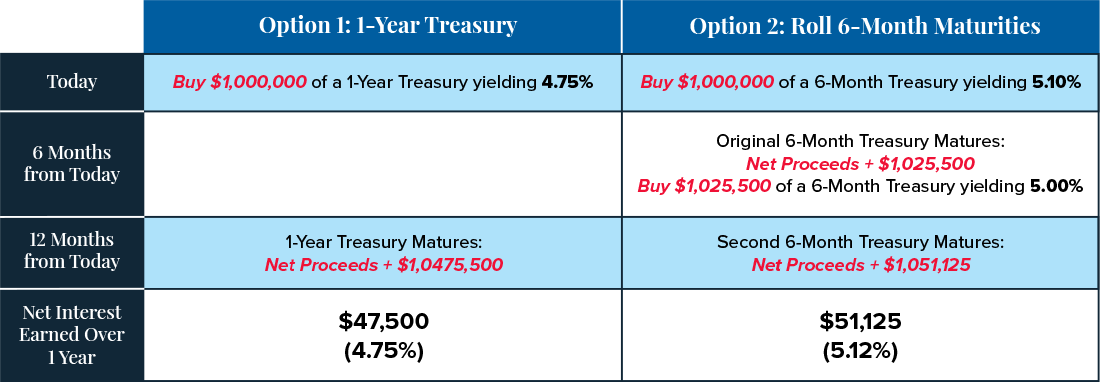

Knowing the approximate breakeven rate helps define the range of outcomes. For example, the math changes when we assume the 6-month rate in the future changes little compared to today. If a 5.00% yield is available when it’s time to reinvest that first maturing 6-month position, there’s a clear winner: Option 2, rolling 6-month maturities, earns more.

Source: Treasury

Partners calculations

For illustrative purposes only

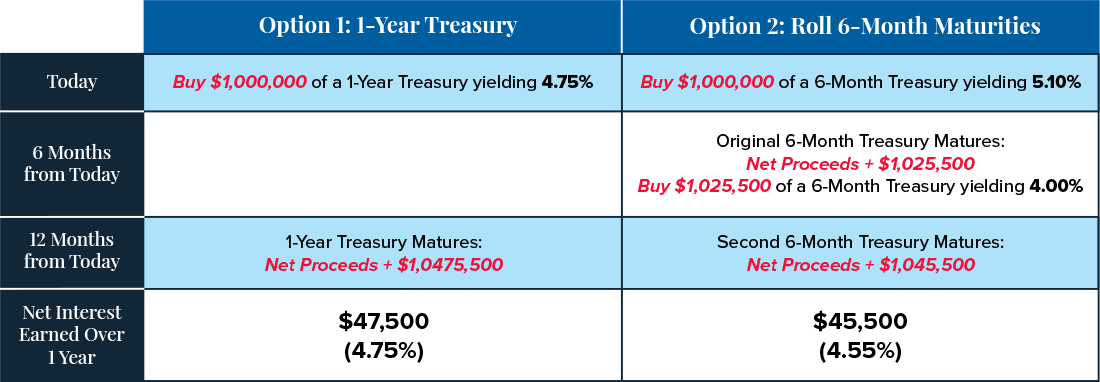

But what if instead rates actually decline by more – much more? If that future 6-month maturity is yielding just 4.00% come reinvestment time, Option 1, or simply locking in the lower 4.75% 1-year yield at the outset, will prove the better strategy.

Source: Treasury

Partners calculations

For illustrative purposes only

This value of this analysis is that it enables the investor to focus on evaluating whether rates will be higher or lower than that critical breakeven point, helping determine the best way to position for such an outcome.

Today’s inverted yield curve bakes in a certain degree of pessimism; the fact that the 6-month breakeven rate is at 4.40%, or nearly 75 basis points below today’s 5.10% 6-month Treasury yield, indicates that markets expect rates to noticeably decline over the next few months. Obviously, if that doesn’t happen – or at least doesn’t decline by that much – then staying shorter will end up the more fruitful call. But if rates fall even farther than that, then those who chose to roll maturities will be in for an unpleasant surprise.

This analysis is the driver of our current recommendation to extend maturities; longer-term rates at appealing absolute levels are available today, but with a slowing economy they might not be there tomorrow.